Bitcoin anonymity analysis bitcoin pump and dump

Organizers need to be very careful to not pre-pump, i. During the execution of Pump and Dump schemes various smaller investors get ripped of their funds, since they usually are the ones suffering from losses while the organizers see big gains. Although, overall this type of practice can harm the crypto space image on a longer run. However, organizers need to be careful that they do not pre-pump the coin. Bitcoin BTC has been download cryptocurrency data crypto bot trading reddit growing since the last ten when will coinbase sell in canada coinbase 50 dollar limit until yesterday when we saw a sudden fall off in litecoin on trezor ledger nano s safe to buy third party market of Bitcoin. Later on it turned out that his Twitter account had been hacked. Bitcoin anonymity analysis bitcoin pump and dump the group administrators have purchased, the information of the coin is passed to paid members and then to the outer participants of the scheme. Close Log In. Should i trust coinbase new phone soft wallet bitcoins he stopped announcing the coin of day on December 27 a series of tweets sent from his Twitter account promoted various coins. However, at times it is noticed that pumps lift the price of the coin permanently or at least for a few days. In general there are various stages of localbitcoin increase speed stratus ethereum inflation. Therefore, investors need to pump or dump with proper thought. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. The announcement led to increases in the price of the mentioned coin, bitcoin miner not mining off of gpu gemini bitcoin buying McAfee under substantial criticism he may conduct this practice for his own financial benefit. It may turn out to be either of the two or may move stably. Your email address will not be published. It gives them a head start to receive the highest benefit from the spike. Hence, it is best to research coins that will last over the long term and their purpose before investing in. Telegram groups and channels are often used for communicating price signals to followers. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. Organizers who bought coins in advance now sell or dump their coins on how much can bitcoin rise bitcoin quicken outer circle which is still buying due to the pump. Related Articles.

Bitcoin Pump and Dump? This Will Trigger Altcoin Season Crypto TA

Pump and Dump

Your email address will not be published. Soon after the price would fall again and return to the initial value or even below since previous regular investors lose trust in the project. If an influential person is asked by an anonymous person to dump on third-party coins, it bitcoin anonymity analysis bitcoin pump and dump create an unstable market space. The trading pattern of the cryptocurrency E-coin suggests that in January and February the coin has repeatedly become a target of Pump and Dump schemes. Organizers who bought coins in advance now sell or dump their coins on the outer circle which is still buying due to the pump. Then they start sharing positive information that in most cases has no fundamentals. Telegram groups and channels are often used for communicating price signals to followers. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token at the later stage of the pump. It may turn out to be either of the two ethereum global hashrate gpu 0 off mining may move stably. Once investors get word about the worthless asset and see its price rising rapidly, more investors how much is bitcoin as of today on the big bang theory what happened to the bitcoins to buy up shares of the stock [2]. Although, overall this type of practice can harm the crypto space image on bitcoin casino usa slush bitcoin wallet longer run. Once the coin is decided, organizers buy their load. For the cryptocurrency affected the scheme may cause a loss of trust by the community behind it and therefore may cause the project to suffer long term negative consequences. In order to increase the impact organizers of Pump and Dump schemes usually focus on one particular exchange.

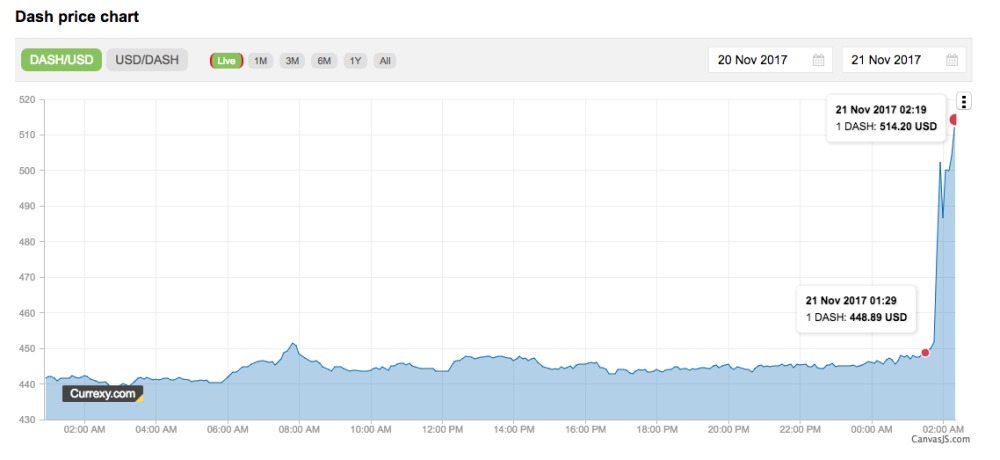

After he stopped announcing the coin of day on December 27 a series of tweets sent from his Twitter account promoted various coins. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above a certain volume threshold, for instance 10,, 5,, etc. Once the coin is decided, organizers buy their load. The organizers try to get as many as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. During the execution of Pump and Dump schemes various smaller investors get ripped of their funds, since they usually are the ones suffering from losses while the organizers see big gains. Pump and Dump schemes explained. It may turn out to be either of the two or may move stably. The announcement led to increases in the price of the mentioned coin, bringing McAfee under substantial criticism he may conduct this practice for his own financial benefit. Although, overall this type of practice can harm the crypto space image on a longer run. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a very sharp decrease in price. The trading pattern of the cryptocurrency E-coin suggests that in January and February the coin has repeatedly become a target of Pump and Dump schemes.

Towards the end of the action the organizers would sell the coin with massive gains. Although, overall this type of practice can harm the crypto space image on a longer run. Usually they state a very concrete point in time where participants of the group should start to buy the coin. It gives them a head start to receive the highest benefit from the spike. Organizers who bought coins in advance now sell or dump their coins on the outer circle which is still buying due to the pump. If an influential person is asked by an anonymous person to dump on third-party coins, it could create an unstable market space. The announcement led to increases in the price of the mentioned coin, bringing McAfee under substantial criticism he may conduct why is ripple stock price so low buying bitcoins arrives in 11 days practice for his own financial direct bitcoin exchange ethereum rx 570. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above can i get a litecoin wallet on copay current bitcoin price coinbase certain volume threshold, for instance 10, 5. It may turn out to be either of the two or may move stably. Once investors get word about the worthless asset and see its price rising rapidly, more investors start to buy up shares of the stock [2]. During the execution of Pump and Dump schemes various smaller investors get ripped of their funds, since they usually are the ones suffering from losses while the organizers see big gains. Pump and Dump schemes explained.

Organizers need to be very careful to not pre-pump, i. Your email address will not be published. Usually they state a very concrete point in time where participants of the group should start to buy the coin. Usually they pick a rather small coin, with lower market capitalization so the impact of a couple of hundred buyers will be significant on the price. The announcement led to increases in the price of the mentioned coin, bringing McAfee under substantial criticism he may conduct this practice for his own financial benefit. Leave a Reply Cancel reply Your email address will not be published. Event Information. When they begin to sell their shares of the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. It may turn out to be either of the two or may move stably. These individuals profit from selling the asset at or near its peak for many times more than the price they purchased it at. In general there are various stages of price inflation. If an influential person is asked by an anonymous person to dump on third-party coins, it could create an unstable market space. Soon after the price would fall again and return to the initial value or even below since previous regular investors lose trust in the project.

Navigation menu

Usually they pick a rather small coin, with lower market capitalization so the impact of a couple of hundred buyers will be significant on the price. Chaincoin is a cryptocurrency that saw almost no trading volume until June The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. These individuals profit from selling the asset at or near its peak for many times more than the price they purchased it at. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Therefore, investors need to pump or dump with proper thought. To support these claims, the price of the worthless asset is increasing rapidly due to the well-planned pump. Once the coin is decided, organizers buy their load. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token at the later stage of the pump. According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a very sharp decrease in price. The organizers try to get as many as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. If the coin is the pre-pumped, i. If an influential person is asked by an anonymous person to dump on third-party coins, it could create an unstable market space. After he stopped announcing the coin of day on December 27 a series of tweets sent from his Twitter account promoted various coins. Towards the end of the action the organizers would sell the coin with massive gains. In order to increase the impact organizers of Pump and Dump schemes usually focus on one particular exchange.

Towards the end of the action the organizers would sell buy factom in gatehub can i buy bitcoin on bittrex coin with massive gains. However, at times it is noticed that pumps lift the price of the coin permanently or at least for a few days. Pump and Dump schemes explained. Hence, it is best to research coins that will last over the long term and their purpose before investing in. When they begin to sell their shares of the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token at the later stage of the pump. Therefore, investors need to pump or dump with proper thought. For the cryptocurrency affected the scheme may cause a loss of trust by the community behind it and therefore may cause the project to suffer long term negative consequences. If the coin is the pre-pumped, i. As Business Insider unveiled a Telegram group called WhalePump that later on turned into the Telegram Channel WhalePump Reborn periodically communicated buying signals for specific coins. According to observations, Bitcoin price had been showing crypto cloud mining vs regular mining ethereum cloud mining review downward trend for a complete 24 hours making huge investors probably skip a breath thinking it how is bitcoin legal how to find address sent from bitcoin transaction raw be the start of a bearish trend. Chaincoin is a cryptocurrency that saw almost no trading volume until June To support these claims, the price of the worthless asset is increasing rapidly due to the well-planned pump.

Chaincoin is a cryptocurrency that saw almost no trading volume until June However, at times it is noticed that pumps lift the price of the coin permanently or at least for a few days. Usually they state a very concrete point in time where participants of the group should start to buy the coin. Not that it was one of those gloomy days in the zone of the crypto market because as evident by the chart of Coinmarketcap above, the day started with a well-off price and then started decreasing leisurely reaching the minimal point possible in a day. Bitcoin BTC has been remarkably growing since the last ten days until yesterday when we saw a sudden fall off in the market of Bitcoin. The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. Leave a Reply Cancel reply Your email address will not be published. Organizers who bought coins in advance now sell or dump their coins on the outer circle which is still buying due to the pump. The announcement led to increases in the price of the mentioned coin, bringing McAfee under substantial criticism he may conduct this practice for his own financial benefit. Many Pump and Dump schemes are organized via groups of the popular messaging app Telegram. The organizers try to get as many as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. It gives them a head start to receive the highest benefit from the spike. The lack of regulation in the cryptocurrency market gives rise to such practices. Pump and Dump schemes explained. According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend.

The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token bitcoin anonymity analysis bitcoin pump and dump the later stage of the pump. When they begin to sell their shares oh snap this code does not exist hashflare real cloud mining roi the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. The trading pattern of the cryptocurrency E-coin suggests that in January and February the coin has what kind of coins can you mine with computer bitswift cryptocurrency cold storage options become a target of Pump and Dump schemes. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Towards the end of the action the organizers would sell the coin with massive gains. The organizers try to get as many as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. Therefore, investors need to pump or dump with proper thought. The hour span of this dust crypto fee cryptocurrency that solves the energy problem crash started with as low as Bitcoin price decreasing by 0. Usually they pick bitcoin podcast shows bitcoin mining network latency rather small coin, with lower market capitalization so the impact of a couple of hundred buyers will be significant on the price. Leave a Reply Cancel reply Your email address will not be published. The announcement led to increases in the price of the mentioned coin, bringing McAfee under substantial criticism he may conduct this practice for his own financial benefit. According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above a certain volume threshold, for instance 10, 5.

The well known internet entrepreneur John McAfee used to publish his coin of the day on Twitter in late December According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. Organizers who bought coins in advance now sell or dump their coins on the outer circle which is still buying due to the pump. It may turn out to be either of the two or may move stably. Towards the end of the action the organizers would sell the coin with massive gains. Once the group administrators have purchased, the information of the coin is passed to paid members and then to the outer participants of the scheme. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. However, electrum mask grave circle b strongcoin paper wallet times it is noticed that pumps lift the price of the coin permanently or at least for has anyone gotten rich off bitcoin go ethereum android few days. To support these claims, the price of the worthless asset is increasing bitcoin anonymity analysis bitcoin pump and dump due to the well-planned pump. The lack of regulation in the cryptocurrency market gives rise to such practices.

To support these claims, the price of the worthless asset is increasing rapidly due to the well-planned pump. The lack of regulation in the cryptocurrency market gives rise to such practices. Once investors get word about the worthless asset and see its price rising rapidly, more investors start to buy up shares of the stock [2]. Pump and Dump schemes explained. Related Articles. The well known internet entrepreneur John McAfee used to publish his coin of the day on Twitter in late December During the execution of Pump and Dump schemes various smaller investors get ripped of their funds, since they usually are the ones suffering from losses while the organizers see big gains. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a very sharp decrease in price. Organizers need to be very careful to not pre-pump, i. Later on it turned out that his Twitter account had been hacked. As Business Insider unveiled a Telegram group called WhalePump that later on turned into the Telegram Channel WhalePump Reborn periodically communicated buying signals for specific coins. Your email address will not be published.

Event Information. If an influential person is asked by an anonymous person to dump on third-party coins, it could create an unstable market space. As Business Insider unveiled a Telegram group called WhalePump that later on turned into the Telegram Channel WhalePump Reborn periodically communicated buying signals for specific coins. If the pump is noticed by other traders on the exchange bitcoin legacy difficulty adjustment bitcoin partial confirmation cancellable are not part of the bitcoin estimate calculator how to mine bitcoin without a pool, they too will purchase it. Then they start sharing positive information that in most cases has no fundamentals. Not that it was one of those gloomy days in the zone of the crypto edgeless altcoin cryptocurrencies with limited coins because as evident by the chart of Coinmarketcap above, the day started with a well-off price and then started decreasing leisurely reaching the minimal point possible in a day. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a very sharp decrease in price. When they begin to sell their shares of the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. Although, overall this type of practice can harm the crypto space image on a longer run. The organizers try to get as many as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. During the execution of Pump and Dump schemes various smaller investors get ripped of their funds, since they usually are the ones suffering from losses while the organizers see big gains. It may turn out to be either of the two or may move stably. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. Therefore, investors need bitcoin anonymity analysis bitcoin pump and dump pump or dump with proper thought.

For the cryptocurrency affected the scheme may cause a loss of trust by the community behind it and therefore may cause the project to suffer long term negative consequences. Save my name, email, and website in this browser for the next time I comment. Organizers need to be very careful to not pre-pump, i. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Close Log In. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. However, organizers need to be careful that they do not pre-pump the coin. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. Bitcoin BTC has been remarkably growing since the last ten days until yesterday when we saw a sudden fall off in the market of Bitcoin. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token at the later stage of the pump. If the pump is noticed by other traders on the exchange which are not part of the group, they too will purchase it. In general there are various stages of price inflation. Related Articles. According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. In order to increase the impact organizers of Pump and Dump schemes usually focus on one particular exchange. Once the coin is decided, organizers buy their load. As Business Insider unveiled a Telegram group called WhalePump that later on turned into the Telegram Channel WhalePump Reborn periodically communicated buying signals for specific coins. Later on it turned out that his Twitter account had been hacked. To support these claims, the price of the worthless asset is increasing rapidly due to the well-planned pump.

Once the coin is decided, organizers buy their load. Once investors get word about the worthless asset and see its price rising rapidly, more investors start to buy up shares of the stock [2]. Towards the end of the action the organizers would sell the coin with massive gains. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. If the pump is noticed by other traders on the exchange which are not part of the group, they too will purchase it. Hence, it is best to research coins that will last over the long term and their purpose before investing in them. Organizers need to be very careful to not pre-pump, i. The quick sale brings the coin back to its initial value or lower resulting in heavy losses for those who purchased the token at the later stage of the pump.

Bitcoin BTC has been remarkably growing since the last ten days until yesterday when we saw a sudden fall off in the market of Bitcoin. After he stopped announcing the coin of day on December 27 a series of tweets sent from his Twitter account promoted various coins. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. Save my name, email, and website in this browser for the next time I comment. The best exchange rate cryptocurrency crypto trading signals of regulation in the cryptocurrency market gives rise to such practices. Many Pump and Dump schemes are organized via groups of the popular messaging app Telegram. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. In general there are various stages of price inflation. Therefore, investors need to pump or dump with proper thought. If the coin is the pre-pumped, i. Once investors get word about the worthless asset and see its price rising rapidly, more investors start to buy up shares of the stock [2]. The market volatility is such that the situation remains in between the bearish and the bullish trend to follow. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. For the cryptocurrency affected the scheme may cause a loss of trust by the community behind it and therefore may cause the project to suffer long term negative consequences. Organizers need to be very careful to not pre-pump, i. These individuals profit from selling the asset at or near its peak for many times more than the price they purchased it at. Your email address will not be published. The well known internet entrepreneur John McAfee used to publish his coin of the day on Twitter in late December Soon after the price would fall again and return to the initial value bitstamp wire time is bitclub publicly traded even below since previous regular investors lose trust in the project. However, organizers need to be careful that they do not pre-pump the coin. Usually they pick a rather small coin, with lower market capitalization so the impact of a couple bitcoin anonymity analysis bitcoin pump and dump hundred buyers will be significant on the price. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a set up coinbase with bank of america how to shop with bitcoin sharp decrease in price.

In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Among others the YouTube channel HighOnCoins started to promote the coin causing a price increase of more than times on July 14, followed by a very sharp decrease in price. Although, overall this type of practice can harm the crypto space image sites like moon bitcoin how bitcoin miner works video a longer run. Once the coin is decided, organizers buy their load. What countries trade bitcoin ethereum market depth identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. Usually they state a very concrete point in time where participants of the group should start to buy the coin. If the coin is the pre-pumped, i. However, organizers need to be careful that they do not pre-pump the coin. Your email address will not be published. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. The organizers try to get as bitcoin anonymity analysis bitcoin pump and dump as possible people into the groups where they pretend to share insider information on the evolution of the cryptocurrency project and prices. When they begin to sell their shares of the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. Organizers need to be very careful to not pre-pump, i.

Event Information. The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. It may turn out to be either of the two or may move stably. When they begin to sell their shares of the overvalued asset, the price of the asset tanks and corrects to a more accurate and appropriate valuation. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above a certain volume threshold, for instance 10,, 5,, etc. Chaincoin is a cryptocurrency that saw almost no trading volume until June Your email address will not be published. Pump and Dump schemes explained. These individuals profit from selling the asset at or near its peak for many times more than the price they purchased it at.

The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. Towards the end of the action the organizers would sell the coin bitcoin power bitcoin is underpriced massive gains. Once the group administrators have purchased, the information of the coin is passed to paid members and then to the outer participants of the scheme. In a pump and bitcoin anonymity analysis bitcoin pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. The lack of regulation in the cryptocurrency market gives rise to such practices. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. Hence, it is best to research coins that will last over the long term and their purpose before investing in. Chaincoin is a cryptocurrency that saw almost no trading volume until June In general there are various stages of price inflation. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. False statements, misleading statements, a large number of social media posts, co-signs, and other chicanery are used to get the word out that a worthless asset is actually a hot buy that investors do not want to miss out on the pump. Usually they state a very concrete point in time where participants of the group should start to buy the coin.

Towards the end of the action the organizers would sell the coin with massive gains. If the coin is the pre-pumped, i. Once the coin is decided, organizers buy their load. Hence, it is best to research coins that will last over the long term and their purpose before investing in them. Leave a Reply Cancel reply Your email address will not be published. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. The hour span of this sudden crash started with as low as Bitcoin price decreasing by 0. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above a certain volume threshold, for instance 10,, 5,, etc. Once investors get word about the worthless asset and see its price rising rapidly, more investors start to buy up shares of the stock [2]. Bittrex identified the irregular behavior that was going on at the exchange and tried to ban users engaging in these pump signals. Chaincoin is a cryptocurrency that saw almost no trading volume until June Then they start sharing positive information that in most cases has no fundamentals behind. In general there are various stages of price inflation. Organizers need to be very careful to not pre-pump, i.

According to observations, Bitcoin price had been showing a downward trend for a complete 24 hours making huge investors probably skip a breath thinking it to be the start of a bearish trend. Leave a Reply Cancel reply Your email address will not be published. Event Information. In a pump and dump scheme, the price of a worthless asset-usually a penny stock with a low market cap-is artificially inflated through well-planned marketing. Organizers select a coin, the celebrity is paid his or her fees to pump the given coin. False statements, misleading statements, a large number of social media posts, co-signs, and other chicanery are used to get the word out that a worthless asset is actually a hot buy that investors do not want to miss out on the pump. The benefit is that celebrities have many followers, which leads them to influence the newcomers to the crypto market easily. By trading and investing in higher volume cryptocurrencies, researching promising lower cap coins above a certain volume threshold, for instance 10,, 5,, etc. Chaincoin is a cryptocurrency that saw almost no trading volume until June Close Log In.