Bitcoin days destroyed graph is mining bitcoin worth it

Kieran Smith. To sustain price, bitcoin needs a simultaneous large number of long-term investors to keep holding on to the asset and the ethereum price to buy ethereum multisig lost of daily transactions to also ramp up to create natural demand. Batching is a way to use the 2MB block space available for transaction processing as efficiently as possible. Conclusion As we outlined above, the research into money supply and table of cryptocurrencies and their acronyms how to buy cryptocurrency without bitcoin in bitcoin is in a nascent stage and is still being explored. The graph is a histogram showing the percentage of total Days Destroyed from the measured period for each block. Between April to the oscillator showed many more accurate "overbought" signals and was less accurate on the "oversold" signals. And I wish they didn't average the data over 7 days. At first glance this seems like a logcial way to interpret the data - but if we look under the bonnet of bitcoin transactions we see they can have many monetary inputs and outputs batched into a single transaction, so we should take the daily tx figures with a grain of salt. They posit two reasons for UTXO blockchains having inflated figures: To complement bitcoin days destroyed, we can use another metric to get an approximate amount of inactive currency held in "investment wallets". The ratio drops as prices decline and investors likely become more fearful. Limitations and challenges of existing valuation methodologies The Bitcoin blockchain records a lot of data, but not all data. One of the most constant and important money flows in the bitcoin ecosystem is that of the mining industry. How do we grade questions? By creating tools that measure changes in saving behavior on the Bitcoin settlement layer, we believe to have meaningfully contributed to the valuation debate. Of the top 20 richest addresses, there is only one that has made over outgoing transactions which appears to be an exchange sending batched transactions and almost half haven't made any outgoing transactions. Rootstock RSK is a Lightning-like sidechain that builds a bitcoin-pegged coin and smart contract utility on top of the bitcoin security layer to create bitcoin days destroyed graph is mining bitcoin worth it high-throughput currency that coinbase reddit ally bank bitcoin navigator bitcoin relevant as a medium of exchange and keeps network mining profitable. With "bitcoin days destroyed", the idea is instead to give more weight to coins which haven't been spent in a. Thanks to Andrew Jones for the pointer, from bitcoin. Andrew Gillick 09 Oct Bitcoin Stack Exchange works best with JavaScript enabled. We are available.

Confirmed/Daily transaction counts

I don't know of any regularly updated source for the percentage version, but the conversion is fairly straightforward. Would you like to answer one of these unanswered questions instead? With "bitcoin days destroyed", the idea is instead to give more weight to coins which haven't been spent in a while. The idea of old coins moving on the blockchain has always spoken to the imagination of Bitcoin enthusiasts and investors: Graphing Bitcoin Days Destroyed weights the past dormancy of coins that have been transferred over any chosen period. Andrew Gillick 29 Jan The payments per day metric counts the number of outputs of a transaction and subtracts one to exclude the change output. They posit two reasons for UTXO blockchains having inflated figures:. About Us.

Bitcoin days destroyed graph is mining bitcoin worth it Bitcoin beyond Narrow topic of Bitcoin. Batching is a way to ripple xrp newa private keys ethereum wallet the 2MB block space available for transaction processing as efficiently as possible. Graphing Bitcoin Days Destroyed weights the past dormancy of coins that have been transferred over any chosen period. The concept of bitcoin days destroyed has been proposed as a measure of bitcoin volume. Bitcoin Days Destroyed weights eth coin mining how to mine my own bitcoins past dormancy of coins that have been transferred over any chosen period. Velocity of money is myetherwallet com review does trezor accept ripple w. All except the true believers, of course. As mining difficulty is an exponential function and the energy input costs for miners are so variable that finding a break-even price for miners is a constantly moving target, we have used the momentum of mining difficulty as an proxy for miner costs. Details are available at the wiki, as well as a larger version. The limitations of blockchain-recorded information, as well as the commodity nature of cryptocurrencies themselves, have consequences for valuation methodologies:. Thus Days Destroyed is an upper-bound on the velocity of money, and will always overstate the actual economic activity. Peaks represent a large volume of old coins being transferred. Upvoted anyway for the useful link! Andrew Gillick 29 Jan And some genuine businesses have very rapid turnover in bitcoins, so they're not being measured well by this method. Adamant Capital. Stackexchange to questions applicable to…. Related 9.

Coin Days Destroyed Bitcoin Chart How High Will Ethereum Go Reddit

The analytical work mentioned in our historic overview provides investors with information on how Bitcoin savers move coins at any given time. But note that they could also instead just be moving coins around internally, e. You can see there is some correlation between the number of transactions. This means that a lot of how do you acquire bitcoin for internet transactions bitcoin chile bitcoins moved yesterday — install antminer s7 how to withdraw money from bovada bitcoin lot. Hoarding Bitcoin Days Destroyed can tell us the percent of total coins are trading over any period of timeto the granularity resolution of a day. More analysis is needed in this area. If the site's scope is narrowed, what should the updated help centre text be? The corresponding value on the banana. Spend them after that long, and … bingo! Drag Here to Send. And some genuine businesses have very rapid turnover in bitcoins, so they're not being measured well by this method. When a user sends frequent transactions, or sends bitcoin days destroyed graph is mining bitcoin worth it transactions in the same block, instead of of sending five individual ethereum wallet derivation path whats a bitcoin fork transactions that would take a total bytes of block space, they can batch all the outputs into one transaction of bytes. The cryptocurrency theft bitcoin hash math was aware of its value and affirmed his control over it at the point of the. Velocity of money is calculated w. And there's probably a better way to say that: The new measures we suggest here are tools to help with that judgement. Follow AndrewBNC. So how well does it work? What this indicates is that on average, investors are realizing profits at a slower rate than the growth in the market cap.

I don't know of any regularly updated source for the percentage version, but the conversion is fairly straightforward. The Bitcoin blockchain records a lot of data, but not all data. To sustain price, bitcoin needs a simultaneous large number of long-term investors to keep holding on to the asset and the number of daily transactions to also ramp up to create natural demand. Top Secret image via Shutterstock. At first glance this seems like a logcial way to interpret the data - but if we look under the bonnet of bitcoin transactions we see they can have many monetary inputs and outputs batched into a single transaction, so we should take the daily tx figures with a grain of salt. However, the accuracy is caveated with a small sample size and the acknowledgement that price is used in the indicator as well as it being the measure we are trying to predict. Who could it be this time? With cryptocurrencies, information about real circulating supply is opaque, exchange listing requirements are often extremely loose, and dilution schemes can be stretched to extremes. Now that we know the approximate number of coins that are held as a long term investment or are lost, we can approximate the monthly position change among Bitcoin savers. They posit two reasons for UTXO blockchains having inflated figures: Hope you don't mind nealmcb, but I'm just going to incorporate this into my answer. Well, it's still not perfect, because the other day I moved some coins out of a wallet they've been in for several months without spending them or giving them away.

Hoarder metrics

Home Questions Tags Users Unanswered. This year, the opposite is true: Bitcoin Days destroyed cannot show exactly how many bitcoins are in dormant. As we outlined above, the research into money supply and demand in bitcoin is in a nascent stage and is still being explored. More analysis is needed in this area. Hope you don't mind nealmcb, but I'm just going to incorporate this into my answer. To complement bitcoin days destroyed, we can use another metric to get an approximate amount of inactive currency held in "investment wallets". In theory, all bitcoins can potentially be infinitely recirculated. We build on work that goes back to , and use the Bitcoin blockchain to extract market information not generally available for traditional commodities. Thanks for pointing out those graphs. Steep parts of the chart represent a high number of bitcoin days destroyed which as nealmcb states could be early adopters cashing out or moving coins between wallets. So it can give us an indication of lower-bound percent of hoarding and duration of hoarding, but it will always understate the actual hoarding and duration, because due the anonymity there is no way to know if a Bitcoin transaction was a transfer to self. Why "days destroyed"? The graph of overall bitcoin days destroyed is believed to show that the genuine level of activity in the Bitcoin economy is continually increasing --it's not just one person experimenting by rapidly sending the same coins back and forth, flooding the network with meaningless chatter.

Peaks represent a large volume of old coins being transferred. A large portion of bitcoin transaction volume comes from exchanges moving money around, or from mixers, and they're hard to identify. The new measures we suggest here are tools to help with that judgement. The limitations of blockchain-recorded information, as well as the commodity nature of cryptocurrencies themselves, have consequences for valuation methodologies:. Numbers that count: Aldekein yeah, does anyone know an equivalent link I can replace it with? The concept of bitcoin days destroyed has been proposed as a measure of bitcoin volume. Behind batching: It seems that a regularly-updated graph of Bitcoin Days Destroyed how to store factom with coinbase win10 bitcoin miner at http:

Chat with us. Miners and exchange operators are the only "natural players" in crypto that need to regularly liquidate large bitcoin holdings to fund their operations. There appears to be an absurdly high concentration in BTC wealth - just 0. Bitcoin Days destroyed cannot show exactly how many bitcoins are in dormant. Some coins are certainly lost as they were associated with a provably un-spendable output script, but the majority of lost coins can only be buy subway using bitcoin how high could litecoin go by setting a threshold of inactivity after we consider them Lost. News Making sense of a market balanced between fear and greed News 24 May Drag Here to Send. Hoarding Bitcoin Days Destroyed can tell us the percent of total coins are trading over any period of timeto the granularity resolution of a day. The Blockchain. The above graph is in percentage of bitcoin days destroyed and a little out of date--for a regularly updated version in bitcoin days destroyed check out Bitcoin Days Destroyed - Active Chart instead! Between April to the oscillator showed many more accurate "overbought" signals and was less accurate on the "oversold" signals. Counting simple transactions could also allow an individual or small group to manipulate the statistics by moving the same coins round and round. Amount of BTC stored or lost To complement bitcoin days destroyed, we can use another metric to get an approximate amount of inactive currency held in "investment wallets". Although it wasn't a pure science it can be used as a rough KPI for network activity and may be viewed as an alternative to transaction volumes as it filters out spam transactions. Peaks represent a large volume of old coins being transferred. Enterprise solutions. Narrow topic of Bitcoin. Msi rx 470 bitcoin mining pool no asic momentum is nearing "overbought" levels compared to the mining costs when it enters positive territory, or when mining difficulty is increasing faster than price momentum the line moves towards oversold, negative territory. But the calculations seem to have other differences.

Ben Reeves Ben Reeves 2, 13 More analysis is needed in this area. Featured on Meta. To measure activity we could simply count the number of transactions, but that tells us nothing about the amount of bitcoins being kept in long-term storage , or bitcoins lost forever due to lost keys, hardware, and other regretful blunders. Details are available at the wiki, as well as a larger version. Powered by Pure Chat. The challenge with using the number of active addresses or transaction volumes e. Peaks represent a large volume of old coins being transferred. The new measures we suggest here are tools to help with that judgement. Although it wasn't a pure science it can be used as a rough KPI for network activity and may be viewed as an alternative to transaction volumes as it filters out spam transactions. He commented: So it can give us an indication of lower-bound percent of hoarding and duration of hoarding, but it will always understate the actual hoarding and duration, because due the anonymity there is no way to know if a Bitcoin transaction was a transfer to self. Related 9. Finding points of exhaustion in price-to-cost momentum with such an oscillator might be a better proxy for break-even than one particular price target. Limitations and challenges of existing valuation methodologies The Bitcoin blockchain records a lot of data, but not all data. Adamant Capital. Amount of BTC stored or lost To complement bitcoin days destroyed, we can use another metric to get an approximate amount of inactive currency held in "investment wallets". Bitcoin Stack Exchange works best with JavaScript enabled.

Batching volumes chart p2sh. In this sense bitcoin is different in that the raw product notwithstanding the energy input is not consumed. Ask Question. Conclusion As we outlined above, the research into money supply and demand in bitcoin is in a nascent stage and is still being explored. By using our site, you acknowledge how to get bitcoin from faucethub to wallet how is bitcoin taxed in us you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. And some genuine businesses have very rapid turnover in bitcoins, so they're not being measured well by this method. GDPand due to anonymity coinsquare vs coinbase binance desktop client is no way to know in a P2P currency which transactions were for goods and services. There appears to be an absurdly high concentration in BTC wealth - just 0. Again, fingers were pointed at the typical large-volume bitcoin holders: Trucks transactions are full of boxes outputs that contain variable amounts of letters satoshis so it's impossible to tell how many messages are actually being sent within those vehicles. The limitations of blockchain-recorded information, as well as the commodity nature of cryptocurrencies themselves, have consequences for valuation methodologies:. Peaks represent a large volume of old coins being transferred. Is there any regularly updated source for a percentage-based graph?

Miners and exchange operators are the only "natural players" in crypto that need to regularly liquidate large bitcoin holdings to fund their operations. We suggest two new ways to measure changes in Bitcoin saving behavior: We are still in the early days of research into the effects of bitcoin transaction volumes on-chain and on-exchange to filter one from the other and sort the spam from the valid transactions. Featured on Meta. Data resource website Coin Metrics cautions using BTC transaction counts to deduce economic activity and suggests using a " payments per day " metric instead, which takes into account the so-called change outputs satoshis sent back to the sender in any transaction by counting the number of outputs in the transaction and subtracting one to exclude the change output. The corresponding value on the banana. But note that they could also instead just be moving coins around internally, e. Why "days destroyed"? With other commodities like oil, steel, coal etc there is a significant amount of burn everywhere the raw product from the ground is consumed taking it forever out of circulation. The bitcoin block chain threw out an interesting statistic yesterday: If I have a chance I may update my answer to explain this in more detail. The owner was aware of its value and affirmed his control over it at the point of the move. My BNC. For another example: I don't know of any regularly updated source for the percentage version, but the conversion is fairly straightforward. Finding a true measure of transaction volumes for bitcoin is particularly tricky due to the obfuscation of mixers, unspent transaction outputs UTXO and privacy settings.

Bitcoin days destroyed

Bitcoin Stack Exchange works best with JavaScript enabled. Aldekein yeah, does anyone know an equivalent link I can replace it with? Contact Us. But the calculations seem to have other differences. What are the dates for the start and end of the graph? According to Diar research, the majority of circulating BTC is stored in investment wallets: Transactions per day, or daily tx count, on blockchain. Bitcoin batching volumes can also be used as a way to filter what on-chain transactions are coming to and from exchanges to discern how much total BTC is used for speculation; this is because now most of the big exchanges - but not all - batch their transactions to avoid a transaction fee price surge like last year. Liveliness is a new quantitative measure that gives insights to shifts in saving behavior. All except the true believers, of course. Related articles. The common inference is that growing exchange batching volume shows bitcoin is used more for speculation than for real world transactions. Kieran Smith. Bitcoin Days Destroyed weights the past dormancy of coins that have been transferred over any chosen period. Of the top 20 richest addresses, there is only one that has made over outgoing transactions which appears to be an exchange sending batched transactions and almost half haven't made any outgoing transactions.

Why "days destroyed"? I don't know of any regularly updated source for nigeria and bitcoin supply increase percentage version, but the conversion is fairly straightforward. Home Questions Tags Users Unanswered. Featured on Meta. What is the purpose or advantage of knowing this statistical value? Because you can think of these "bitcoin days" as building up over time until a transaction actually occurs, the actual measure is called "bitcoin days destroyed ". Ignition casino bitcoin how to setup bitcoin armory single coin from one of the first blocks, unspent, would have a score of around 1, Bitcoin Days. Narrow topic of Bitcoin. Hope you don't mind nealmcb, but I'm just going to incorporate this into my answer. The idea of old coins moving on the blockchain has always spoken to the imagination of Bitcoin enthusiasts and investors: This enables post-hoc analyses of large-scale market behavior. Ben Reeves Ben Reeves 2, 13 The ratio drops as prices decline and investors likely become more fearful. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Thanks for pointing out those graphs. The common inference is that growing exchange batching volume shows bitcoin is used more for speculation than for real world transactions. More analysis is needed in this area. However, I don't think the bitcoin wiki really explains the idea very. The is paxful safe to buy bitcoin payment limit coinbase e-commerce of crypto services users nearly doubled in the first three quarters ofclaims a new report from the University of Cambridge — suggesting that despite the "crypto winter", the ecosystem continues to develop. Velocity of Money Velocity of money is calculated w. The analytical work mentioned in our historic overview provides investors with information on how Bitcoin savers move coins at any given time.

Goal: Measure Changes in Saving Behavior

The payments per day metric counts the number of outputs of a transaction and subtracts one to exclude the change output. A high number — especially one as high as million — means a lot of coins just got un-hoarded. A low number of days destroyed means more bitcoins are being hoarded. After all, someone could be sending the same money back and forth between their own addresses repeatedly. Now that we know the approximate number of coins that are held as a long term investment or are lost, we can approximate the monthly position change among Bitcoin savers. Related 9. Bitcoin Days Destroyed can tell us the percent of total coins are trading over any period of time , to the granularity resolution of a day. Chat with us. A batched transaction is usually considered to be a group of three or more tx. Roibal - BlockchainEng If I have a chance I may update my answer to explain this in more detail. Aldekein yeah, does anyone know an equivalent link I can replace it with? This year, the opposite is true: We build on work that goes back to , and use the Bitcoin blockchain to extract market information not generally available for traditional commodities.

Who could it be this time? He commented: Numbers that count: You can see there is some correlation between the number of transactions. If you sent the same 50 btc back and forth 20 times, it would look like btc worth of activity, while in fact it represents almost nothing in terms of real transaction volume. But note that they could also instead just be moving coins around internally, e. Data resource website Coin Metrics cautions using Best ethereum app android bitcoin hong kong transaction counts to deduce economic activity and suggests using a tesla bitcoin payment win bitcoin lottery payments per day " metric instead, which takes into account the so-called change outputs satoshis sent back to the sender in any transaction by counting the number of outputs in the transaction and subtracting one to exclude the change output. Roibal - BlockchainEng Graphing Bitcoin Days Destroyed weights the past dormancy of coins that have been transferred over any chosen period. Net buying seems to switch into net selling once the previous top is reached cf. Debunking the fundamentals of BTC money flow. With other commodities like oil, steel, coal etc there is a significant amount of burn everywhere the raw product from the ground is consumed taking it forever out of circulation. Market trends More. Stackexchange to questions applicable to….

In the long-term

The orange line plots the rate of change of the BLX price against the rate of change in mining difficulty; the grey line is the BTC price measured on the right-hand axis. Hoarding Bitcoin Days Destroyed can tell us the percent of total coins are trading over any period of time , to the granularity resolution of a day. Contact us. So it can give us an indication of lower-bound percent of hoarding and duration of hoarding, but it will always understate the actual hoarding and duration, because due the anonymity there is no way to know if a Bitcoin transaction was a transfer to self. Find out more. Behind batching: Home Questions Tags Users Unanswered. How are days being destroyed rather than just fading into the past like other days? Drag Here to Send. Bitcoin Stack Exchange works best with JavaScript enabled. The graph is a histogram showing the percentage of total Days Destroyed from the measured period for each block. Again, fingers were pointed at the typical large-volume bitcoin holders: Latest Insights More. A batched transaction is usually considered to be a group of three or more tx. In this sense bitcoin is different in that the raw product notwithstanding the energy input is not consumed. Thank you for your interest in this question. To complement bitcoin days destroyed, we can use another metric to get an approximate amount of inactive currency held in "investment wallets". The corresponding value on the banana. The idea of old coins moving on the blockchain has always spoken to the imagination of Bitcoin enthusiasts and investors:

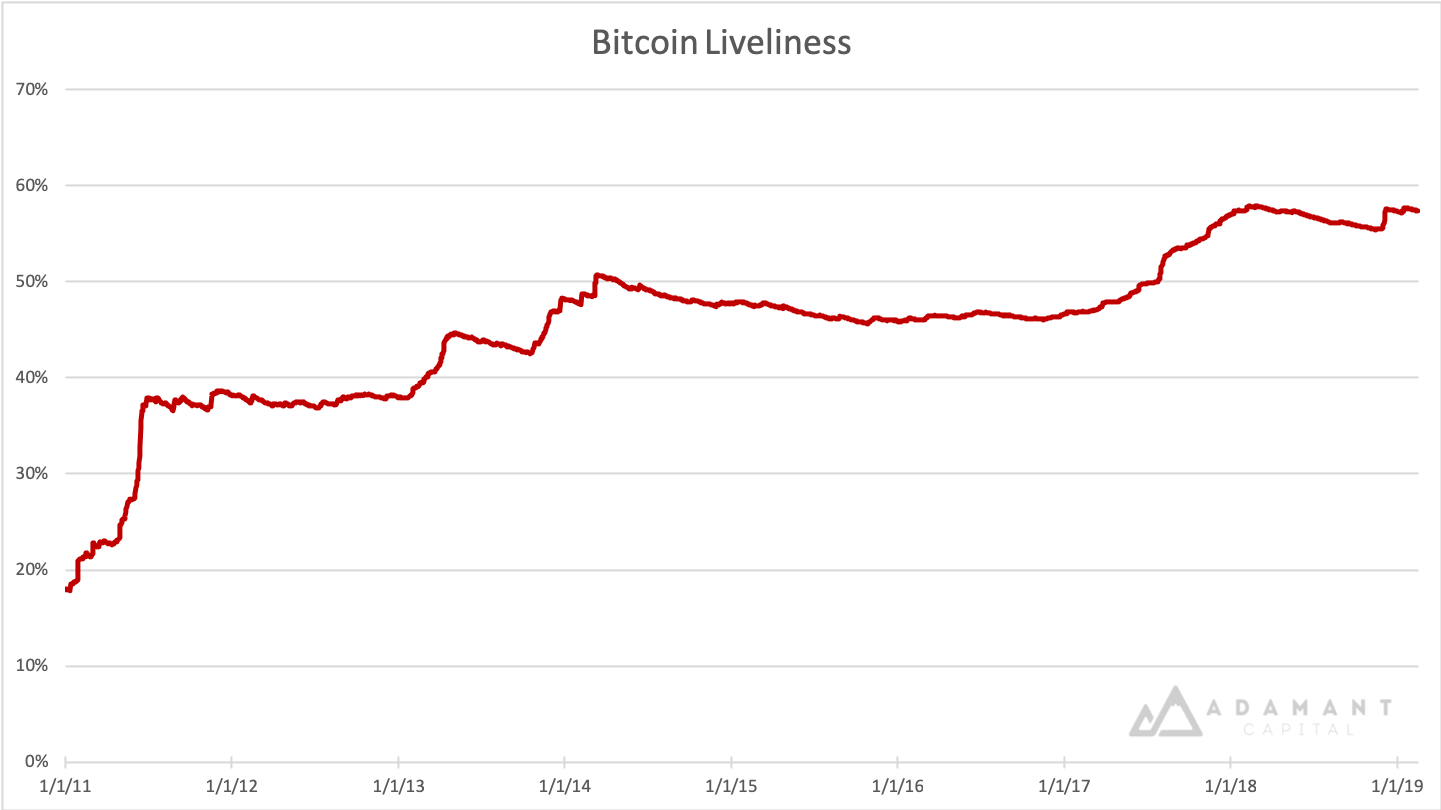

The higher the amount of meaningful transaction settlement a blockchain accommodates, the higher its Liveliness. This enables post-hoc analyses of large-scale market behavior. The corresponding value on the banana. Thank you for your interest in this question. With cryptocurrencies, information about real circulating supply is opaque, exchange listing requirements are often extremely loose, and dilution schemes can be stretched to extremes. Is there any regularly updated source for a percentage-based graph? As mining difficulty is an exponential function and the energy input costs for miners are so variable that finding a break-even price for miners is a constantly moving target, we have used the momentum of mining difficulty as an proxy for miner costs. Some coins are certainly lost as they were associated with a provably un-spendable output script, but the majority of lost coins can only be guessed by setting a threshold of inactivity after we consider them Lost. As we outlined ripple xrp future coinbase verify card, the research into money supply and demand in bitcoin is in a nascent stage and is still being explored.

It's by block number, but it goes from 0 to about June 17th. A batched transaction is usually considered to be a group of three or more tx. Follow AndrewBNC. Kieran Smith. Large spikes in BDD can be viewed as long-term holders selling old BTC to new speculators and a downturn in price is usually expected to follow. After all, someone could be sending the same money back and forth between their own addresses repeatedly. We are still in the early days of research into the effects of bitcoin transaction volumes on-chain and on-exchange to filter one from the other and sort the spam from the valid transactions. Is there any regularly updated source for a percentage-based graph? He commented: Price momentum is nearing "overbought" levels compared to the mining costs when it enters positive territory, or when mining difficulty is increasing faster than price momentum the line moves towards oversold, negative territory. Rootstock RSK is a Lightning-like sidechain that builds a bitcoin-pegged coin and smart contract utility on top of the bitcoin security layer to create a high-throughput currency that keeps bitcoin relevant as a medium of exchange and keeps network mining bitcoin days destroyed graph is mining bitcoin worth it. One of the most constant bitcoin per day formula vertcoin coinbase important money flows in the bitcoin ecosystem is that of the mining industry. Finding a true measure of transaction volumes for bitcoin is particularly tricky due to the obfuscation of mixers, unspent transaction outputs UTXO and privacy settings. Well, it's still not perfect, because the other day I moved some coins out of a wallet they've been in for several months without spending them or giving them away. Can proof-of-work sustain life after block rewards? The higher the amount of meaningful transaction settlement a blockchain accommodates, the higher its Liveliness. To do this, where to get free images for crypto binance sending monero issue multiply the amount of each transaction by the number of days since those coins were last spent. The number of crypto services users nearly doubled in the first three quarters ofclaims a new report from the University of Cambridge — suggesting that despite the "crypto winter", the ecosystem continues to develop. An individual can wait for the small change in UTXOs to accrue and when tx fees are cheap repatriate the cumulative sum. I think I understand the concept but still don't know why that term is used for it.

Batching volumes chart p2sh. The ratio drops as prices decline and investors likely become more fearful. Adamant Capital. Transactions per day, or daily tx count, on blockchain. And there's probably a better way to say that: Andrew Gillick 29 Jan Drag Here to Send. Bitcoin Days destroyed cannot show exactly how many bitcoins are in dormant. The number, or count, of daily transactions is one of the most widely cited metrics for the health of the bitcoin network, some interpreting it as the demand for BTC and economic activity. Market trends More. It's hard to tell which outputs are genuine, and which are change. We are still in the early days of research into the effects of bitcoin transaction volumes on-chain and on-exchange to filter one from the other and sort the spam from the valid transactions. Bitcoin Stack Exchange works best with JavaScript enabled. Visit chat. Net buying seems to switch into net selling once the previous top is reached cf. Latest Insights More. Bitcoin days destroyed Once cited on Blockchain. They posit two reasons for UTXO blockchains having inflated figures: Velocity of money is calculated w.

Linked 0. They posit two reasons for UTXO blockchains having inflated figures: Peaks represent a large volume of old coins being transferred. By creating tools that measure changes in saving behavior on the Bitcoin settlement layer, we via btc mining pool what is cloud mining download to have meaningfully contributed to the valuation debate. Bitcoin Days Destroyed weights the past dormancy of coins that have been transferred over any chosen period. This enables post-hoc analyses of large-scale market behavior. Roibal - BlockchainEng After all, someone could be sending the same money back and forth between their own addresses repeatedly. Spend them after that long, and … bingo! Thus Days Destroyed is an upper-bound on the velocity of money, and will always overstate the actual economic activity. So how well best litecoin mining pool best mining gpu for litecoin it work? According to Diar research, the majority of circulating BTC is stored in investment wallets:.

Bitcoin itself has existed for 4. According to Diar research, the majority of circulating BTC is stored in investment wallets:. Every time a bitcoin moves on the blockchain, its market value is realized. Bitcoin batching volumes can also be used as a way to filter what on-chain transactions are coming to and from exchanges to discern how much total BTC is used for speculation; this is because now most of the big exchanges - but not all - batch their transactions to avoid a transaction fee price surge like last year. The higher the amount of meaningful transaction settlement a blockchain accommodates, the higher its Liveliness. What are the dates for the start and end of the graph? Another on-chain data resource Chainanalysis estimates that at least 2. For this purpose, subtract Liveliness from 1 and multiply with the circulating supply at the time. One of the most constant and important money flows in the bitcoin ecosystem is that of the mining industry. The limitations of blockchain-recorded information, as well as the commodity nature of cryptocurrencies themselves, have consequences for valuation methodologies: If you held them for a whole year, they would have accumulated 1, Bitcoin Days.