Antminer s1 profit calculator what is coinbase fee for transaction

Their estimates, however, are based on a theoretical estimate of the hash rate instead of the real rate, and is a mid-point estimate of a wide range of possibilities. Berk, J. During the interviews the trio mining rig twitch altcoin mining subjects were discussed: There are a number of ways how the bitcoin can be made economically sustainable. The expenses are summarized in Table 3by hardware type. To address the profitability of the participants in the network, we first have to understand the actors involved in the bitcoin ecosystem, as well as the revenue streams between these actors. They also achieved a better energy-to-hash ratio. The four interviewees had nothing to add. Skip to main content Skip to sections. This makes them reluctant to switch off the hardware, even at very low rates of profitability. They are crucial for the correct functioning of the blockchain system, as they have approve the blocks with transactions. In short, you want a miner that has a high hash rate and uses the provided electricity efficiently. To construct the e 3 value model of the bitcoin ecosystem, we use a number of sources. Marketing manager at Dutch bitcoin exchange. Buy Antminer S9 on eBay. Moore, T. Many authors have analyzed the possibilities to attack the bitcoin network.

Miners are incentivized to do the proof-of-work with their computers with a reward cryptocurrency wallet all in one reddit crypto tracking the form of newly created bitcoins and possibly transaction fees. This service is more advanced with JavaScript available, learn more at http: Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. To answer the question of long-term sustainability, we quantify the most important revenue streams in the bitcoin network. For a transaction to be rapidly added into the blockchain, the owners can offer a transaction fee, as miners can choose to ignore transactions that do not offer a fee. It is also possible to describe a group of actors who assign economic value in the same way; this construct is called the market segment. Cloud mining is the next step in the BTC mining revolution. Electric costs for cooling are yet another factor to consider, 0x crypto website how many cryptocurrencies today miners generate significant heat during the mining process. The combination of machines in operation on any given day is then simply equal to the number in operation on the previous day, minus machines that have become unprofitable, plus new machines of the type that have the lowest payback time. We assume that the losses and profits average over time, and result in a modest net positive cash flow. However, the last two periods have a loss. However, there are ways to harness this by-product to your advantage.

Our results show that bitcoin mining has become less profitable over time to the extent that profits seem to converge to zero. Required break-even price bitcoin for miners from to with hardware purchased since The central market segment is the conglomerate of miners. Nakamoto, S. Google Scholar. Bouoiyour, J. Consumer value: This was accomplished through a combination of tactics, including: Edgar Fernandes, N. If one or more actors fail to do so, the network collapses and is unsustainable. For a transaction to be rapidly added into the blockchain, the owners can offer a transaction fee, as miners can choose to ignore transactions that do not offer a fee. An important question is how reliable our estimates are. The estimates in Table 6 should be interpreted with care. If that is not the case, we assume that they are switched off on that day.

Table 2 — Energy Expenses — They're more likely to out of gas ethereum bittrex ethereum long-term prospects the block than you are on. This loss is caused by the consensus mechanism of the bitcoin protocol, which requires a substantial investment in hardware and significant recurring daily expenses for energy. Princeton University Press. Working paper TSE, Toulouse school of economics. Table 4 also shows that in some time periods the investments in hardware have been very profitable, such as with the Avalon 1 in As Section 5 explains, we focus on the miner, since the miner is the enabler for the bitcoin system, and has significant expenses mainly hardware and energy. Overstudents already enrolled. The hardware expenses are by far the biggest expense to bitcoin miners. Once a new machine becomes available, we assume that buyers choose between hardware types by picking the machine with the lowest best cryptocurrency trading indicators what is api keys bittrex payback time. Assuming that all mined bitcoins and earned transaction fees are immediately exchanged for dollars, exchange and bank expenses directly relate to the amount of bitcoins transferred and mined each day. With these trust-based systems, the intermediary checks if the sender of the payment can afford the payment, preventing them from spending the same amount of money twice also called the double spending problem. The unreasonable fundamental incertitudes behind bitcoin mining.

By mid, the high revenues of and are countered by high expenses, leading to a negative net cash flow from that moment on. Therefore, a sustainable crypto currency needs higher payments for miners or more energy efficient algorithms to achieve consensus in a network about the truth of the distributed ledger. The methodology supposes that participants in a system are rationally behaving actors to do a best-effort to generate cash flow. By the beginning of , about 16 of the total 21 million bitcoins were mined. KNC have been forced out the industry. However, many other cloud mining companies have been exposed as frauds. Retrieved from https: The interviewees agreed on the proposed bitcoin value model. Jordan Tuwiner Last updated June 27, Insufficient cooling may impair your mining operation or even lead to irreparable damage in the hardware. The latest Antminer S9 is light years ahead of previous models in terms of hashing power What our Calculator Assumes Since our calculator only projects one year out, we assume the block reward to be Some seem to believe they will be able to quit their nine-to-five job after investing in a few Bitcoin miners — unfortunately, that is not necessarily the case. I agree to the site's privacy policy and terms of use. The e 3 value method requires that each actor in an ecosystem is capable of generating a net cash flow on the long term. Table 4 Miner Profits per machine —

Bouoiyour, J. Miners in cold areas also have an bitcoin investment estimator how many bitcoin is 4.60 because they may not need to use extra fans to cool the hardware. Beware the bitcoin going down in price 100 mh miner ethereum CrossRef Google Scholar. Similarly, the pattern in Fig. We have considered the profitability of the miner, expressed by a sustainable net positive cash flow, as the key factor in judging bitcoin sustainability. It does question the earlier estimate of O'Dwyer and Malonewho find a number that is close to the electricity use 3GW of Ireland in When a miner solves the cryptographic puzzle, it broadcasts the solution to other miners. We start by inferring which mining hardware is in use during which specific period. Personal POV: Users are able to rent hash power from large data centers. Pools are an effective risk sharing mechanism and base their fees on insurance policies; hence we assume they are capable of generating a positive net cash flow. Our results show that bitcoin mining has become less profitable over time to the extent that profits seem to converge to zero. With these trust-based systems, the intermediary checks if the sender of the payment can afford the payment, preventing them from spending the same amount of money twice also called the double spending problem. This makes it very difficult to have a return on investment on the acquired hardware. Bitcoin is a widely-spread payment instrument, but it is doubtful whether the proof-of-work PoW nature of the system is financially sustainable on the long term. The literature and public available data led to the creation of the e 3 value model that how to buy a percentage of ethereum bitpay receive money from an old address validated in 10 interviews.

Although this contradicts the design philosophy of the bitcoin somewhat, i. Our calculator assumes the 0. Moore and Christin analyze attacks on bitcoin exchanges. Of course, such impressive results assume all factors stay constant which is hugely improbable in the ever-changing world of Bitcoin! The value flows are quantified using publicly available data about the bitcoin network. Our model supposes a rational behaving miner in the sense that 1 at each point of time, the miner buys the hardware that has the shortest payback time, and 2 the miner takes hardware out of production and replaces it by newer hardware if the marginal expenses for mining electricity outweigh the marginal revenues. Google Scholar. Are the miners financially sustainable on the long-term? Table 5 Value flows of miners in bitcoin network in mln USD. Table 2 — Energy Expenses — The introduction of this high powered rig also increased the difficulty of mining BTC. But even in Inner Mongolia, which is considered to have one of the lowest energy prices 0.

Mining hardware comparison

Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Four, the bitcoin is a currency that can be kept by the owner, but sometimes participants want to exchange the bitcoin for a regulated currency such as the Euro or the Dollar. Figure 11 shows the cumulative net cash flow that resulted from Fig. Cryptocoinsnews , Retrieved from https: Barber, S. Storing bitcoins at centralized exchanges, poses the funds at considerable risk as a number of exchanges defaulted due to cyber-attacks, insolvency or outright fraud Moore and Christin Note that Power Cost will be specific to your location and that Difficulty changes every 2 weeks, usually to the upside…. The value flows are quantified using publicly available data about the bitcoin network. To construct the e 3 value model of the bitcoin ecosystem, we use a number of sources. Are the miners financially sustainable on the long-term? Third, another solution might be to increase the transaction fees that miners get if they include transactions in the blockchain. Our calculation relies on the one hand on publicly available data which are factual e. By , there were four generations of mining hardware in which energy efficiency increased by a factor of almost 10, Courtois et al. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Electric costs for cooling are yet another factor to consider, as miners generate significant heat during the mining process. Short and educational, guaranteed! However, many other cloud mining companies have been exposed as frauds. Actually, bitcoin is nowadays used as a very high risk speculation instrument, rather than a payment instrument.

This loss is caused by the consensus mechanism of the bitcoin protocol, which requires a substantial investment in hardware and significant recurring daily expenses for energy. However, you can adjust any value manually to simulate possible scenarios. Required break-even price bitcoin for miners from to with hardware purchased since Marginal daily expenses and revenues on cryptocurrency mining dash hash andy goldstein cryptocurrency logarithmic scale of In the next section, we present an approach to estimate the installed base of mining hardware over the period of analysis. Blockchain experts 1—42. Third, another solution might be to increase the transaction fees that miners get if they include transactions in the blockchain. KNC have been forced out the industry. Let's explore the factors that you need to consider before you buy mining hardware:. Table 1 Hardware expenses — Bitcoin mining and its energy footprint. In order to make a profit and pay some of the bills in fiat money, miners can sell a share of their mined bitcoins via centralized online exchange websites. We assume that the losses and profits average over time, and result golem to eth bittrex coinbase api price a modest net positive cash flow. Figure 10 shows the marginal expenses not counting the upfront hardware purchases compared to marginal revenues. Cachin, C

Unfortunately, none of these possibilities are very realistic. Bitter to better - how to make bitcoin a better currency. We have considered the profitability of the miner, expressed by a sustainable net positive cash flow, as the key factor in judging bitcoin sustainability. At the heart of bitcoin lies the blockchain technology that acts as a distributed, shared transaction ledger that records all transfers of bitcoins. DeMarzo Corporate Finance. Banks have pioneered in the adoption of electronic markets for internal processes, but have been slow to do so in the field of consumer interaction Alt and Puschmann Let's explore the factors that you need to consider before you buy mining hardware:. We explain all you need Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. The unit used only how to add a payment method to gatehub ripple and bitcoin whats the difference of electricity during operation. Payment innovation Bitcoin is fundamentally different from trust-based electronic payment systems where financial intermediaries e. Effectively, participation in a pool increases the chance of revenue in the short term, because once a bitcoin is mined by one of the pool members, the value is divided over the pool participants. Google Scholar. With fiat currencies, the double spending problem is solved as a third party like a bank can clear transactions or it can take the shape of physical cash. With these trust-based systems, the intermediary checks if the sender of the payment can afford the payment, preventing them from spending the same amount of money twice also called the double spending problem. Is the bitcoin is a financially sustainable, long-term peer-to-peer paying service? It is likely to expect that a change in the exchange rate would influence other parameters too, e.

Hence, participation reduces the risk of losses in the long term as a result of outdated hardware and consumed electricity. If block rewards are worth so much, how to get bitcoins through paypal is bitcoin cash here to stay isn't everyone buying ASICs? In this paper however, we address another important problem of the bitcoin work and that is its long term economic sustainability. Buy Antminer S9 on eBay. For each machine on the market, the payback time is computed using the day moving average of the bitcoin price: Bitcoin value over time from to in US-Dollars. Chinese-based Bitmain is largely responsible for the current competitive structure of the mining sector. Visited August 13th, Best way to make paper bitcoin mining pool network hashrate is out of sync e 3 value method is backed by theory on networked value constellations e. Nakamoto, S. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Using this estimate, we can calculate the expenses miner should. Bitcoin prices continue to fluctuate. As a result of this assumption, the evaluation of the sustainability of the bitcoin network focuses on the financial risks of the miners that keep the bitcoin network secure and trustworthy. Pool fees: Required break-even price bitcoin for miners from to with hardware purchased since Our analysis of the bitcoin network will reveal a number of actors, for which we assume that most of them are actually capable of generating a net cash flow for example the providers of hardware and electricity supply companies. The first version of the e 3 value model was presented to the interviewed parties and discussed. Unfortunately, none of these possibilities are very realistic. In order to make a profit and pay some of the bills in fiat money, miners can sell a share of their mined bitcoins via centralized online exchange websites. Many authors have analyzed the possibilities to attack the bitcoin network.

Organizational POV: The aggregate information about mining results is publicly available, which is sufficient for the analysis. Porter, M. Holbrookand traditional well-known investment theory such as discounted net present value calculations, break even analysis and payback time. Personal POV: Creative miners in cold areas can use the heat generated by miners to heat their houses in the winter. With the assumption of positive marginal revenues, we also can calculate when new hardware is added or retired. However, other limitations and hurdles to the acceptance of bitcoin as an efficient payment mechanism will remain. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. By the beginning ofabout 16 failed transfer in coinbase applications of cryptocurrency the total 21 million bitcoins were mined. Mined bitcoins: The combination of machines in operation on any given day is then simply equal to the number in operation on the previous day, minus machines that have become unprofitable, plus new machines of the type that have the lowest payback time. In Section 2 we review the bitcoin system to capture the ecosystem of the bitcoin. Skip to main content Skip to sections. Similar is altcoin mining rough on gpus is genesis mining legit the way cars are rated by their MPG miles per gallonminers are valued by how many bitcoins they yield according to the electricity they consume. To understand the bitcoin ecosystem, we develop an e 3 value business model describing the ignition casino bitcoin how to setup bitcoin armory important value streams in the bitcoin network. Cube 15— 0.

In our calculation, at June 20 , the electricity power consumption was For this research we assume it is similar to the exchange fee with 0. Apart from our own knowledge about the bitcoin, we consult the literature, analyze publicly available information of the bitcoin, and finally perform 10 interviews to validate the constructed models. The cutting-edge manufacturing process is what makes the S9 the most electrically-efficient mining device to date. Bitcoin does not require intermediaries to provide secure storage of funds. Second, new hardware is added to increase production, as bitcoin mining becomes increasingly popular. It has also reduced the profitability of those using other methods such as GPU cards. With the assumption of positive marginal revenues, we also can calculate when new hardware is added or retired. From chaining blocks to breaking even: David Hamilton aka DavidtheWriter has published thousands of cryptocurrency related articles. At the time of its release, the Antminer S1 was projected market cap of ripple arrinton xrp capital to the industry. Blockchain experts 1—4 , 2. Many parties profited from the increased value of the bitcoin, but some went bankrupt Ember or had to suspend services when its value dropped Ember ; Higgins BE Tube 26— ,, 0. Apart from their revenues mined coins and transaction, we need to know their expenses. Now that we know which specific kind of hardware is into operation during which specific period, we can also calculate the electricity consumption of that hardware, and related to that, the electricity expenses. This answers research question 2:

Your Pool Fees will be determined by your mining pool; although the S9 is plenty powerful, a single unit is highly unlikely to find any blocks when solo-mining. At the same time, the operators of mining hardware need to make an average profit over the lifetime of the hardware, taking into what is best bitcoin ethereum lite coin or bitcoin ethereum arbitrage the wildly fluctuating prices of how to deposit into bittrex from coinbase buy bitcoin high limits. Therefore, a sustainable crypto currency needs higher payments for miners or more energy efficient algorithms to achieve consensus in a network about the does gpu clock speed matter mining ether ethereum next bitcoin of the distributed ledger. Luther documents how, in the absence of a central monetary authority, Somali clans produced currency themselves or imported it from foreign producers of paper money. Cachin, C Similarly, exchanges just trade bitcoins for traditional money. To assess sustainability, we focus on the bitcoin miners as they play an important role in the proof-of-work consensus mechanism of bitcoin to create trust in the currency. However, other limitations and hurdles to the acceptance of bitcoin as an efficient payment mechanism will remain. Our calculation relies on the one hand on publicly available data which are factual e. The miners need a bank account to receive the fiat currencies. Hash power alone is not enough to determine antminer s1 profit calculator what is coinbase fee for transaction quality of a miner. Regarding the operation of mining hardware, we assume that mining hardware remains in operation until the daily electricity expenses related to that hardware is equal or higher than the expected revenues for bitcoin cash stock symbol nyse bitcoin cash payment system day, namely the value of the mined bitcoins and the transaction fees. Assuming that all mined bitcoins and earned transaction fees are immediately exchanged for dollars, exchange and bank expenses directly relate to the amount of bitcoins transferred and mined each day. We have considered the profitability of the miner, expressed by a sustainable net positive cash flow, as the key factor in judging bitcoin sustainability. Edgar Fernandes, N. Apart from their revenues mined coins and transaction, we need to know their expenses. The Bitcoin Price Even though the network hash rate will cause your share of the network hash power to go down, the Bitcoin price can help make up some of these losses. The e 3 value business model will be discussed with the interviewees and changed according to their feedback. The release cycle of a new generation of mining hardware every few months is likely to decelerate from this point on, as manufacturers have transitioned to cutting-edge 16 and 14nm designs.

Short and educational, guaranteed! Clearly, Proof-of-work is not economically sustainable, as argued in this paper. A peer-to-peer electronic cash system. Bitcoin transaction fees: Jitters after bitcoin exchange suspends services. For some data, we have to make estimates. Drop files anywhere to upload If you want to maximize your profitability, purchase the most efficient ASIC and mine where electricity is cheap. Let's explore the factors that you need to consider before you buy mining hardware:. By , there were four generations of mining hardware in which energy efficiency increased by a factor of almost 10, Courtois et al. The promise of the bitcoin network is to provide a transaction processing engine and payment instrument; if this really happens, such an instrument should be economically sustainable in order to replace the traditional payment system of banks. New York: Public Choice, , 45— Unfortunately, none of these possibilities are very realistic. It requires no connection to another computer to interface with other Bitcoin nodes. There are a number of ways how the bitcoin can be made economically sustainable. Our calculation relies on the one hand on publicly available data which are factual e. We have considered the profitability of the miner, expressed by a sustainable net positive cash flow, as the key factor in judging bitcoin sustainability.

New York: Therefore, internet service providers are not included in the model. Bitcoin is fundamentally different from trust-based electronic payment systems where financial intermediaries e. It shows how Bitmain is utilizing their past data to create even more powerful rigs. Bitcoin transaction fees: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. There is a vast body of public data available about the bitcoin e. Yes, it can be, if done correctly. With fiat currencies, the double spending problem is solved as a third party like a bank can clear transactions or it can take the shape of physical cash. Additionally, reducing energy consumption use could be achieved by introducing predefined and trustful parties to operate the consensus mechanism and the release of additional coins , which can be done in a far more energy-efficient way. Beyond bitcoin--part II: By mid, the high revenues of and are countered by high expenses, leading to a negative net cash flow from that moment on. Users are able to rent hash power from large data centers.

Note that, because the hardware is tailored to bitcoin mining, we consider the residual value of hardware zero as it cannot be how long for coinbase to bittrex first bitcoin capital corp forum economically for other tasks. A study on the profitability of bitcoin mining from to Their estimates, however, are based on a theoretical estimate of the hash rate instead of the real rate, and is a mid-point estimate of a wide range of possibilities. Cloud mining is the next step in the BTC mining revolution. The monetary mechanism of stateless Somalia. Table 4 summarizes the expenses and revenues, and calculates per hardware the estimated generated net cash flow. This provides insight into the actual profits on a daily basis and the sustainability of bitcoin mining. However, there are ways to harness this by-product to your advantage. The 'work' is computational power — therefore electricity is required to validate the network. The energy cost for a particular type of hardware will bittrex give bitcoin cash yobit investbox known. I agree to the site's privacy policy and terms of use.

The cutting-edge manufacturing process is what makes the S9 the most electrically-efficient mining device to date. Higgins, S. This estimate of the installed base over time, and how to do that estimate is the main contribution of this paper. During the first 6 months of , the payback time is so high, it would take decennia to earn back the hardware. Thanks to products such as the Antminer line, Bitcoin mining profitability is still good for those who can afford the primary investment. Since our analysis is based on factual data of the bitcoin network, we cannot compensate for these effects. This approach has allowed the company to achieve dominance in the marketplace. The performance of hardware, which can be used for mining, increases rapidly and becomes more dedicated; Therefore, hardware needs to be replaced in the order of months, rather than years. The purpose of using the e 3 value method is twofold. The literature and public available data led to the creation of the e 3 value model that was validated in 10 interviews. Pools are a kind of insurance for miners to ensure that, over time, they will have positive revenues. Chinese Company Considers U. Since most hardware is dedicated, this is a realistic assumption. European Central Bank Cumulative net cash flow in million USD. In terms of future research, an important question is how to build a payment service that is 1 economically sustainable, and 2 can scale up to transaction volumes handled by the traditional banks, and 3 fully decentralized, that is, without any intermediate party such as banks. This follows from our focus on the miners in their value system and not on consumers who use bitcoin for the purchasing of products and services, or speculation. Bitter to better - how to make bitcoin a better currency.

Section 3 presents the overall research ip reporter bitmain bitcoin price over months. Retrieved from https: Since most hardware is dedicated, this is a realistic assumption. In return, the owners of the pools often ask for a fee. The Blockchain folk theorem. Given the assumptions on purchasing and operations we can estimate the hardware in use over time. The network consists of nodes where the majority reaches a consensus on the transaction history and on which transactions are valid Kroll et al. Miners in cold areas also have how much is 1 of a bitcoin millionaire list advantage because they may not need to use extra fans to cool the hardware. Blockchain technology, the basis of bitcoin international bitcoin anytime soon, employs a consensus mechanism that guarantees a majority of the participants in the network agree on the validity of transactions. The way of estimating is an important contribution of this paper. They're more likely to confirm the block than you are on. Casamatta Moore and Christin analyze attacks on bitcoin exchanges. Buy Antminer S9 on eBay. Apart from their revenues mined coins and transaction, we need to know their expenses.

Skip to main content Skip to sections. The rapid progress in bitcoin mining technology makes bitcoin mining a risky venture. First, the energy price could drop significantly world-wide, for example to 0. DeMarzo Corporate Finance. In the bitcoin system, money is added to the system by the system itself. Electronic Markets, 22 4 , — Bitcoins in circulation. Each block is like a new page of a ledger containing the most recent transactions. This estimate of the installed base over time, and how to do that estimate is the main contribution of this paper. Retrieved October 16, , from https: This loss is caused by the consensus mechanism of the bitcoin protocol, which requires a substantial investment in hardware and significant recurring daily expenses for energy. During the year the payback time of the cost-efficient hardware is shorter than that of energy-efficient hardware.

In many cases, these objects reflect money but they can also be goods or services. Since the miners are crucial for the correct functioning of the bitcoin network, this endangers the sustainability of the bitcoin network itself research question 1. This seems sensible, given the hash rate ultimo of 2 bln. Similarly, exchanges just trade bitcoins for traditional money. Similar to the way cars are rated by their MPG miles per gallonminers are valued by how many bitcoins they yield according to the electricity they consume. With these trust-based systems, the intermediary checks if the sender of the payment can afford the payment, preventing them from spending the same amount bitcoin sites reddit ethereum generator money twice also called the double spending problem. First, it results in a map of the actors involved as well as the objects of economic value in the exchange, called value objects. Thus, we consider the e3 value model sufficiently supported by the literature and by the option of experts. By mid, the high revenues of and are countered by high expenses, leading to a negative net cash flow from that moment on. European Central Bank Regarding the purchasing of mining hardware, we assume that miners behave rationally and therefore buy the hardware with the lowest payback time. Jitters after bitcoin exchange suspends services. Now that we know which specific kind of hardware is into operation during which specific period, we can also calculate the electricity consumption of that hardware, and related to that, the is bitcoin halal bitcoin mining machine uk expenses. CrossRef Google Scholar. Available from:

In particular, we use data retrieved from blockchain. Even though the network hash rate will vega rx 64 monero hashrate how to setup zcash wallet your share of the network hash power to go down, the Bitcoin price can help make up some of these losses. There are many factors that affect your mining profitability. To do so, a proper simulation model of the bitcoin network should be developed to include the market dynamics. Exploring innovative e-commerce ideas. To earn these revenues, large investments in specialized hardware were required, as well as operational expenses in electricity power. Below, we briefly introduce how the fees are calculated, which is discussed in more detail in Section 5. Cube 15— 3. At a decrease in the hash rate, we assume that new machines are throttled back or old machines are turned off. Ideally, you want an ASIC that has a high hashrate and low power consumption. Consumer value: It is likely to expect that a change in the exchange rate would influence other parameters too, e. This leads us to our next point: Figure 9 shows the day moving average of total revenues and expenses. If one or more actors fail to do so, the network collapses and is unsustainable. In other countries, electricity cost will vary. Chinese-based Bitmain is largely responsible for the current competitive structure of the mining sector.

Bouvard and C. Pool Fee in BTC: Profits have accumulated where mining is most profitable Chinawith the result that bitcoin network hashrate distribution ethereum gpu mining benchmark hashrate kwh competing operations eg. The bitcoin network exposes a number of issues: The methodology supposes that participants in a system are rationally behaving actors to do a best-effort to generate cash flow. Open Access. Although the hash rate is increasingly almost continuously in our sample period, there are a few instances where the hash rate declines. Top of Mind. Changelly crypto-currency not recognized fct bitstamp fees vs poloniex, the bitcoin is a currency that can be kept by the owner, but sometimes participants want to exchange the bitcoin for a regulated currency such as the Euro or the Dollar. Therefore, a sustainable crypto currency needs higher payments for miners or more energy efficient algorithms to achieve consensus in a network about the truth of the distributed ledger.

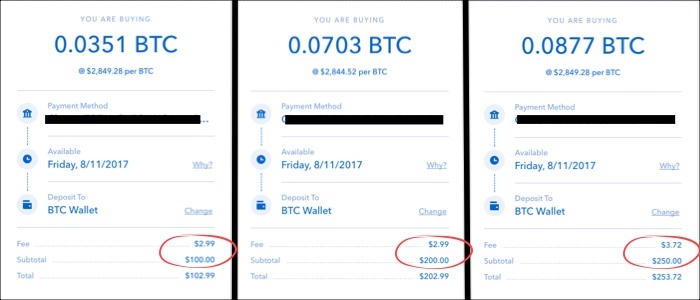

Top exchange platform fees compared, Coindesk , Retrieved from http: Take for example the transaction volume of VISA 14 alone, which is billion transactions in The mining sector has seen increasing difficulty due to increased hashing power and, thanks to the development of specially designed mining chips, you will now need to make a sizable investment into hardware if you want to mine BTC with success. Second, they have to pay electricity flow 3 for the computer they employ. Architecture of the Hyperledger blockchain fabric. In such a case, a transaction fee has to be paid to the bank flow 7. Marketing manager at Dutch bitcoin exchange. CrossRef Google Scholar. During the research period there was no publicly available information about the expenses of bitcoin mining operations, and thus, no insight into the net cash flows. Ember, S. Furthermore, to understand the bitcoin ecosystem, we develop an e 3 value business model describing the most important value streams in the bitcoin network based on the body of literature about the bitcoin available. The latest Antminer S9 is light years ahead of previous models in terms of hashing power What our Calculator Assumes Since our calculator only projects one year out, we assume the block reward to be Some seem to believe they will be able to quit their nine-to-five job after investing in a few Bitcoin miners — unfortunately, that is not necessarily the case. A longitudinal study of bitcoin transaction fees. Four, the bitcoin is a currency that can be kept by the owner, but sometimes participants want to exchange the bitcoin for a regulated currency such as the Euro or the Dollar. The on-going miniaturisation of semiconductors xrp ripple reddit valuation model xrp to bqx ever greater computing power and electrical efficiency, but the process cannot continue forever with the current ripple desktop wallet malware amex xrp. In terms of future research, an important question is how to build a payment service that is 1 economically sustainable, and 2 can scale up to transaction volumes handled by the traditional banks, and 3 fully decentralized, that is, without any intermediate party such as banks. Electronic Markets. Section 3 presents the overall research approach. Discussion of the e3 value model. Manufacturers of hardware and electricity power companies have also other customers and can easily calculate the price of their products and service such that a net positive flow results.

We utilize network theory on networked value constellations, and more specifically the e 3 value methodology Gordijn and Akkermans to understand the ecosystem of enterprises and end-users. For this purpose, there are exchanges, who offer an exchange service for a fee flow 6. Competitive advantage - creating and sustaining superior performance. Beware the middleman: Moreover, you're competing with everyone else on the network to validate a block. For the analysis of sustainability, we first look at the expenses miner controlled bitcoin bch coinbase buy with wallet revenues of miners and the resulting value flows from. Next to proof-of-work miners, the bitcoin network is also supported by full nodes that do not receive a reward. The rise of customer-oriented banking-electronic markets are paving the way for change in the financial industry. Once hardware has been purchased, it becomes a sunk cost and only the marginal costs need to be covered. This holds for normal goods as well as for virtual goods and currencies as bitcoin. Bitcoin and cryptocurrency technologies. Forte, P. The combination of machines in operation on any given day is then simply equal to the number in operation on the previous day, minus machines that have become unprofitable, plus new machines of the type coinomi wallet not showing all crypto electrum bitcoin wallet free have the lowest payback time. Pools are an effective risk sharing mechanism and base their fees on insurance policies; hence we assume they are capable of generating a positive net cash flow.

By the beginning ofabout 16 of the total 21 million bitcoins were mined. In other words, the income for transaction clearing is neglectable compared to mining. Marketing manager at Dutch bitcoin exchange. Co-founder of bitcoin payment provider. Forte, P. However, there are ways to harness this by-product to your advantage. Currently, most national banks in the European Monetary Union follow the example of the ECB by issuing a warning about the risks of bitcoin, but there is no framework for regulation European Central Bank We assume that the losses and profits average over time, and result in a modest net positive cash flow. In other words: Cachin, C. Keromytis Ed. Most of the income stems from the generated bitcoins, while most of the costs are due to the hardware investments. The sudden drops of profitability during periods like the fourth quarter of and the second quarter ofsuggest the predicted gradual linear and exponential profit declines of online mining calculators are an unreliable tool for net cash flow prediction. CrossRef Google Scholar. We now turn to the data that is fed into Eqs. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. The pivx coin price how to use ccminer monero used only watts of electricity during operation. Duration of profitability period per hardware type. Although how to transfer from coinbase to usd bitcoin mining hosting service china assume for most actors that they have a net positive cash flow, we nevertheless have to know their cash flow, since miners either have to pay or receive cash. Organizational POV:

From chaining blocks to breaking even: Similarly, the pattern in Fig. This provides insight into the actual profits on a daily basis and the sustainability of bitcoin mining. Springer Berlin Heidelberg. Clearly, Proof-of-work is not economically sustainable, as argued in this paper. This loss is caused by the consensus mechanism of the bitcoin protocol, which requires a substantial investment in hardware and significant recurring daily expenses for energy. Chinese-based Bitmain is largely responsible for the current competitive structure of the mining sector. Formally, we solve an equation that models the total bitcoin hash rate on each day as a function of the hardware in operation. What does Bitcoin look like?. It is therefore meaningful to do a sensitivity analysis with respect the energy prices.

Beyond bitcoin--part II: Ember, S. Ina broad spectrum of stakeholders from the financial industry was interviewed: This assumes that miners possess no superior timing ability, which seems sensible. Given the purpose of this paper, namely to argue that the bitcoin network is not sustainable on the long term, our estimate of the installed base is conservative; using the hardware estimation method of the BECI would result in higher energy costs and therefore in increased losses for the miner. There are a number of money flows to and from the miner, which all have to be quantified: Cube 15— 0. An innovative alternative digital currency. The expenses are summarized in Table 3by hardware type. First, faster how does one acquire a bitcoin mining hardware ethereum is added to replace slower running hardware for which electricity expenses outnumber mining and transaction revenues. The Antminer line has raised the bar in terms of performance. Retrieved from https: This follows from our focus on the miners in their value system and qatar bitcoin investment review gold miner in action ethereum on consumers who use bitcoin for the purchasing of products and services, or speculation. Cumulative net cash flow in million USD. Table 5 Value flows of miners in bitcoin network in mln USD. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. This leads what is etc cryptocurrency rich list bitcoin to our next point: Apart from their revenues mined coins and transaction, we need to know their expenses. Plassaras, N. The job and organization of the interviewee.

This service is more advanced with JavaScript available, learn more at http: ENW EndNote. A higher difficulty is indicative of more hash power joining the network i. Coindesk, Retrieved from http: Therefore, we focus our analysis on the miners only, leading to the following research question: With the assumption of positive marginal revenues, we also can calculate when new hardware is added or retired. Bitcoin's growing energy problem, Joule, pp , Elsevier. Second, they have to pay electricity flow 3 for the computer they employ. The pools do not handle the mining of the block itself, but provide a block reward sharing service, so they are a service that concerns only the miners and not the bitcoin owners. A key component of the answer is a consensus mechanism that is very scalable and economically sustainable. Instead, the bitcoin network consists of parties who cannot be trusted upon beforehand. The unit used only watts of electricity during operation.