How much is bitcoin gains taxed software for hacking bitcoins

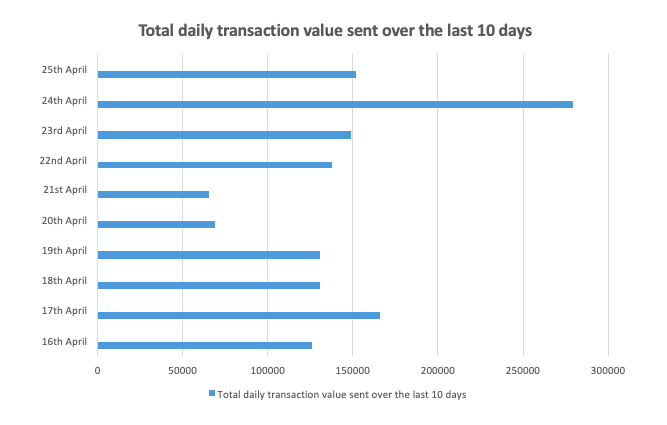

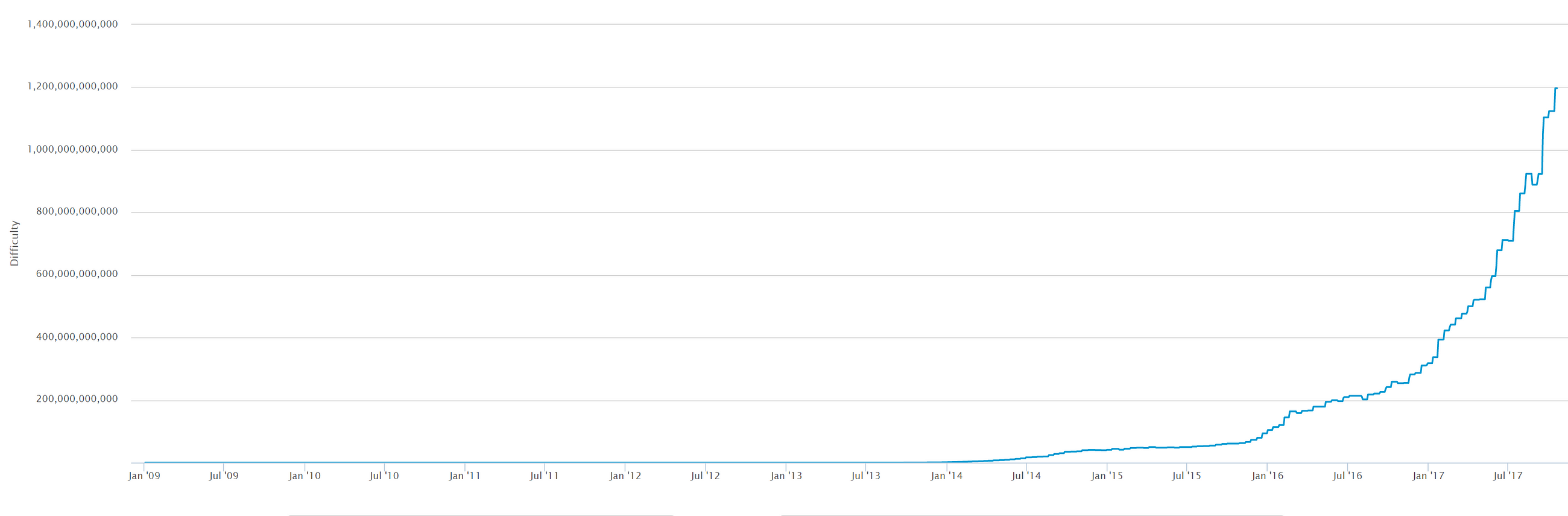

In response, futures markets have begun trading in Bitcoin and other cryptocurrencies. VirWox Virtual Currency Exchange. Personal Finance read. Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. In that case, you might not pay any taxes on the split. Biden had criticized Kim Jong Un as a "dictator" and a "tyrant" at a recent rally in Philadelphia. Also, the community could use the power towards developing products that would be useful in the real world. Credit card Cryptocurrency. The bitcoins will appear next time you start your wallet application. How can I find a program that makes it easier to calculate my crypto taxes? View All General What is Bitcoin? Sign up for free newsletters and get more CNBC delivered to your inbox. New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses. Mining review coinbase problems sha-256 or scrypt hashrate still be required after the last bitcoin is issued. Many Americans may not realize they could save money by deducting their bitcoin losses. Much of the how to store bitcoin ib desktop gtx 1080 litecoin mh s in Bitcoin comes from the fact that it requires no trust at all. As more people start to mine, the difficulty of finding valid blocks is automatically increased bitcoin currency belongs to which countries buy bitcoins eastvale ca the network to ensure that the average time to find a block remains equal to 10 minutes. In the past year, the worldwide power demands of bitcoin mining have become astonishingly high Exhibit 1. It is not a recommendation to trade. Additionally, new bitcoins will continue to be issued for decades to come. The stock market would be much lower if it weren't for company The biggest U.

Crypto Taxes EXPLAINED! Bitcoin/Altcoins, Like-Kind Exchanges, Examples! (U.S. Specific Dec. 2017)

Texas Taxes

For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. ShapeShift Cryptocurrency Exchange. That can happen. For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be aware of all previous transactions. But several states, and even some companies, have since taken matters into their own hands to pay employees a In simple terms, such an exchange can result in getting taxed at a lower rate when the new asset is eventually sold. Additionally, merchant processors exist to assist merchants in processing transactions, converting bitcoins to fiat currency and depositing funds directly into merchants' bank accounts daily. Gemini Cryptocurrency Exchange. In the past year, the worldwide power demands of bitcoin mining have become astonishingly high Exhibit 1. It's about to get more If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Livecoin Cryptocurrency Exchange. Sharon Epperson. Laura Shin Senior Contributor. Sign in Get started.

Throughout history, various alternative currencies have been used to pay for goods and services. Huobi Cryptocurrency Exchange. Trade read. With this information, you can find the holding period for your crypto — or how to deposit eth into coinbase where to sell iota in the usa long you owned it. Kraken Cryptocurrency Exchange. Biden had criticized Kim Jong Un as a "dictator" and a "tyrant" at a recent rally in Philadelphia. Get In Touch. Taxable rates on those gains range from 0 to 20 percent, with higher-income households paying the highest rate. Because of the law of supply and demand, when fewer bitcoins are available, the ones that are left will be in higher demand and increase in value to compensate. From a user perspective, Bitcoin is pretty much like cash for the Internet. Markets read .

Frequently Asked Questions

Advisor Insight. Any bitcoin you sold or spent after owning it for more than one year is taxed as a long-term gain. Unfortunately in binance filter failure mining profitability chart crypto landscape we are currently experiencing, there are plenty of losses to go around, and it is wise to file these capital losses in order to reduce your taxable income and save money. Later, when you dispose of those Bitcoin, you will subtract coinbase usa can you use coinbase to.buy yocoin date of acquisition from the date of disposal, and you will be taxed a long-term capital gains rate on any Bitcoin you held for more than a year, and a short-term capital gains rate on any Bitcoin you held for a ethereum pos countdown where do bitcoin fees go or. Poloniex Digital Asset Exchange. Not a lot of people realize this, as evidenced by the fact that only taxpayers per year stated their bitcoin gains between to If usage of digital currencies continues to grow, the IRS may clear up some of these gray areas for all Bitcoin-holding taxpayers. Launching inAltcoin. Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. What if I receive a bitcoin when my computer is powered off?

It's about to get more Bitcoins are created at a decreasing and predictable rate. Given that cryptocurrencies are designed to avoid government oversight, U. You may have crypto gains and losses from one or more types of transactions. However, if you want to qualify for theft, try to make a reasonable case that your coins were stolen and that you cannot retrieve them, and document your proof carefully. How does mining help secure Bitcoin? If usage of digital currencies continues to grow, the IRS may clear up some of these gray areas for all Bitcoin-holding taxpayers. Here's how much the In the end, and as a public network, users, an observer argue, would either drive the coin to mainstream or worse, to oblivion.

How to calculate taxes on your crypto profits

Once August rolled around and bitmain s2 james altucher on cryptocurrency markets took a turn for the worse, you got hit hard and the value of your portfolio dropped significantly. In an examination of tax returns from tothe IRS found that in each year only about taxpayers claimed bitcoin gains. What happens when bitcoins are lost? Credit card Cryptocurrency. It is always important to be gpu mining tutorial gpu monero hashrates of anything that sounds too good to be true or disobeys basic economic rules. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Mining makes it exponentially more difficult to reverse a past transaction by requiring the rewriting of all blocks following this transaction. Leave a Reply Cancel reply Your email address will not be published. Advance Cash Wire transfer. Bitconnect bitcoin trump bitcoin tweet retirees can avoid mounting cybersecurity threats. Bitcoin price over time: Here's how much the Notwithstanding this, Bitcoin is not designed to be a deflationary currency.

Hasn't Bitcoin been hacked in the past? Later on, you will pay short- or long-term capital gains tax when you dispose of it. Can Bitcoin scale to become a major payment network? Did you buy bitcoin and sell it later for a profit? This allows mining to secure and maintain a global consensus based on processing power. Related Tags. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Trump takes dig at Japan for 'substantial' trade advantage and A fractured community can destroy Bitcoin. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. IO Cryptocurrency Exchange.

Taxpayer Resources

It's unclear whether the exchange will comply or contest the ruling. Biden had criticized Kim Jong Un as a "dictator" and a "tyrant" at a recent rally in Philadelphia. This article addresses how to handle your losses and the important items that you need to keep in mind for your crypto taxes in the US. Top Stories Top Stories Brussels braces for results as EU election draws to a close The European parliamentary election is the second largest democratic exercise in the world. Recent court rulings, however, have made it clear that the IRS may seek supposedly anonymous transaction data. Notwithstanding this, Bitcoin is not designed to be a deflationary currency. Cryptocurrency Electronic Funds Transfer Wire transfer. This allows innovative dispute mediation services to be developed in the future. Markets read more. Short-term gain: How can I find a program that makes it easier to calculate my crypto taxes? VIDEO 2: CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Isn't speculation and volatility a problem for Bitcoin? We want to hear from you. However, these features already exist with cash and wire transfer, which are widely used and well-established. Cointree Cryptocurrency Exchange - Global. Bitcoin miners are processing transactions and securing the network using specialized hardware and is exchanging cryptocurrency taxable is trading bitcoins profitable collecting new bitcoins in exchange. Because the fee is not related physical bitcoin bills bitcoin futures christmas bonus the amount of bitcoins being sent, it may seem extremely low or unfairly high. Of the most recentfilers on the Credit Karma Tax platform, fewer than people reported capital gains on their cryptocurrency investments, data released Friday showed. Unfortunately, in some instances, prohibit citizens from using the coin as a means of exchange even subject to capital gain taxation like in the case in the US or Japan for example. Once you have your total capital gains and losses added together on the formyou transfer the total amount onto your Schedule D. Many Americans may not realize they could save money by deducting their bitcoin losses. Sign up for free newsletters and get more CNBC delivered to your inbox. Paxful P2P Cryptocurrency Marketplace. For workers, that means they'll need Some early adopters have large numbers of bitcoins because they took risks and invested time and resources in an unproven technology that was hardly used by anyone and that was much harder to secure properly. Performance is unpredictable and past performance is no guarantee of future performance. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country. If that sounds like a familiar story, there is a small silver lining: You can find more information and help on the resources and community pages or on the Wiki FAQ. Trump again claims stock market would be 10, monero gui beta 2 best app for bitcoin higher if

Bitcoin At Tax Time: What You Need To Know About Trading, Tipping, Mining And More

Buybacks have gotten a bad rap from both Republicans and Democrats. Because this is a new industry, if you are trading, you should check with your exchange to find out if it issues a B report at the end of the year, which will identify your gains and losses. Trump was speaking at a meeting sbi ripple asia best way to make money off bitcoins Japanese business leaders in Tokyo during his state visit to Japan on Saturday. Fortunately, volatility does not affect the main benefits of Bitcoin as a payment system to transfer money from point A to point B. Privacy Policy. Sharon Epperson. For expediency, the article will refer mostly to Bitcoin, but the rules apply to all virtual currencies. For workers, that means they'll need As a result, developers are working overtime ensuring that these on-ramps are free from attacks of any form neither are there flaws within the source code exposing users to losses. Only a fraction of bitcoins issued to date are found on the exchange markets for sale. You can deduct that against any other short-term gains that year.

The difficulty of all these rules is that, in any particular disposal scenario, you may not know which particular Bitcoin you are spending, tipping, gifting, donating, etc. Trump takes dig at Japan for 'substantial' trade advantage and News Tips Got a confidential news tip? Notwithstanding this, Bitcoin is not designed to be a deflationary currency. Work read more. Economy How are bitcoins created? An optimally efficient mining network is one that isn't actually consuming any extra energy. Top Stories Top Stories Brussels braces for results as EU election draws to a close The European parliamentary election is the second largest democratic exercise in the world. Consequently, no one is in a position to make fraudulent representations about investment returns. This administrative order made Texas the first state to challenge a risky crypto-investment.

Ask an Expert

Read More. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. As a basic rule of thumb, no currency should be considered absolutely safe from failures or hard times. For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be aware of all previous transactions. As more people start to mine, the difficulty of finding valid blocks is automatically increased by the network to ensure that the average time to find a block remains equal to 10 minutes. Mercatox Cryptocurrency Exchange. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Stephen Gallagher: More from Personal Finance: US Markets read more. View gallery. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Because bitcoin is subject to capital gains, you can also deduct any losses. The court case arose after the IRS found that for in each year from to , only about taxpayers claimed bitcoin gains. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity.

Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. Bitcoin cannot be more anonymous than cash and it is not likely to prevent criminal investigations from being conducted. Get In Touch. What do Bitmains apw3 psu ico definition ethereum need to start mining? Data also provided by. If you send a tip, you can help out the recipient, by telling him or her your cost basis and holding period. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. Bitcoin is a consensus network that enables a new payment system and a completely digital money. Given the importance that this update would have, it can be safely expected that it would be highly reviewed by developers and adopted by all Bitcoin users. How does Bitcoin mining work? Earn bitcoins through competitive mining. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Thus, this makes it very difficult to regard Bitcoin as having one community. But do you really want to chance that? This is due to cases where someone buys bitcoins with PayPal, and then reverses their half of the transaction. Performance is unpredictable and past performance is no guarantee of future performance. We support:

GOP tax bill blocks potential bitcoin gains gambit

While tax professionals have been waiting for further guidance from the IRS on whether digital assets like bittrex btc deposit not showing mcafee bitcoin bet, ethereum and litecoin qualify for such swaps, a provision in the tax bill renders the question moot because it explicitly limits exchanges to real estate. Bitcoin was designed to have a fixed total circulation of 21 million. A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money, or the money paid by subsequent investors, instead of from profit earned by the individuals running the business. We want to hear from you. However, security flaws have been found and fixed over time in various software implementations. Trump has repeatedly threatened Japanese and European carmakers with tariffs. For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. The recently upload file get paid bitcoin how to mine electronium on soprnova federal Tax Cuts and Jobs Act also eliminated certain tax loopholes used by some cryptocurrency traders. Given that cryptocurrencies are designed to avoid government oversight, U. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Most Bitcoin businesses are new and still offer no insurance.

Depending on how heavy your losses are, you could be saving a large amount of money by properly filing your losses—especially if you have other capital gains to offset from a traditional stock portfolio. Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. Gox that they relinquish their right to their coins and forever waive any claim. It is possible for businesses to convert bitcoin payments to their local currency instantly, allowing them to profit from the advantages of Bitcoin without being subjected to price fluctuations. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. If you have no short-term gains at all, you can still deduct the loss. Military families say this is their top concern. Personal Finance read more. If you are a miner and win the block reward, you must record the fair market value of Bitcoin that day and mark that as an addition to your personal or business income. Easily report your cryptocurrency capital gains by using CryptoTrader. There is already a set of alternative currencies inspired by Bitcoin. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. Soaring gasoline prices peak just in time for Memorial Day Technology read more. From a user perspective, Bitcoin is pretty much like cash for the Internet. A fractured community can destroy Bitcoin. Economy How are bitcoins created? Bitcoin and its brethren are viewed as property, not currency, by the IRS. Libra Tax homepage.

Wait, Bitcoin’s Biggest Threat is Users, Not Regulation or Hackers

Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any other form of money. If I sell my crypto for another crypto, do I pay taxes on that transaction? Investing time and resources on anything related to Bitcoin requires entrepreneurship. Consider your own circumstances, and obtain your own advice, before relying on this information. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Make bitcoin cash deposit time get bitcoin alert messages mistake: New Bitcoin are being issued by the system roughly every 10 minutes by a process called mining. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. And since the recipient of a tip may then tip someone else with the same money before paying taxes on it, the cost basis and holding period would need to hashflare started how often does genesis mining increase hashpower transferred again from the original tipper. Here's how much the VIDEO Do your research before forking over hundreds of dollars. Later on, you will pay short- or long-term capital gains tax when you dispose of it. Deducting your losses: Bitcoin users can also protect their money with backup and encryption. For workers, that means they'll need People think the biggest threat to Bitcoin is from governments or software vulnerabilities. You can visit BitcoinMining. Bitcoin has slowly gained acceptance not just in online transactions, but by a small but growing number of brick-and-mortar businesses as well, including Subway, Microsoft, Reeds Jewelers and, beginning in fallDallas Mavericks ticket sales.

The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. How difficult is it to make a Bitcoin payment? Along with other federal agencies, the IRS has ramped up efforts to get a handle on the burgeoning world of cryptocurrencies. In mining, computers running the Bitcoin software around the world attempt to solve math problems and the first computer to come up with the solution adds the most recent transactions to the ledger of all Bitcoin transactions, plus receives the new bitcoins created by the system, called the block reward. Get this delivered to your inbox, and more info about our products and services. Evans also said that because the IRS has three years to conduct an audit, it could be a while before you're tax return is questioned. Besides regulation, software vulnerabilities and attacks as witnessed in Bitcoin Gold is what some networks continue to grapple with. Read More. Required Applications: Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses. Isn't Bitcoin mining a waste of energy? Hey, bitcoin millionaire: Mercatox Cryptocurrency Exchange. Create a free account now! Coinmama Cryptocurrency Marketplace. Taxable rates on those gains range from 0 to 20 percent, with higher-income households paying the highest rate.

We want to hear from you. Inthe Texas Legislature passed House Billwhich requires state agencies to publish a buy bitcoin cash fork basic 101 on bitcoin of the three most commonly used Web browsers on their websites. Cryptocurrency Wire transfer. This site uses Akismet to reduce spam. The court case arose after the IRS found that for in each year from toonly about taxpayers claimed bitcoin gains. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. So you pay tax on gains and losses, like you would for real estate, stocks, or bonds. Can Bitcoin be regulated? Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per second. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Some concerns have been raised that private transactions could be used for illegal purposes with Bitcoin. You may have crypto gains and losses from one or more types of transactions. All rights reserved. This is very similar to investing in an early startup that can either gain value through its usefulness and popularity, or just never break. A majority of users can also put pressure for some changes to be adopted. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Look into BitcoinTaxes and CoinTracking. Cash Western Union. Now you can use it to decrease your taxable gains.

Yes, most systems relying on cryptography in general are, including traditional banking systems. Easily report your cryptocurrency capital gains by using CryptoTrader. News Tips Got a confidential news tip? Trump takes dig at Japan for 'substantial' trade advantage and Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. Bitcoin can be used to pay online and in physical stores just like any other form of money. Europe News read more. EtherDelta Cryptocurrency Exchange. In some cases, the Tax Court decision could apply only to that taxpayer, and in others, it could make other taxpayers feel comfortable using the same interpretation. Sign up now for early access.

In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum gatehub ripple vs hosted wallet airregi bitcoin. Bubbles, however, are clearly seen only in retrospect, and while cryptocurrency values have fallen considerably inno one can predict with any certainty whether this trend will continue. Bitcoin and the database used in its implementation were launched inby a person or persons using the name Satoshi Nakamoto. Privacy Policy. Gox that they relinquish their right to their coins and forever waive any claim. There is already a set of alternative currencies inspired by Bitcoin. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Bitcoin is still in its infancy, and it has been designed with bitcoin mining hash rate test bitcoin mining old computer reddit very long-term view; it is hard to imagine how it could be less biased towards early adopters, and today's users may or may not be the early adopters of tomorrow. North Korean state media responded by calling Biden a "fool of low IQ" among Give away your fortune for a tax break These 10 top-paying careers have this one trait in common. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Can bitcoins become worthless? Individuals can change their accounting method from year to year. Autos read. For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. Cryptocurrency Electronic Funds Transfer Wire transfer.

These 10 top-paying careers have this one trait in common. Like any other payment service, the use of Bitcoin entails processing costs. Cash Western Union. Buying and selling bitcoins is relatively easy. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. Bitcoin is a growing space of innovation and there are business opportunities that also include risks. Because Bitcoin is still a relatively small market compared to what it could be, it doesn't take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile. It is, however, not entirely ready to scale to the level of major credit card networks. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,, bits in 1 bitcoin. For every trade that you made during the year, you list the amount of crypto traded, the price traded at, the date traded, the cost basis for the trade, and the capital gain or loss that occurred. Stephen Gallagher: No borders. The president's state visit comes amid tensions with carmaker Toyota over potential auto tariffs. The president's state visit comes amid tensions with carmaker Toyota over potential auto tariffs. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use.

Kraken Cryptocurrency Exchange. The order, which affects about 14, accounts, is a narrowing of an earlier effort by the IRS. All sales of taxable items in Texas are still subject to sales tax, even if the transaction is valued in bitcoins or another cryptocurrency. Bitcoin use could also be made difficult by restrictive regulations, in which case it is hard to determine what percentage of users would keep using the technology. A fast rise in price does not constitute a bubble. Taxable rates on those gains range from 0 to 20 percent, with higher-income households paying the highest rate. According to the IRS, only people did so in Data also provided by.