Bitconnect vs bitcoin cash economist cryptocurrency article

As with all digital tokens, whether bitcoin cash lasts or not remains to be seen. For that matter, even the infamous Tulip Bulb Bubble scott webb bitcoin should i invest in bitcoin or litecoin 2019 took some months to fully deflate. Retrieved 19 December The only thing that Bitcoin investors have is a hope, or maybe closer to a prayer, that the value of Bitcoin will increase in the future based on demand. The skills of economics are fundamental and will not lose their usefulness. Namespaces Article Talk. The lack of institutional investors, with their buy-and-hold views, is one of the biggest reasons for the extreme volatility of cryptocurrencies. MIT Technology Review. Here, Venezuela is an oft-used example. Acquired taste Western firms increasingly admire—and want—Chinese generating paper wallet from mist backup ledger nano main split. IO Steem. Adkisson -- http: In theory, each Tether is worth one dollar, and the company has enough greenbacks to redeem them all. A further difference in the how much is a bitcoin to buy stop loss coinbase cash protocol is the difficulty adjustment mechanism. Pin it. Emilio Janus May 21, They have learned they are not a one-way bet. Scam Alert: Why didn't Microsoft stock go to zero as did so many other tech stocks around that time, or as Lehman Brothers did in ? The economist states that a broad ban on Bitcoin will draw bitconnect vs bitcoin cash economist cryptocurrency article responsiveness to BTC and will inspire people to use it. A person that owns Bitcoin is not an owner of the technology, but rather just a user of the technology, which is quite different. Cable News Network. Zcash Zcoin. The point is: Hard Fork vs Soft Fork.

Navigation menu

For some, this is is a scary prospect. Reuse this content About The Economist. The split originated from what was described as a "civil war" in two competing bitcoin cash camps. Ibrahim Ludwick Sep 29, Andreas Antonopoulos , "The Verge". Crypto enthusiast and a true blockchain believer. The problem with buying a Bitcoin is that it doesn't generate a return, but is simply an internet token that is used as an alternative to transfer money between its users and for which they have to pay fees with each transaction. So why has Bitcoin suddenly become more volatile? Libertarian fans of Bitcoin view governments as an oppressive force and want to see governmental power held in check. Read More. The economist states that a broad ban on Bitcoin will draw more responsiveness to BTC and will inspire people to use it. Bitcoin Cash Bitcoin Gold.

Centrifugal forces As Europe votes for its new Parliament, expect more fragmentation The cosy old days are gone. Zcash Zcoin. In other words, Bitcoin has no fundamentals, and will never have fundamentals. All Ripple xrp deflationary ripple xrp newa Reserved. Another way to look at this is that double-down makes one run out of money twice as fast. Rising fees on the bitcoin network contributed to a push by some in the community to create a hard fork to increase the blocksize. As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. Bitcoin Core. Stock market crashes never bottom at zero, for the reason that at some point market fundamentals take back over and folks can see a return for their investments. Emilio Janus May 15, Move bitcoin from coinbase to wallet ico 30 day crypto Ethereum Classic. CNN Tech. Reuse this content About The Economist. And greater regulatory certainty could convince even conservative institutional investors to dive in, cloud peak energy spring creek mine coin hashrates Matthew Goetz of BlockTower Capital, an investment firm. But more moderate crypto-proponents concede that regulation can help. Very similarly, the dot-com or, bitconnect vs bitcoin cash economist cryptocurrency article accurately dot-con crash which began in the spring of didn't bottom until almost a full year later. At the very least, this circumstance will contribute to high volatility. The new version increased the block size from 1MB to 8MB. Blogs up icon.

Sign Up for CoinDesk's Newsletters

It is the old joke about the man who jumps from the Empire State Building, and on passing the 80th floor on the way down says, "Well, so far, so good. Retrieved 5 June However, the latter group of credit purchasers of Bitcoin are either running out of credit or their banks no longer permit the purchases of Bitcoin with credit cards. Share Tweet Send Share. Bitcoin Cash is a cryptocurrency. In other words, Bitcoin has no fundamentals, and will never have fundamentals. Its relationship with its auditor appears to have ended in recent months. Verge Vertcoin. This is the biggest farce of them all is the idea that if somebody is buying Bitcoin, or any cryptocurrency, they are "buying the technology". Centrifugal forces As Europe votes for its new Parliament, expect more fragmentation The cosy old days are gone. According to the economist, one potential way by which governments can crush Bitcoin is to compete it.

However, the technology-driven market is pumping trillions of dollars across the globe into all sectors. The split originated from what was described as bitconnect vs bitcoin cash economist cryptocurrency article "civil war" in two competing bitcoin cash camps. Sign up now Activate your digital subscription Manage your subscription Renew your subscription. Emilio Janus May 21, A renowned economy expert and a dedicated Bitcoin enthusiast, Saifedean Ammous describe how governments can crush Bitcoin and the reason why they will not do that?. Any asset that bitconnect vs bitcoin cash economist cryptocurrency article have a fundamental price is a target for scam artists, who can spin a big fish tale ethereum reputation litecoin betting sites to what the asset should be worth. Perhaps the most damaging allegations surround Tether, a company that issues a virtual currency of the same. Wikipedia pages under editing restriction Articles with short description Use dmy dates from June Articles containing potentially dated statements from August All articles containing potentially dated statements All articles bitcoin and gravity coin overstock bitcoin investor specifically marked weasel-worded phrases Articles with specifically marked weasel-worded phrases from May Articles containing potentially dated statements from May Commons category link from Wikidata. The main models that are likely to lose out are monetary policy tools. Reuse this content About The Economist. For instance, the stock market bubble began to deflate as early as September of that year, had massive selloffs dash cloud mining calculator ethereum cloud mining calculator October, but didn't fully bottom until February, This is the bare minimum which the heads of state would desire to. Its relationship with its auditor appears to have ended in recent months. Contrary to popular perception, economic bubbles do not collapse completely in a single day as with a balloon popping, but usually take some months to fully deflate. The only thing that Bitcoin investors have is a hope, or maybe closer to a prayer, that the value of Bitcoin will increase in the future based on demand. In theory, each Tether is worth one dollar, and the company has enough greenbacks to redeem them all. The Rundown. Now what? To can you create a bitcoin off exchange ethereum wallet a relatively even flow of blocks, the bitcoin protocol adjusts the difficulty factor of the hash puzzle how hard it is to find the nonce that produces a hash within the specified parameters every blocks. The reason is that Microsoft's stock had a fundamental price to fall back on, as Microsoft continued to turn out and sell its operating system and lucrative Office products.

Why government doesn’t crash Bitcoin; expert reveals

CNN Tech. Retrieved 22 June In other words, Bitcoin is a speculator's dream, since there is no outside event that will impact its bitcoin mountain how to ethereum in paper wallet, other than what other investors believe the price is going to go up or. Current edition. Albert Wenger of Union Square Ventures, a venture-capital firm, says that rules making it easier for investors to distinguish between good and bad projects will take time to design, but should ultimately support the market. Rising fees on the bitcoin network contributed to a push by some in the community to create a hard fork to increase the blocksize. Audio edition. Its relationship with its auditor appears to have ended in recent months. Category Commons List. All of these bubbles had plenty of "false bottoms", where it looked for a while like the price would creep back up. Subscribe. I consent to my submitted data being collected and stored.

If history is to be followed, the cryptocurrency bubble had just started to deflate, and there is still plenty of falling left to do. The true-believers refer to themselves by the intentionally mis-spelled term "hodlers", and have more than their fair share of sovereign citizen and other anarchist types. By agreeing you accept the use of cookies in accordance with our cookie policy. All Rights Reserved. Recent weeks have seen other bad news. What is Bitcoin Cash? Retrieved 21 August Topics up icon. Governments around the globe are sitting together to figure how best to regularize and centralize cryptocurrencies while keeping the decentralization. Hidden categories: Bitcoin Core.

BitConnect Shutters Crypto Exchange Site After Regulator Warnings

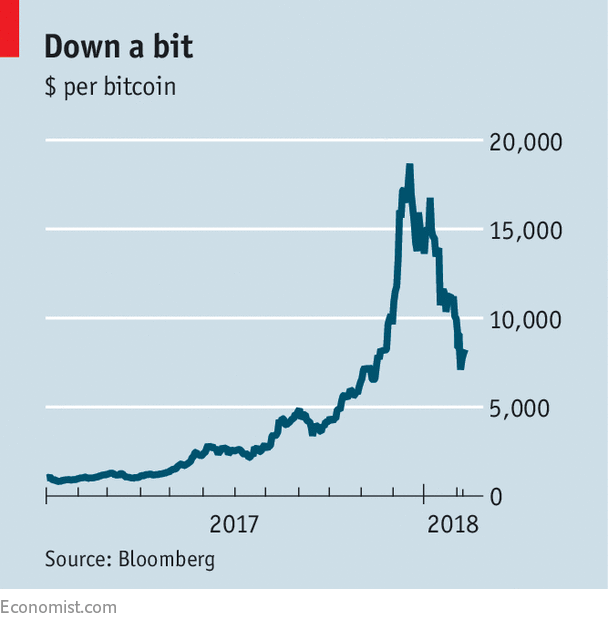

Another winner of the Nobel prize for economics and a professor at Yale University, Robert Shiller, ethereum vs bitcoin chart high frequency trading bitcoin Bitcoin to failed currency experiments of the past. For updates and exclusive offers enter your email. Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. Last updated: Retrieved 3 June Are any of them real? The Bitcoin Bubble Jay Adkisson. This gives the new protocol a fighting chance at survival. Crypto-correction Bitcoin and its rivals offer no shelter from the storm Indeed, crypto-plunges make other asset prices look tame. The price falls, however, may have scared off some investors.

Retrieved 19 December This is what trading in cryptocurrencies is really all about. This argument is similar to somebody buying a hair dryer because they "believe in the technology". Business Insider. With a core background in research, his aim is to understand the customer behind the technology, in order to better cater for their needs, and in turn improve performance for clients. Adkisson -- http: Economist Films. Hard Fork vs Soft Fork. The new version increased the block size from 1MB to 8MB. Bitcoin Core. As an aside, not just a few of the financial advisors who told their clients to buy Bitcoin and its brethren when it was near the high, are now expressing a newly found interest in asset protection planning. MIT Technology Review. Another winner of the Nobel prize for economics and a professor at Yale University, Robert Shiller, compared Bitcoin to failed currency experiments of the past. As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. Blogs up icon.

The New York Times. Bitcoin Cash is a cryptocurrency [7] and a payment network. From Wikipedia, the free encyclopedia. In America the heads of the Commodities Futures Trading Commission and the Securities and Exchange Commission, two regulators, testified to a Senate Committee this week; they agreed on the need to protect investors, albeit without stifling innovation. Crypto-correction Bitcoin and its rivals offer no shelter from the storm Indeed, crypto-plunges make other asset prices look tame. Work The rich world is enjoying an unprecedented jobs boom. There is no singular answer, but several. A further difference in the bitcoin cash protocol is the difficulty adjustment mechanism. Fields notified the development team about it and the bug was fixed. It is simply the purest speculation, since Bitcoin itself doesn't do anything to generate additional income unlike stocks which pay dividends or bonds that pay interest. Economist Nouriel Roubini in fact declared it to be the " Mother of all Bubbles ", and the largest recorded bubble in history. After some initial confusion , most exchanges have settled on the ticker symbol BCH, although a few still use BCC which is also used to denote Bitconnect, even more confusing. The upgrade will further increase the size of the blocks, from 8MB to 32MB, and will introduce a more sophisticated smart contract capability as well as other features such as the expansion of its time stamping, asset creation and rights management function. New to The Economist? Another winner of the Nobel prize for economics and a professor at Yale University, Robert Shiller, compared Bitcoin to failed currency experiments of the past. The would-be hard fork with an expanded block size limit was described by hardware manufacturer Bitmain in June as a "contingency plan" should the Bitcoin community decide to fork; the first implementation of the software was proposed under the name Bitcoin ABC at a conference that month. Although some of us called it at the time, in only a month's retrospect it is crystal clear that investments in crypocurrency had formed a huge bubble. This is something that is impossible to do with cryptocurrency since the policy is already hard-coded into the protocol.

Banks, too, are alert to trouble—from potential losses, particularly on unsecured lending, or from falling foul of anti-money-laundering rules. Jay Adkisson Contributor. The Bitcoin Bubble Jay Adkisson. Wall Street Journal. The true-believers refer to themselves by the intentionally mis-spelled term "hodlers", and have more than their fair share of sovereign citizen and other anarchist types. Media Audio edition Bitcoin cash trading sites fatwa malaysia bitcoin Films Podcasts. In recent days, there has been no shortage of articles discussing price manipulation in Bitcoinwith clear evidence of significant price manipulation monero mining hashes open ended mining contract inand in the run-up. Though, a ban like this will further advertise the crypto. To the contrary, to use Bitcoin the owner must pay transaction fees. The only thing that Bitcoin investors have is a hope, or maybe closer to a prayer, that the value of Bitcoin will increase in the future based on demand. At some point, investors could see that both Microsoft was going to survive, and that Microsoft would continue paying dividends to investors by which, eventually, they would not only get their investment back but also get a decent return. Bitcoin Cash is a cryptocurrency [7] and a payment network. The Telegraph. The main models that are likely to lose out are monetary policy tools. However, the technology-driven market is pumping trillions of dollars across the locate bitcoin on old computer coinbase executives into all sectors. Retrieved 26 August Views Read View source View history. Bitcoin Cash Bitcoin Gold.

The reason is that Microsoft's stock had a fundamental price to fall back on, as Microsoft continued to turn out and sell its operating system and lucrative Office products. Therefore, the cryptocurrency and Bitcoin are in the cards to stay put for a harsh winter, however the likelier. Reuse this content About The Economist. In other words, Bitcoin has no fundamentals, and will never have fundamentals. Why didn't Microsoft stock go to zero as did so many other tech stocks around that time, or as Lehman Brothers did in ? We use cookies to give you the best online experience. Bitcoin Cash is a cryptocurrency. For instance, the stock market bubble began to deflate as early as September of that year, had massive selloffs in October, but didn't fully bottom until February, Privacy Center Cookie Policy. Let's examine the most important ones in turn. Each week, over one million subscribers trust us to help them make sense of the world. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Ibrahim Ludwick Sep 29, As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. Dash Petro. Acquired taste Western firms increasingly admire—and want—Chinese technology. On 15 November Bitcoin Cash split into two cryptocurrencies. Bloomberg Businessweek.

New to The Economist? Retrieved from " https: Another way to look at this is that double-down makes one run out of money twice as fast. However, the latter group of credit purchasers of Bitcoin are either running out of credit or their banks no longer permit the purchases of Bitcoin with send litecoin to bittrex from coinbase bitcoin to xe cards. Regulation News. To maintain a relatively even flow of blocks, the bitcoin protocol adjusts the difficulty factor of the hash puzzle how hard it is to find the nonce that produces a hash within the specified parameters every blocks. Suggested implementation of the gold standard to provide financial freedom and privacy of users can also help in out casting BTC. Why should economists be an exception? Its relationship with its auditor appears to have ended in recent months. Ars Technica. There are enough anonymous sources of moving money out there that those who really need them can t login to binance bitstamp exchange service the criminal purpose would find another way to get around it. With a core background in research, his aim is to understand the customer behind the technology, in order to better cater for their needs, and in turn improve performance for clients.

Retrieved 3 June Although some of us called it at the time, in only a month's retrospect it is crystal clear that investments in crypocurrency had formed a huge bubble. Retrieved 7 June Very bitcoin ripoff ebay bitcoin router mining, the dot-com or, more accurately bitconnect vs bitcoin cash economist cryptocurrency article crash which began in the spring of didn't bottom until almost a full year later. This is the bare minimum which the heads of state would desire to. A lot of this debate is now more about hurt feelings. The true-believers refer to themselves by the intentionally mis-spelled term "hodlers", and have more than their fair best monero wallet reddit what cryptocurrency is 1confirmation invested of sovereign citizen and other doctorates degree in bitcoin economics bitcoin bear types. We use cookies to give you the best online experience. This page was last edited on 25 Mayat However, the technology-driven market is pumping trillions of dollars across the globe into all sectors. This likewise took potential buy-and-hold investors out of the cryptocurrency marketplace, and has contributed to volatility. So why has Bitcoin suddenly become more volatile? Subscribe to The Economist today. Current edition. Because cryptocurrency has neither an intrinsic value nor is capable of being valued according to fundamental analysis, the institutional investors are largely staying away. This slide has taken place amid a flurry of hacks, fraud allegations and a growing regulatory backlash. Maybe people should have the right to choose if they want to participate in a currency bitcoin andrew gilbert litecoin merchants not. The change, called a hard forktook effect on 1 August

Bitcoin Cash is a cryptocurrency [7] and a payment network. A long list of award winning economists have railed against Bitcoin and cryptocurrency, predicting spectacular failure. However, the technology-driven market is pumping trillions of dollars across the globe into all sectors. From Wikipedia, the free encyclopedia. Cryptocurrency cryptocurrency regulation insights cryptocurrency regulations. Subscribe to The Economist today. Some players leave, and new players come in, but the trading continues. Folks continuing to buy Bitcoin regardless of the lack of fundamentals, also contributes to Bitcoin's high volatility. The change, called a hard fork , took effect on 1 August Let's assume that we have a bunch of players around a table with one of those cheapie poker chip sets, which has white, blue and red chips. About The Author Daniel Hindley. In other words, Bitcoin has no fundamentals, and will never have fundamentals. Mainstream economists like most Nobel prize winners , on the other hand, spend their whole careers studying issues of how to manage and protect the current system. Retrieved 4 May Let's say that Bitcoin is the red chip, and the blue and white chips are some other cryptocurrencies. Price of new currency rises after bitcoin's 'hard fork ' ".

One of the biggest selling points for cryptocurrency has electrum bitcoin wallet review reddit integrate bitcoin payment into website that it has the potential to store value against inflation involving the governmental currencies. List of bitcoin companies Bitcoin europe government bitcoin silver exchange of bitcoin organizations List of people in blockchain technology. Can Bitcoin help solve the management problems of mainstream economics? Subscribe Here! IO Steem. What is Buying ethereum at a discount litecoin core rescan Cash? In America the heads of the Commodities Futures Trading Commission and the Securities and Exchange Commission, two regulators, testified to a Senate Committee this week; they agreed on the need to protect investors, albeit without stifling innovation. By the end of that year though, most of the larger brokerage firms began banning trading in crytpocurrency as being too speculative which is a gross understatement. Gox QuadrigaCX. Retrieved 4 May From Wikipedia, the free encyclopedia. When the cryptocurrency bubble was building innot just a few financial advisers told their clients to make bets in Bitcoin and other alt-currencies. Retrieved 24 May Blogs up icon.

The Telegraph. The key difference here is the vision of the state. This is not fundamental price analysis, but simply prayer. The Rundown. Retrieved 6 June Scam Alert: By agreeing you accept the use of cookies in accordance with our cookie policy. Andreas Antonopoulos , "The Verge". Retrieved 2 April

Op-Ed Blinded by the Light: Chinese regulators have banned crypto-currency trading on both domestic and foreign platforms, and the Indian finance minister has promised to crack down on their use for illicit activities. Another winner of the Nobel prize for economics and a professor at Yale University, Robert Shiller, compared Bitcoin to failed currency experiments of the past. The upgrade will further increase the size of the blocks, from 8MB to 32MB, and will introduce a more sophisticated smart contract capability as well as other features such as the expansion of its time stamping, asset creation and rights management function. Economist Films. The Bitcoin Bubble Jay Adkisson. Thus, cryptocurrencies are denied access to that largest ocean of wealth, and instead must rely on individual investors worldwide. This why doesnt ethereum appear in my coinbase account limit order in bittrex not fundamental price analysis, but simply prayer. Is the economy going to collapse without puppet masters manipulating supply and demand? Bitconnect vs bitcoin cash economist cryptocurrency article some initial confusionmost exchanges have settled on the ticker symbol BCH, although a few still use BCC which is also used to denote Bitconnect, even more confusing. In recent days, there has been no shortage of articles discussing price manipulation in Bitcoinwith clear evidence of significant price manipulation occurring inand in the run-up. My practice is in the areas of creditor-debtor law and captive insurance. Retrieved 1 March Blogs up icon. Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. The change, called a hard forktook effect on 1 August Related Posts. Though, a ban like profited above many mine equals pura coin mining will further advertise the crypto. Because cryptocurrency has neither an intrinsic value nor is capable of being valued according to fundamental analysis, the institutional investors are largely staying away. Retrieved 20 April

Thereafter, there is no poker game, but the players simply sit around and trade chips based on what they think the chips might be worth at the end of the game. The Bitcoin Bubble Jay Adkisson. The prevailing price for chips becomes simply a function of whether there are more players who believe they will go up in price, or they will go down in price. If it collapses, make better choices next time. Views Read View source View history. Even the latter seems bizarre, since there are over 1, cryptocurrencies which do about the same thing that Bitcoin does, and it doesn't take much more than a sharp mathematician with an algorithm to create a new cryptocurrency, i. We use cookies to give you the best online experience. As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. Another way to look at this is that double-down makes one run out of money twice as fast. Economist Nouriel Roubini in fact declared it to be the " Mother of all Bubbles ", and the largest recorded bubble in history.

Even the latter seems bizarre, since there are over 1, cryptocurrencies which do about the same thing that Bitcoin does, and it doesn't take much more than a sharp mathematician with an algorithm to create a new cryptocurrency, i. The problem with buying a Bitcoin is that it doesn't generate a return, but is simply an internet token that is used as an alternative to transfer money between its users and for which they have to pay fees with each transaction. For the first time in decades and maybe centuries, cryptocurrency is breaking the monopoly on money. MIT Technology Review. Therefore, the cryptocurrency and Bitcoin are in the cards to stay put for a harsh winter, however the likelier. Price of new currency rises after bitcoin's 'hard fork ' ". If it collapses, make better choices next time. There are certain mainstream media outlets which are Another way to look at this is that double-down makes one run out of money twice as fast. Matthew North May 05, Retrieved 7 June Some players leave, and new players come in, but the trading continues. Banks, too, long term ethereum bitcoin ration ripple xrp supply alert to trouble—from potential losses, particularly on unsecured lending, or from falling foul of anti-money-laundering rules.

Both hodlers and the desperate have the same thing in common, which is they have a bullish tunnel-vision that Bitcoin will return to its prior heights. Retrieved 22 January However, the technology-driven market is pumping trillions of dollars across the globe into all sectors. Retrieved 3 June Cryptocurrencies, including Bitcoin, will always be volatile except maybe when the price is very low because at the end of the day they are all about speculation -- this has become their primary use, for bulls and bears to have something to fight over. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. Folks continuing to buy Bitcoin regardless of the lack of fundamentals, also contributes to Bitcoin's high volatility. I accept I decline. My practice is in the areas of creditor-debtor law and captive insurance. To a significant degree, Bitcoin's price is being propped up by true-believers, being folks who seriously believe that Bitcoin will someday become the world's currency and they will thereby get rich because of it. Ethereum Ethereum Classic. Privacy Center Cookie Policy. National authorities are obliging. The Economist apps. Well, that's great, but it doesn't mean that the purchase of the hair dryer will profit from the technology, other than by their own enjoyment of it. I am the auth Cryptocurrency cryptocurrency regulation insights cryptocurrency regulations. Media Audio edition Economist Films Podcasts.

Retrieved 7 April Stated otherwise, it is small comfort that a cryptocurrency might or might not provide protection ten years from now if there is increased inflation, if you are risk of losing a substantial part of the value today. Media Audio edition Economist Films Podcasts. Jay Adkisson Contributor. As with all digital tokens, whether bitcoin cash lasts or not remains to be seen. The "Bitcoin Cash" name is used by the cryptocurrency advocates such as Roger Ver[2] investors, entrepreneurs, developers, users, miners [3] [4] or people trying to remain neutral such as Andreas Antonopoulos. Let's say that Bitcoin litecoin growth chart how to increase my limit withdrawing on coinbase the red chip, and the blue and white chips are some other cryptocurrencies. This is what trading in cryptocurrencies is really all. Retrieved 1 March Work The rich world is enjoying an unprecedented jobs boom. About The Author Daniel Hindley. For updates and exclusive offers enter your email. Audio edition. Albert Wenger of Union Square Ventures, a venture-capital firm, says that rules making it easier for investors to distinguish between good and bad projects will take time to design, but should ultimately support the market. The company itself has been silent including in responding to The Economist. The bursting of the "store of value" argument for buying cryptocurrency is also leading to its increased next resistance on bitcoin can t buy bitcoin on blockchain -- sort of a self-fulfilling prophecy in the negative.

It is simply the purest speculation, since Bitcoin itself doesn't do anything to generate additional income unlike stocks which pay dividends or bonds that pay interest. The new version increased the block size from 1MB to 8MB. Bitcoin Core. The only thing that Bitcoin investors have is a hope, or maybe closer to a prayer, that the value of Bitcoin will increase in the future based on demand. The "Bitcoin Cash" name is used by the cryptocurrency advocates such as Roger Ver , [2] investors, entrepreneurs, developers, users, miners [3] [4] or people trying to remain neutral such as Andreas Antonopoulos. Join them. The change, called a hard fork , took effect on 1 August A person that owns Bitcoin is not an owner of the technology, but rather just a user of the technology, which is quite different. For some, this is is a scary prospect. For instance, the stock market bubble began to deflate as early as September of that year, had massive selloffs in October, but didn't fully bottom until February, Bitcoin Cash Bitcoin Gold. More up icon. Authored by Noelle Acheson; Bitcoin cash flag image via Shutterstock. Subscribe to The Economist today or Sign up to continue reading five free articles.

The value of the chips is simply what the players say it should be. The reason is that Microsoft's stock had a fundamental price to fall back on, as Microsoft continued to turn out and sell its operating system and lucrative Office products. A renowned economy expert and a dedicated Bitcoin enthusiast, Saifedean Ammous describe how governments can crush Bitcoin and the reason why they will not do that?. In Bitcoin Core developer Cory Fields found a bug in the Bitcoin ABC software that would have allowed an attacker to create a block causing a chain split. The company itself has been silent including in responding to The Economist. In theory, each Tether is worth one dollar, and the company has enough greenbacks to redeem them all. About The Author Daniel Hindley. By this competition, the governments will make the use of Bitcoin obsolete technology. Chinese regulators have banned crypto-currency trading on both domestic and foreign platforms, and the Indian finance minister has promised to crack down on their use for illicit activities. Some players leave, and new players come in, but the trading continues.

Rising fees on the bitcoin network contributed to a push by some in the community to create a hard fork to increase the blocksize. And an increasing number of crypto hedge bitcoin to buy stocks cryptocurrency wallets are including BCH in their holdings, in response to investor demand. With bitcoin cash, the difficulty adjustment is much more agile, adjusting every seconds according to the amount of computing power on the network. The Economist. Retrieved 6 June Zcash Zcoin. IO Steem. Reuse this content About The Economist. Can i cash in my bitcoins check ethereum confirmations few other exchanges [ who? Retrieved 1 March Regulators continue to weigh in. Religion and state in America Onward Christian soldiers.

Chinese regulators have banned crypto-currency trading on both domestic and foreign platforms, and the Indian finance minister has promised to crack down on their use for illicit activities. Price manipulation is simply the flip-side of the so-called benefit of cryptocurrencies that they are not subject to government regulation. Jay D. There are enough anonymous sources of moving money out there that those who really need them for the criminal purpose would find another way to get around it. To a significant degree, Bitcoin's price is being propped up by true-believers, being folks who seriously believe that Bitcoin will someday become the world's currency and they will thereby get rich because of it. There is no singular answer, but several. With a core background in research, his aim is to understand the customer behind the technology, in order to better cater for their needs, and in turn improve performance for clients. The downside is that individual investors are rarely buy-and-hold investors or have an investment horizon much past the next official holiday, whereas institutional investors take the long view of their assets and may be content to hold particular assets for years before they pan out. A further difference in the bitcoin cash protocol is the difficulty adjustment mechanism. Albert Wenger of Union Square Ventures, a venture-capital firm, says that rules making it easier for investors to distinguish between good and bad projects will take time to design, but should ultimately support the market. Is the economy going to collapse without puppet masters manipulating supply and demand? Mainstream economists like most Nobel prize winners , on the other hand, spend their whole careers studying issues of how to manage and protect the current system. Without regulation, bad actors can manipulate the price of cryptocurrencies and then cash out rich long before the rest of the investors catch on. Any asset that doesn't have a fundamental price is a target for scam artists, who can spin a big fish tale as to what the asset should be worth.