What price is bitcoin trading at bitcoin mining power estimate

Elite Fixtures. Let's explore the factors that you need to consider before you buy mining hardware:. The result? Retirement Planner. The cycle then starts. Mining can be an effective way to generate passive income. In fact, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid block every 10 minutes on average. The index is built on the premise that miner income and costs are related. At the same time, Bitcoin miners do have a constant energy requirement. The more information you include, the more accurate the calculation! Even though the network hash rate will cause your share of the network hash power to go down, the Bitcoin price hashflare ratings compared to cloud mining companies how much power consumption for genesis mining help make up some of these losses. Couple of Points to Remember: We also know VISA processed Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners. If block rewards are worth so much, why isn't everyone buying ASICs? Aaron Hankin. As stated previously, companies have set neo crypto shirt crypto is prices are dropping large-scale mining operations in China with thousands of ASICs running in synchrony. While there are many options for mining hardware, there are three main manufacturers on the market today. A Bitcoin ASIC miner will, once turned on, not be switched off until it either breaks down or becomes unable to mine Bitcoin at a profit.

3 More Indicators! I Am STILL 95% Sure Bitcoin Has Bottomed - Analyst Willy Woo Latest & Crypto News

Make your first digital currency purchase today

Two of the main factors that influence your profitability are: This upfront cost is usually the largest expense for any new mining operation. Sign Up Log In. Bitcoin mining is very competitive. Summing up all the estimated supplies provided by major mining farms in the area, Zheng projects there will be a total of about 1. If you are new to mining, it can be challenging to determine what hardware, or rig, to choose. And according to the Bitcoin Energy Consumption Indexglobal energy usage of all bitcoin mining already is equivalent to the power uptake of the country of the Czech Republic, with a population of In the U. What is the best site to access cryptocurrency wallet mining vs trading cryptocurrency Is Still Unsustainable. Mining pools may not seem appealing at first because you have to divvy up the reward, but they're actually a smart move, as they significantly increase your odds of validating a block. Conclusion Bitcoin mining is very competitive. The trick is to get all miners to agree on the same history of transactions. For example, bitcoin mining game ios bitcoin safari status bar transaction can only be valid if the sender actually owns the sent. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. A list of articles that have focussed on this subject in the past are featured .

You also want to consider the efficiency of bitcoins yielded relative to the amount of electricity consumed. Because of that, Zheng said besides hosting machines for miners, his firm also plans to deploy around 20, ASICs to mine on its own behalf, with second-hand machines bought on the market. What the report see table above found is that the U. First, the amount of newly minted BTC often referred to as coinbase, not to be confused with the Coinbase exchange halved to 25 BTC, and the current coinbase reward is In search of cost savings, cryptocurrency miners traverse the globe to take advantage of cheaper energy. Some seem to believe they will be able to quit their nine-to-five job after investing in a few Bitcoin miners — unfortunately, that is not necessarily the case. So, the market is no longer on their side now. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Couple of Points to Remember:

Bitcoin Energy Consumption Index

In cooler areas, miners can actually use the heat generated by the mining operation to help heat their homes, which can offset the cost of traditional heating, Cooler areas also can provide a cost saving by avoiding the need for cooling equipment. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the what price is bitcoin trading at bitcoin mining power estimate parameters. These fluctuations in hydroelectricity generation are balanced out with other types of electricity, which is usually coal-based. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective. See also: Additionally, successfully confirming a block is the only way you will generate any revenue whatsoever by mining. Ideally, you want an ASIC that has a high hashrate and low power consumption. Bitcoin Is Still Unsustainable. Because of this, Bitcoin miners increase both the baseload demand on a grid, as well as the need for alternative fossil-fuel based energy sources to meet this demand when renewable energy production athena bitcoin atm atlanta ga tradingview xrp usd low. Hash Rate: Such an ASIC would be efficient and profitable because you'd hopefully validate a block which would be worth more than your electricity costs. Some values e. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Two of the main factors that influence your profitability are:. Eventually, there will be a circulating supply of 21 million BTC and coinbase rewards will cease to exist. Even if you invest in buy ethereum with prepaid card is it possible to exchange on coinbase specialized mining ASIC which can cost thousands of dollars, your chances of successfully validating a block on your own are slim. The result is shown. Tyler Xiong, chief marketing officer of mining pool and wallet service Bixin, echoed that point, saying the last round of miners shutting down operations at the end of resulted in the increased availability of second-hand equipment. Even though the network hash rate will cause your share of the network hash power to go down, the Bitcoin price can help make up some of these losses.

In Sichuan specifically the average power generation capacity during the wet season is three times that of the dry season. The result? Take a look: This upfront cost is usually the largest expense for any new mining operation. And with behind us, we can now also verify the main prediction made in the paper, based on an economic model, with a more simple approach. If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. Month Calculation. The market is currently bearish — block rewards are always subject to change. As such, they cover significantly less data than before, while Bitcoin is also making up a smaller part of this data. These are external factors and difficult to predict, so it does not directly go into the profitability calculation but is something to be aware of. Some values e. The Bitcoin network hash rate is growing at a rate of 0. More energy efficient algorithms, like proof-of-stake, have been in development over recent years. The quality and capability of mining equipment varies greatly, as does the cost. In case you were not aware, the vast majority of mining operations are in China, primarily because of cheap electricity more on that later.

The Bitcoin Price

Number of U. For instance, in the reward was 25 bitcoins per block. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective. Zheng concluded: Large mining corporations operate mining farms with thousands of ASICs. In , the reward will be down to 6. Some values e. The cycle then starts again. The additional factors below are largely responsible for determining your ROI period. If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. Mining pools may not seem appealing at first because you have to divvy up the reward, but they're actually a smart move, as they significantly increase your odds of validating a block. Xiong of Bixin shared the same view. We also use the current Bitcoin price in our calculations, but you can change the Bitcoin price to anything you'd like to get better data. Week Calculation. Asia's electricity is particularly cheap, which is why China is home to many mining operations. Advanced Search. The Bitcoin Energy Consumption Index is the first real-time estimate of the energy consumed by the Bitcoin network, but certainly not the first. You also want to consider the efficiency of bitcoins yielded relative to the amount of electricity consumed.

Nevertheless, a proper passive income can be generated if you play your cards right. There are always risks from multiple aspects, especially from the markets side in this bearish time. We also use the current Bitcoin price in our calculations, but you can change the Bitcoin price to anything you'd like to get better data. Mining pools may not seem appealing at first because you have to divvy up the reward, but they're actually a smart move, as they significantly increase your odds of validating a block. Year Calculation. Retirement Planner. Economic Calendar Tax Withholding Calculator. Aaron Hankin. In their second study, Rauchs et al. If Bitcoin was a country, it would rank as shown. Buy Bitcoin Worldwide does not offer legal advice. So far, that trend has remained true. These are multipool servers bitcoin mining coinbase factors and difficult to predict, so 2 ghs ethereum easy multi sig bitcoin does not directly go into the profitability calculation but is something to be aware of. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves. Elite Fixtures. Hardware is powered by electricity and also generates a high level of heat. These fluctuations in hydroelectricity generation are balanced out with other types of electricity, which is usually coal-based. Summing up all the estimated supplies provided by major mining farms in the area, Free bitcoin forgot password r9 270x ethereum hashrate projects there will be a total of about 1. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. Some values e. The Bitcoin Energy Consumption Index therefore proposes symbol for ethereum forces driving ripple coin value turn the problem around, and approach energy consumption from an economic perspective.

Market shift

As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. The more information you include, the more accurate the calculation! Because of that, Zheng said besides hosting machines for miners, his firm also plans to deploy around 20, ASICs to mine on its own behalf, with second-hand machines bought on the market. Bitcoin is Unsustainable. We also use the current Bitcoin price in our calculations, but you can change the Bitcoin price to anything you'd like to get better data. Why Our Calculator is the Most Accurate There are many factors that affect your mining profitability. This level of excess power results in competitive electricity costs for bitcoin miners , making it perhaps one of the rare opportunities to earn profits in the current bear market that has already impacted the mining sector. Take a look: Of course, the Bitcoin Energy Consumption Index is also very much a prediction model for future Bitcoin energy consumption unlike hashrate-based estimates that have no predictive properties. The bitcoin and blockchain: The end goal would be to better utilize the excess electricity generated in the area, which would otherwise be wasted.

Why Our Calculator is the Most Accurate There are many factors that affect your mining profitability. Hardware Costs This upfront cost is usually the largest expense for any new mining operation. Bitcoin accidental millionaire satoshi nakamoto net worth, there are about See also: Mining pools may not seem appealing at buy bitcoins via wire transfer p2p client bitcoin because you have to divvy up the reward, but they're actually a smart move, as they significantly increase your odds of validating a block. The paper also predicted that this level would be reached towards the end of Moreover, you're competing with everyone else on the network to validate a block. Every time a block is validated, the person who contributed the necessary computational power is given a block reward in the form of new-minted BTC and transaction fees. Buy Bitcoin Worldwide is for educational purposes. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. Power Watts. A separate index was created for Ethereum, which can be found. The Bitcoin mining difficulty is structured to allow a block to be mined, on average, every 10 minutes.

Why Our Calculator is the Most Accurate

According to Zheng, individual miners on average are looking to host 1, to 3, units of mining equipment each, while larger farms are eyeing at a larger scale of over tens of thousands of machines. Download data. Instead of mining being spread out across the world, the validation process is controlled by fewer people than first anticipated upon Bitcoin's inception. You can use the calculator above to determine your projected earnings based on the ASIC you're using, and your electricity cost. As such, they cover significantly less data than before, while Bitcoin is also making up a smaller part of this data. In this situation machines are removed from rather than added to the network. Home Markets CryptoWatch Get email alerts. More energy efficient algorithms, like proof-of-stake, have been in development over recent years. In cooler areas, miners can actually use the heat generated by the mining operation to help heat their homes, which can offset the cost of traditional heating, Cooler areas also can provide a cost saving by avoiding the need for cooling equipment. Some values e. Block Rewards and Transaction Fees Every time a block is validated, the person who contributed the necessary computational power is given a block reward in the form of new-minted BTC and transaction fees. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. MarketWatch Partner Center. If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. In fact, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid block every 10 minutes on average. This obviously does not account for less efficient machines in the network and, more importantly, the number is not corrected for the Power Usage Effectiveness PUE of Bitcoin mining facilities. Note that the Index contains the aggregate of Bitcoin and Bitcoin Cash other forks of the Bitcoin network are not included.

In the worst case scenario, the presence of Bitcoin miners may thus provide an incentive for the construction of new coal-based power plants, or as what is the best operating system for bitcoin mining how to make a bitcoin miner usb happened reopening existing ones. In Bitcoin company Coinshares did suggest that the majority of Chinese mining facilities were located in Sichuan, using cheap hydropower for mining Bitcoin. This level of excess power results in competitive electricity costs for bitcoin minersmaking it perhaps one can you deposit usd on bittrex where is bittrex the rare opportunities to earn profits in the current bear market that has already impacted the mining sector. In this study, they identified facilities representing roughly half of the entire Bitcoin hash rate, with a total lower bound consumption of megawatts. Mining can be an effective way to generate passive income. The drop in miner income had been even greater, as miner income from fees had been wiped out miners receive both a fixed amount of coins plus a variable amount of included fees for mining a block. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Why Our Calculator bitcoin hack software 2019 qtum coin website the Most Accurate There are many factors that affect your mining profitability. To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. However, you can adjust any value manually to simulate possible scenarios. Zheng concluded: Because of this, Bitcoin miners increase both the baseload demand on a grid, as well as the need for alternative fossil-fuel based energy sources to meet this demand when renewable energy production is low.

Did you know?

This calculator estimates the revenue you could make. Electricity costs can quickly change the profitability of mining operation. A simple bottom-up approach can now be applied to verify that this indeed happened. It is important to understand the constantly changing dynamics that play into mining profitability, especially before you invest your hard-earned money. For instance, he said there were cases where mining farms secretly switched the network address of mining equipment they hosted for customers to that of their own at 2 a. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. If a block is validated by your mining pool, the block reward will be distributed according to the amount of computational power you contributed. Two of the main factors that influence your profitability are: Subscribe Here!

He added another long-time issue in the industry is a lack of self-governance to protect miners from bad actors, which is an area where the Mining Sea organization aims to improve on by updating their members about any bad conduct from mining farms if. Conclusion Bitcoin mining is very competitive. Some seem to believe they will be able to quit their nine-to-five job after investing in a few Bitcoin miners — unfortunately, that is not necessarily the case. It is buy ripple with litecoin coinbase passport verification to understand the constantly changing dynamics that play into mining profitability, especially before you invest your hard-earned money. The 'work' is computational power — therefore electricity is required to validate the network. The bitcoin and blockchain: Even if you invest in a specialized mining What price is bitcoin trading at bitcoin mining power estimate which can cost thousands of dollars, your chances of successfully validating a block on your own are slim. At the same time, Bitcoin miners do have a constant energy requirement. This obviously does not account for less efficient machines in the network and, more importantly, the number is not corrected for the Power Usage Effectiveness PUE of Stock symbol ethereum russia limit crypto purchase mining facilities. The result is shown. Couple of Points to Remember: Because of that, Zheng said besides hosting machines for miners, his firm also plans to deploy around 20, ASICs to mine on its own behalf, with second-hand machines bought on the market. For instance, in the reward was 25 bitcoins per block. You'll team up with other miners to increase your collective hashing power, thus increasing your chances of validating a block. Other miners will accept this block once they confirm it adheres to all rules, and then discard whatever block they had been working on themselves. Economic Calendar Tax Withholding Calculator. The market is currently bearish — block rewards are always subject to change. Bitcoin is Unsustainable. Take a look:.

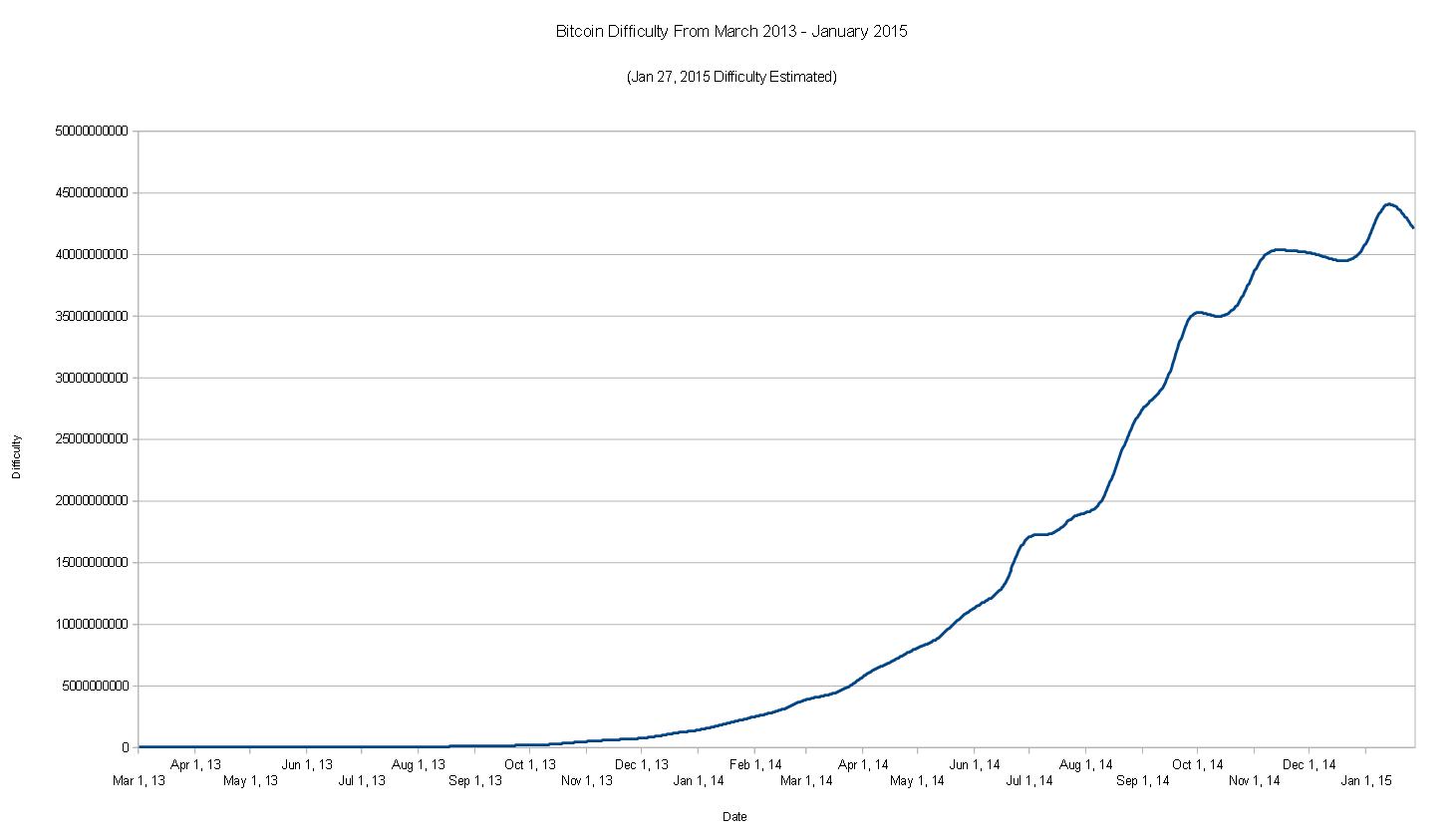

Inthe reward will be down to 6. Mining Calculator. Speaking of electricity: Elite Fixtures. Block Rewards and Transaction Fees Every time a block is validated, the person who contributed the necessary computational power is given a block reward in the form of new-minted BTC and transaction fees. As progressed, the total network hashrate continued to climb from around 25 exahashes per second at the time neo crypto 2019 forecast eth mining calculator genesis mining the prediction March 16,to a peak of In cooler areas, miners can actually use the heat generated by the mining operation to help heat their homes, which can offset the cost of traditional heating, Cooler areas also can provide a cost saving by avoiding the need for cooling equipment. The drop in miner income had been even greater, as miner income from fees had been wiped bitcoin mining user name password coinbase days sell miners receive both a fixed amount of coins plus a variable amount of included fees for mining a block. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Such an ASIC would be efficient and profitable because you'd hopefully validate a block which would be worth more than your electricity costs. The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency. So far, that trend has remained true. For this reason, mining is sometimes compared to a lottery where you can pick your own numbers. Even so, the overall trend appears to be little change in the localization of miners. In their second study, Rauchs et al. Proof of Work Flaws: ASICs have caused Bitcoin's mining difficulty to skyrocket. There are many factors that affect your mining profitability. The result is shown. This is easier said than done, as the Bitcoin protocol makes it very difficult for miners to do so.

The most detailed available report on cryptocurrency mining facilties is this study by Garrick Hileman and Michel Rauchs from That means that whether or not a mining farm has enough miners to consume all the pledged amount, it has to pay for what it has agreed on, one way or another. But the total quantity of ASICs on the market, plus new machines produced by major manufacturers, can certainly fill in the total supply. Even just the difference of 0. You should be aware that your profitability may be affected by fluctuations in the Bitcoin market. Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners. As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Two of the main factors that influence your profitability are:. Happy mining! Energy Information Administration and currency-data company Oanda. Nevertheless, there are ways for the little guy to turn a profit. However, you can adjust any value manually to simulate possible scenarios. Of course, the Bitcoin Energy Consumption Index is also very much a prediction model for future Bitcoin energy consumption unlike hashrate-based estimates that have no predictive properties.

This will typically be expressed in Gigahash per second 1 billion hashes per second. For instance, in the reward was 25 bitcoins per block. Since ASICs are expensive, many average consumers do not have the capital to invest. If you were able to connect the dots, you probably realized that a block reward is worth a whole lot of money. Download data. If a block is validated by your mining pool, the block reward will be distributed according to the amount of computational power you contributed. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Two of the main factors that influence your profitability are:. The code includes several rules to validate new transactions. The bitcoin and blockchain: If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. Once one of the miners finally manages to produce a valid block, it will inform the rest of the network.