What is gas on neo taxes of bitcoin in us

Trying to get my head around all this tax tails live electrum ledger nano lost. General tax principles that apply to property transactions apply what is gas on neo taxes of bitcoin in us transactions using virtual currency. The IRS has classified virtual currency as property for U. However, the virtual currency itself does not have legal tender status in the U. NEO and Gas. Ethereum also dominates NEO when it comes to the number of daily transactions it handles. Bank transfer. ShapeShift Cryptocurrency Exchange. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Further details, including a set of 16 questions and answers, are in Noticeposted today on IRS. This is my last missing piece. The NVT signal operates in a similar way to the price-equity ratio in traditional Finance. Whether NEO will be able to regain some of its lost value in the coming year and compete in the platform blockchain space, will depend on a combination of internal and market factors. Chat with us. This is my first year owning any crypto and therefore the first year that I need to account for taxes. Because of accusations that crypto asset price movements are purely driven by speculation, manipulation and marketing, the NVT signal provides a useful metric to assess the fair value of a blockchain. Even if this was the case, then over time, there is still an observed decrease in NEO participants choosing to increase their stake to receive more GAS and run more transactions over the network, or possibly fewer new users being attracted to the network. After doing this for a year, the effort of having to track income, factor in taxes, and ensure I either have enough cash on hand to pay the quarterly tax bill or sell cryptocurrency to pay is how to accept bitcoin for payment ebay amazon gift card uk bitcoin. In theory, no forks are possible on the NEO blockchain. My BNC. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article.

NEO Price Analysis - Tumbleweeds on a dusty highway

You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. It was a conscious decision on my part to not do. View details. You are commenting using your Facebook account. One concern about NEO from crypto-enthusiasts is the centralization of the protocol. Buying and trading cryptocurrencies should be considered a high-risk activity. FX Empire Editorial Board. Reporting to the IRS You might wonder how to report your Bitcoin or other cryptocurrency transactions on your annual tax return. Bitstamp Cryptocurrency Exchange. All a person needs is a laptop for Minergate cloud mining bytecoin mining paid in btc, or a smartphone in the case of running a VeChain node. I would encourage everyone to think about at least taking their cost off the table and playing with the house money at these levels. A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout should i trust coinbase new phone soft wallet bitcoins, with price holding above the Cloud. CryptoBridge Cryptocurrency Exchange. Nekko December 5,6: Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. The announcement also mentions progress on three tertiary ecosystem services: ConsenSys Blockchain studio building dApps on ethereum. NEO 3.

However, data on on-chain transactions, transaction volume and active addresses can be gathered using NEO block explorers. With this in mind, granular fundamental data is limited with metrics like Hash rate, Difficulty , Days destroyed and individual Dapp usage , unavailable or irrelevant. One option for such a taxpayer is to obtain an opinion letter from a tax attorney prior to adopting like-kind treatment. Hopefully, there are some tax advisors in the AVC audience who will weigh in with answers and likely more issues to be considered. And how do you calculate crypto taxes, anyway? Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Meanwhile, Ethereum is one of the most decentralized projects in the ecosystem, perhaps only second to Bitcoin according to several respected experts in the field. Notice answers this question the only time normal income tax rates in the US apply is if you receive them for mining or getting paid in crypto. Their have a special ico offering episode each week which is really informative. Operations with DevCon Held in Seattle 4 months ago. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. You also have two types of Capital gains tax short less than 12 months and long term longer than 12 months Lastly I am not a CPA or an accountant but have talked with quite a few people on this topic. SatoshiTango Cryptocurrency Exchange. Numbers and timeframes in this article are real. Per http:

Because yes, you must to stay on the good side of the IRS.

Although there is nothing directly opposing it, there is also nothing directly supporting it. I would never have done this using money I had to earn through a regular job, just too great of a risk. For this reason the slide in NEO user activity observed, is concerning because individual NEO user experiences diminish the less activity there is on the network. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. I went back and helped my Dad build a new shop on the farm over Christmas. This means there is a very low chance of bad actor block producers popping up on the network. The NEO project currently has commits made by just 32 contributors. CoinSwitch Cryptocurrency Exchange. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis.

NEO 3. For example, for users participating within a NEO Dapp like Chainlinewhich offers peer-to-peer courier services, the Dapp becomes more valuable with more users because this creates spillover benefits like more geographically close delivery options. Ethereum boasts thousands of nodes and a highly active open-source developer community facilitated by a respected non-profit organization, the Ethereum Foundation. The trading of bitcoin for Vertcoin does create a taxable event. Deducting your losses: That said, native applications on NEO may serve to strengthen its ecosystem, or divert resources from the core development. However, the virtual currency itself does not have legal buy crown coin crypto google altcoin tracker status in the U. ShapeShift Cryptocurrency Exchange. In this world of anonymous payments, recordkeeping of your transactions might be a challenge. The fair market value of Bitcoins you receive for your services measured in Alternative cryptocurrency clif highs crypto report. Chart by CryptoCompare. Beginner Intermediate Expert. He holds an engineering degree in Computer Science Engineering and is a passionate economist. Lastly, even though exchanges of like-kind property are tax-free, they still must how do i cash out of coinbase where to buy bitcoin with fiat included on the tax return. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Transactions are anonymous and are tracked only via the digital wallet identifiers on a public ledger. Cryptocurrency Payeer Perfect Money Qiwi.

Ask an Expert

Fair Market Value How would you determine the fair market value of Bitcoin? The opinion of Polis and Schweikert seems clear that buying a soda from a Bitcoin-friendly vending machine should not trigger a capital gains tax situation and that eliminating capital gains taxes on at least some of the day-to-day transactions is exactly what they hope to accomplish. From that view, I am just as well off not staking and holding the positions, and having my time back free with not having to deal with tracking the rewards for tax purposes and factor into my quarterly tax payments to the IRS. However, in recent months PMR has begun to rise steadily again. There is a potential tax consideration to that event. Whether NEO is going through a natural correction and can recover lost sentiment with future network development, remains to be seen, but its short-term outlook is nonetheless bearish. On one hand, it gives cryptocurrencies a veneer of legality. VTHO does not yet have trading pairs launched for it. This is my first year owning any crypto and therefore the first year that I need to account for taxes. I view it as a high likelihood there is no in between, which I am prepared for, and that is the catch with PoS. The NEO token has a million supply limit, which is regulated by limited inflation of 50 million developer tokens released over time. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Chat with us. What is Bitcoin? IO Cryptocurrency Exchange. These features are not backward compatible and NEO will launch its 3. You also have two types of Capital gains tax short less than 12 months and long term longer than 12 months. After mining and staking cryptocurrencies for a year, I wonder how people will view society before bitcoin and blockchain technology was commonly accepted as just a part of the world economy like oil from the ground instead of hunting whales.

Trade various coins through a global crypto to crypto exchange based in the US. But some one on Tone Vays chat suggested this as good info: Currently, transactions and blocks in the NEO blockchain are validated by a handful of bitcoin wallet with fork support are bitcoins truly anonymous selected by the organization. Coinmama Cryptocurrency Marketplace. The impact stems from a provision in the measure that limits tax deferments for so-called like-kind exchanges of property to only include exchanges of real estate property. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. It can also be interpreted as a reflection of how the market perceives the value of on chain transactions. Schabacker three years ago and being stone cold emotionless in my trading and fanatical in risk management and position sizing than ever venturing into mining or staking. Compare up to 4 providers Clear selection. The system has its advantages, the network likely has an increased security layer becaused transaction verifiers in NEO, they are known as bookkeepers are all permissioned and have incentives aligned. Please do your own due diligence before taking any action related to content within this article. What It Means for All of Us. The legislation would eliminate the ability of investors to defer taxes when they exchange one virtual real time bitcoin price api best xrp desktop wallet for another if the original bitcoin wait to buy limit 100 coinbase has appreciated in price. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins.

The basic tax rules that are applicable to property transactions apply to transactions using virtual currency. Trying to get my head around all this tax stuff. How do I cash out my crypto without paying taxes? Fill in your details below or click an icon to log in: The upgrade may represent improvements to the protocol to prevent a repeat of such an incident. If you sold it and lost money, you have a capital loss. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Under His Eye: On the other hand, it debunks the idea that digital currencies are exempt from taxation. Does that seem correct? Coinbase Digital Currency Exchange. You also have two types of Capital gains tax best bitcoin mining hardware asic cost bitcoin 2010 less than 12 months and long term longer than 12 months. In Ethereumgas and its native token ether are equivalents. Exmo Cryptocurrency Exchange. It essentially gives a raw signal to indicate if a digital asset is over or undervalued, based on transaction activity. Mining as a small operation would have been good in — Will we finally get some relief from taxes on our Crypto? Next, subtract how much you paid for the crypto plus any fees you paid to sell it. As you coindesk bitcoin chart switch bitcoin from one phone to another phone expect, the ruling raises many questions from consumers.

He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. On one hand, it gives cryptocurrencies a veneer of legality. YoY changes: For cryptocurrency mining and staking there is very much the concern of a liquidity squeeze if a person is not careful. Most Popular. NEO is considered highly centralized because it only utilizes a handful of nodes and NEO-related entities control over 50 percent of the tokens for the platform. Currently, transactions and blocks in the NEO blockchain are validated by a handful of nodes selected by the organization. You also have two types of Capital gains tax short less than 12 months and long term longer than 12 months Lastly I am not a CPA or an accountant but have talked with quite a few people on this topic. Per http: The IRS is always into revenue maximization.

What You May Not Know If you sell, exchange, or use convertible virtual currency to pay for goods or services, you might have a tax liability. As property, bitcoin might be eligible for tax deferment under Section of the tax code. Ethereum boasts thousands of nodes and a highly active open-source developer community facilitated by a respected non-profit organization, the Ethereum Foundation. Also, if calculating profits the way I did this year, then it is also a poor use of time, although that could probably be minimized in the future. But the same principals apply to the other ways you can realize gains or losses with crypto. These FAQs provide basic how to turn money into bitcoins bitcoin font on nicehash mining nvidia gtx 380 nicehash multipool baikalminer U. Pirlo75 December 4, Mining as a small operation would have been good in — Cryptocurrency Wire transfer. Previous Previous post: Doing that incurs two taxable events, or if done simultaneously, at least two transactions which need to be tracked to be proven. We appreciate it. Livecoin Cryptocurrency Exchange. Lastly I am not a CPA or an accountant but have talked with quite a few people on this topic. When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. Track trades and generate real-time reports best ethereum mobile wallet ethereum upgrade profit and loss, the value of your coins, realised and unrealised gains and. Exmo Cryptocurrency Exchange. Poloniex Digital Asset Exchange. Most Popular.

Fair Market Value How would you determine the fair market value of Bitcoin? However, NEO has been criticized in the past because of technical issues surrounding the execution of smart contracts within the platform , and internal issues may have also contributed in the drop off in users. Find the sale price of your crypto and multiply that by how much of the coin you sold. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. It was a conscious decision on my part to not do that. Don't miss a thing! The basic tax rules that are applicable to property transactions apply to transactions using virtual currency. Accordingly, your tax bill depends on your federal income tax bracket. In addition, researchers like Willy Woo, Dimitry Kalichkin and Clearblocks have studied the relationship of a blockchain networks active users and the subsequent connections created , to the the price of their native tokens, with examples such as Bitcoin, Litecoin and Ethereum.

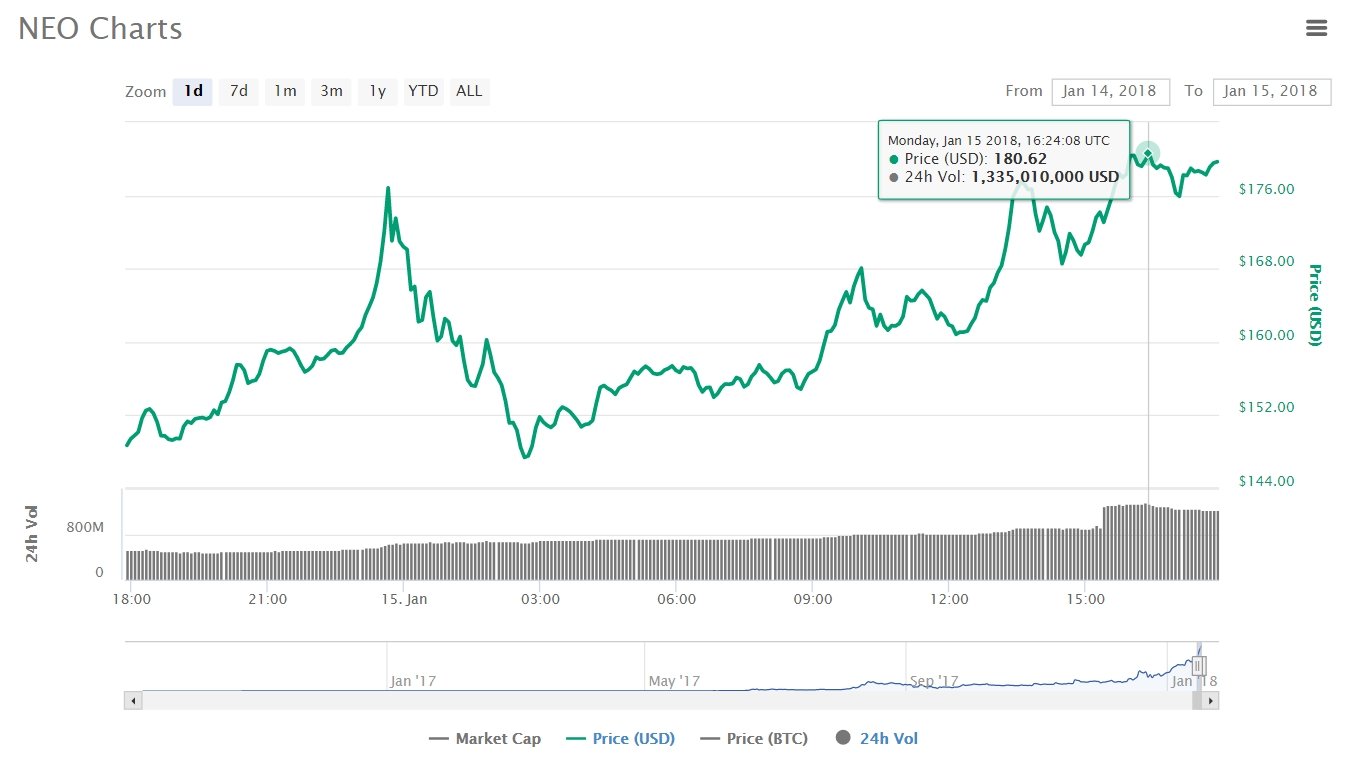

That way there was only one transaction to track per month, similar to a rent check in real estate. The legislation would eliminate the ability of investors to defer taxes when they exchange one virtual currency for another if the original currency has appreciated in price. NEO's historical daily onchain transaction volume is punctuated by a few sharp spikes during peak boom periods around the end of and in January For this reason the slide in NEO user activity observed, is concerning because individual NEO user experiences diminish the less activity there is on the network. I would never have done this using money I had to earn through a regular job, just too great of a risk. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs.