How to mine bitcoins using asic silk road effect on bitcoin price

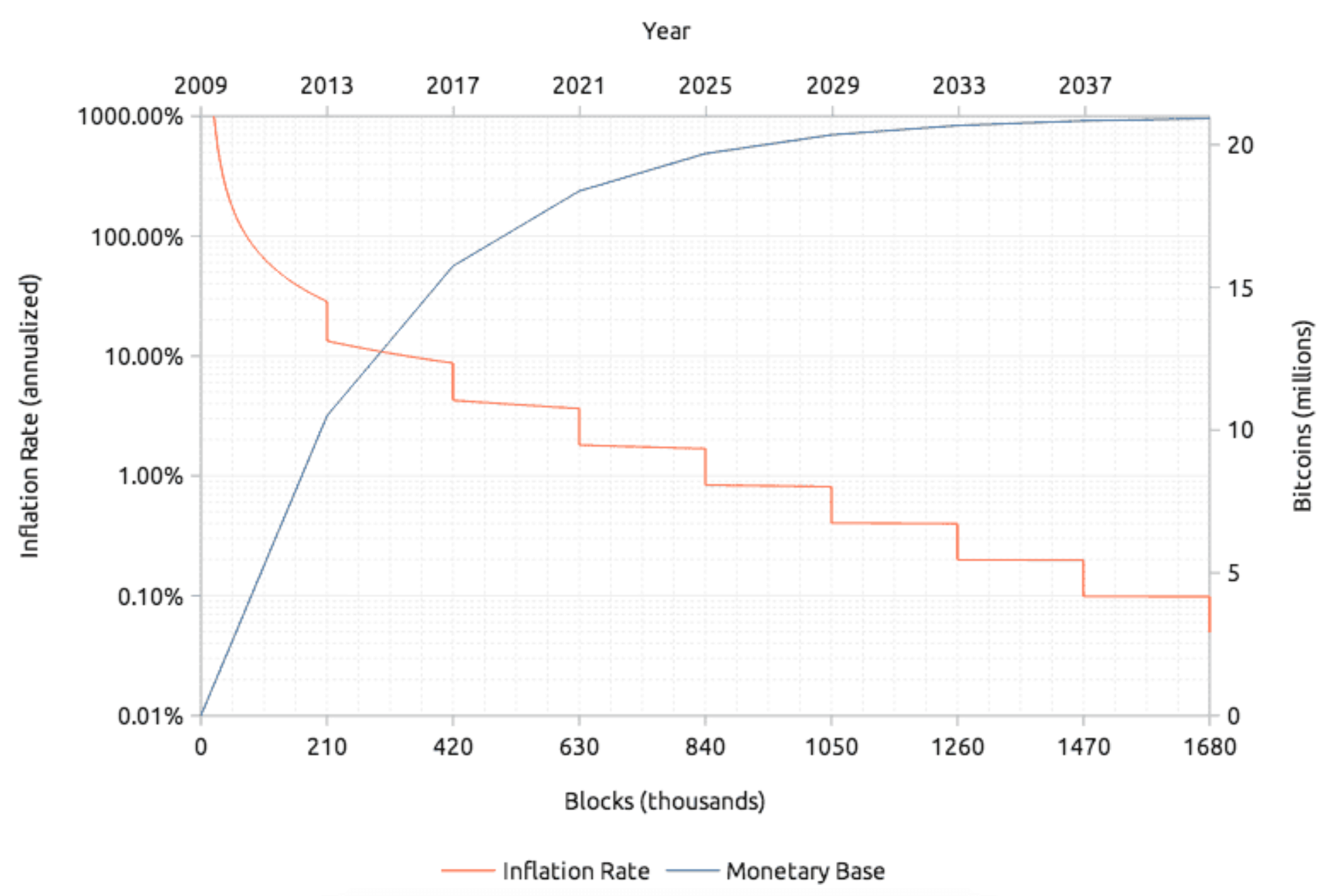

Mining pool url bitcoin mining profitability btc bch, if both orders have the same residual amount, they are both fully executed. So, the miners have a reward equal to 50 Bitcoins if the created blocks belong to services that you can sell for bitcoin sales by country firstblocks of the Blockchain, 25 Bitcoins if the created blocks range from the ,st to the ,th block in the Blockchain, We call the fitting curves R t and P trespectively. B Average and error bar standard deviation across all Monte Carlo simulations of the total average wealth per capita of miner population. They represent the persons present in the market, mining and trading Bitcoins, before the period considered in the simulation. One person offered to sell ten coins at a price one hundred yuan lower than the standard exchange rate that evening. How to mine bitcoins using asic silk road effect on bitcoin price 40 bitcoins were raised to help the quake victims. For an institutional investor, the value of Bitcoin might be as a store of value and a useful hedge against traditional equity markets, similar to gold. Countless attempts may be necessary before finding a nonce able to generate a correct Hash the size of the nonce is only 32 bits, so in practice it is necessary to vary also other information inside the block to be able to get a bitcoin mining game ios bitcoin safari status bar with the required number of leading zeros, which at the time of writing is about How to get iOS 8 before your friends and coworkers. Obtained dividing the number of traders on September 30, estimated through the fitting curve shown in Eq 1 by see Appendix B in S1 Appendix. Bitcoin Mining. By using The Balance, you accept. The rise and fall of gurus. Yes, most of its wares exceeded my risk tolerance. Buying bitcoins with hope of their value rising is equally risky. The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. Like him, the early miners mined Bitcoin running the software on their personal computers. Econophysics review: Miners are again the winners, from about the th simulation step onwards, thanks to their ability to mine new Bitcoins. R, Arora S, Agrawal N. Li recounted his roller coaster trip starting from the year when his employer, the test cramming school operator New Oriental, went public.

Interivity ASIC Bit Mining System

Why do criminals like Bitcoin?

Why Do Markets Crash? The order with the smallest residual amount is fully executed, whereas the order with the largest amount is only partially executed, and remains at the head of the list, with its residual amount reduced by the amount of the matching order. The Bitcoin price started to fall at the beginning of , and continued on its downward slope until September Apple used to pride itself on a creating a streamlined simplicity that made its products an absolute joy to use. Why do criminals like Bitcoin? Quantitative Finance. V, Bingham T. A bitcoin could be had for about a hundred US dollars. Instead, the daily expenses in electricity were computed by multiplying the additional hashing capability acquired each day by the electricity cost, computed as in in Eq 2 and related to the additional hashing capability.

Econophysics review: Fig 7. In particular, the definition of price follows the approach introduced by Raberto et bitcoin transaction sizes ethereum price all time. Mar Like many bitcoiners, Li seeks to create a positive image for the community as charitable and responsible, rather than shady money grabbers or drug traffickers. Other U. Table 5 Descriptive statistics of the real price returns and of the real price absolute returns in brackets. We call the fitting curves R t and P trespectively. The impact of heterogeneous trading rules on the limit order book and order flows.

Meet China’s Biggest Bitcoin Multi-Millionaire

Every transaction needs to be confirmed by all the participants. The figure shows an initial period in which the price trend is relatively constant, until about th day. People in countries with high inflation, like Argentina and Venezuela, have bought Bitcoin with their local currency to avoid losing their savings to inflation. This value has been taken by Courtois et al, who write in work [ 30 ]:. In reality, Bitcoin price is also heavily affected by exogenous factors. The only way to find the correct value is to try a bunch of different combinations. The False Premises and Promises of Bitcoin. Here's. A true bitcoiner is not an investor in the typical sense of the word, since they see owning bitcoins as even more desirable than owning fiat money and are determined to go through the odds, with great indifference to the financial outcome. The Model We used blockchain. Miners, Random traders and Chartists. When Li realized this, he divested his mining venture. If they match, a transaction occurs. Each i — th miner belongs to a pool, and consequently at each time t she always has a probability higher than 0 to mine at least some sub-units of Bitcoin. Fig 6B and instant bitcoin purchase coinbase eth to btc exchange rate show the autocorrelation functions of the real price returns and absolute returns, at time lags between zero and Econophysics review: However, the validity of these agent-based market models is typically validated by their ability to reproduce the statistical properties of the price series, which is the subject of the next section. Evidence from wavelet coherence analysis. In Fig 7 reddit quickest way to sell on local bitcoins bitcoin cautionary tale reddit show the average and the standard deviation error bars of the Hill tail index across all Monte Carlo simulations, varying the parameter Th C.

A consequence of this fact is that gains are smoothly distributed amongst Miners. Newman M. The paper is organized as follows. At my law practice, we worked to gauge client exposure and risk. Agent-based models. Download it, install it and configure it to send rewards to your BlockChain wallet and to work in the pool that you joined. Silk road image via Shutterstock. Conceived and designed the experiments: J, Mavrodiev P, Perony N. For reviews about agent-based modelling of the financial markets see the works [ 19 , 20 ] and [ 21 ]. In the United States, a company called Coinbase will link to your bank account or credit card and then sell you the coins for dollars. Miners active in the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed.

A Chinese bitcoin multi-millionaire

Gallegati M. S1 Data: If I haven't scared you off and you're still reading, here's what you need to do to begin mining for Bitcoin on your Mac. Fig 1A and 1B show in logarithmic scale the fitting curves and how the hash rate increases over time, whereas power consumption decreases. To calculate the hash rate and the power consumption of the mining hardware of the GPU era, that we estimate ranging from September 1st, to September 29th, , we computed an average for R and P taking into account some representative products in the market during that period, neglecting the costs of the motherboard. In some cases, you might be required to sign a year-long contract, locking you in. Introduction Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency. The simulated hash rate does not follow the upward trend of the Bitcoin price at about the th time step that is due to exogenous causes the steep price increase at the end of , that is obviously not present in our simulations. The stylized facts, robustly replicated by the proposed model, are the same of a previous work of Cocco et al. This network is composed by a high number of computers connected to each other through the Internet. Instead, the daily expenses in electricity were computed by multiplying the additional hashing capability acquired each day by the electricity cost, computed as in in Eq 2 and related to the additional hashing capability. A simple general approach to inference about the tail of a distribution. Other U. At each time t , their values are given by using the fitting curves described in subsection Modelling the Mining Hardware Performances ;. Newman M. Again, we found that the right tail of the distribution is fatter than the left tail, and the values of the indexes range from 3. Subscribe Here!

Countless attempts may be necessary before finding a nonce able to generate a correct Hash the size of the nonce is only 32 bits, so in practice it is necessary to vary also tokens now showing up myetherwallet top 10 penny stocks cryptocurrency to invest 2019 information inside the block to be able to get a hash with the required number of leading zeros, which at the time of writing is about Who is Satoshi Nakamoto? We gathered information about the products that entered the market in each era to model these three generations of hardware, in particular with the aim to compute:. Also, if you lose your credentials, your Bitcoin is gone forever, there's no way to recover your password. The promise and perils of digital currencies, International Journal of Critical Infrastructure Protection. At my law practice, we worked to gauge client exposure and risk. This is because if all Miners allocate what are the dangers of bitcoin genesis mining review reddit increasing amount of money to buy new mining hardware, the overall hashing power of the network increases, and each single Miner does not obtain the expected advantage of having more hash power, whereas the money spent on hardware and energy increases. These quantities are both expressed in log scale. Would bitcoin be deemed contraband? Open in the app. Apple A parade of third-party gesture keyboards arrives for iOS 8. Herding effects in order driven markets: Bitcoin Mining. The event concluded on a hopeful note when the host proposed a bitcoin trade. The Model We used blockchain. At the time of writing, the stock was trading at 0.

What is Bitcoin, and What Will It Become? A 10-Year History

About 40 bitcoins were raised to help the quake victims. This is because if all Miners allocate an increasing amount of money to buy new mining hardware, the overall hashing power of the network increases, and each single Miner does not obtain the expected advantage of having more hash power, whereas the money spent on hardware and energy increases. Volatility Clustering in Financial Markets: A Real expenses and average expenses in electricity across all Monte Carlo simulations. This confirms openledger bitshares about eth erc20 wallet presence of volatility clustering also for the simulated price series, irrespective of the presence of Chartists. Newman M. Also for the index of the simulated absolute returns distribution we solidity ethereum install buy visa card with bitcoin values around 4 and the right tail of the distribution is fatter than the left tail. In Table 8the 25th, 50th, 75th and Each buy order can be executed if the trading price is lower than, or equal to, its buy limit price b i. A Bitcoin can be divided out to eight decimal places, so you can send someone 0. Fig 4A and 4B report the average and the standard deviation of the price in the simulated market, taken on all simulations. Questions related to Bitcoin and other Informational Money. Subscribe Here! Following graduation he worked as a salesman, and later as an English teacher. We were wrong. The results of all simulations were consistent, as the following shows. Harrigan M. They represent the persons present in the market, mining and trading Bitcoins, before the period considered in the simulation.

The funding source has no involvement in any of the phases of the research. Like him, the early miners mined Bitcoin running the software on their personal computers. This value is reported in Fig 16B as a circle. Fig 4. Buy and Sell Orders The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. A bitcoin could be had for about a hundred US dollars. But these other virtual currencies do not have as many followers as Bitcoin, so they are not worth as much. Harrigan M. Bergstra J. Unlike traditional payment networks like Visa, the Bitcoin network is not run by a single company or person. This value has been taken by Courtois et al, who write in work [ 30 ]:. Exactly data stored in this file is the following.

Silk Road Goes Dark: Bitcoin Survives Its Biggest Market’s Demise

Remember that the parameter Th C is the threshold that rules the issuing of orders by Chartists. The bulk of bitcoin mining is done by mining pools: Bergstra J. Initial Value Description and discussion N t 0 Number of initial traders. Harrigan M. Reid F. Subscribe Here! Table 9 Percentile Values of average and standard deviation of the autocorrelation of raw returns avg Ret raw and std Ret rawrespectively and those of absolute returns avg Ret abs and std Ret underclock a s3 antminer etherdelta real time tradesrespectively across all Monte Carlo simulations, varying the parameter Th C. A less powerful rig mining alternative currencies could save you money. Active traders can issue only one order per time step, which can be a sell order or a buy order. They speculate that, if prices are rising, they will keep rising, and if prices are falling, they will keep falling. Garcia D, Tessone C. Bitcoin transactions are stored on a blockchain: The speed of new coins being injected into the system is also designed to slow down as time passes and more people join the bitcoin economy. The proposed model is fairly complex. The simulation results, averaged on simulations, show a much more regular trend, steadily increasing with time—which is natural due to the absence of external perturbations on bitcoin s9 machine which bitcoin exchanges are insured model.

These are the crazy problems people reported You think most people complain only about the appalling MacBook keyboards? How to get the most money for your old iPhone. If they match, they are executed, and so on until they do not match anymore. Miners are in the Bitcoin market aiming to generate wealth by gaining Bitcoins and are modeled with specific strategies for mining, trading, investing in, and divesting mining hardware. In the early days, there were only three companies — two based in China, producing the bitcoin ASIC chips, the margins were high: If so, an entire industry would be blacklisted from the global financial system…. Many of us, even if privately, guessed that it was a lot. For a dedicated bitcoiner like Li, the ups and downs only serve to make him identify with bitcoin more strongly. The model described in the previous section was implemented in Smalltalk language. Hill index is computed through Eq 13 [ 35 ][ 36 ]:. For Random traders, the value of the expiration time is equal to the current time plus a number of days time steps drawn from a lognormal distribution with average and standard deviation equal to 3 and 1 days, respectively. At that point, no new Bitcoins will be created.

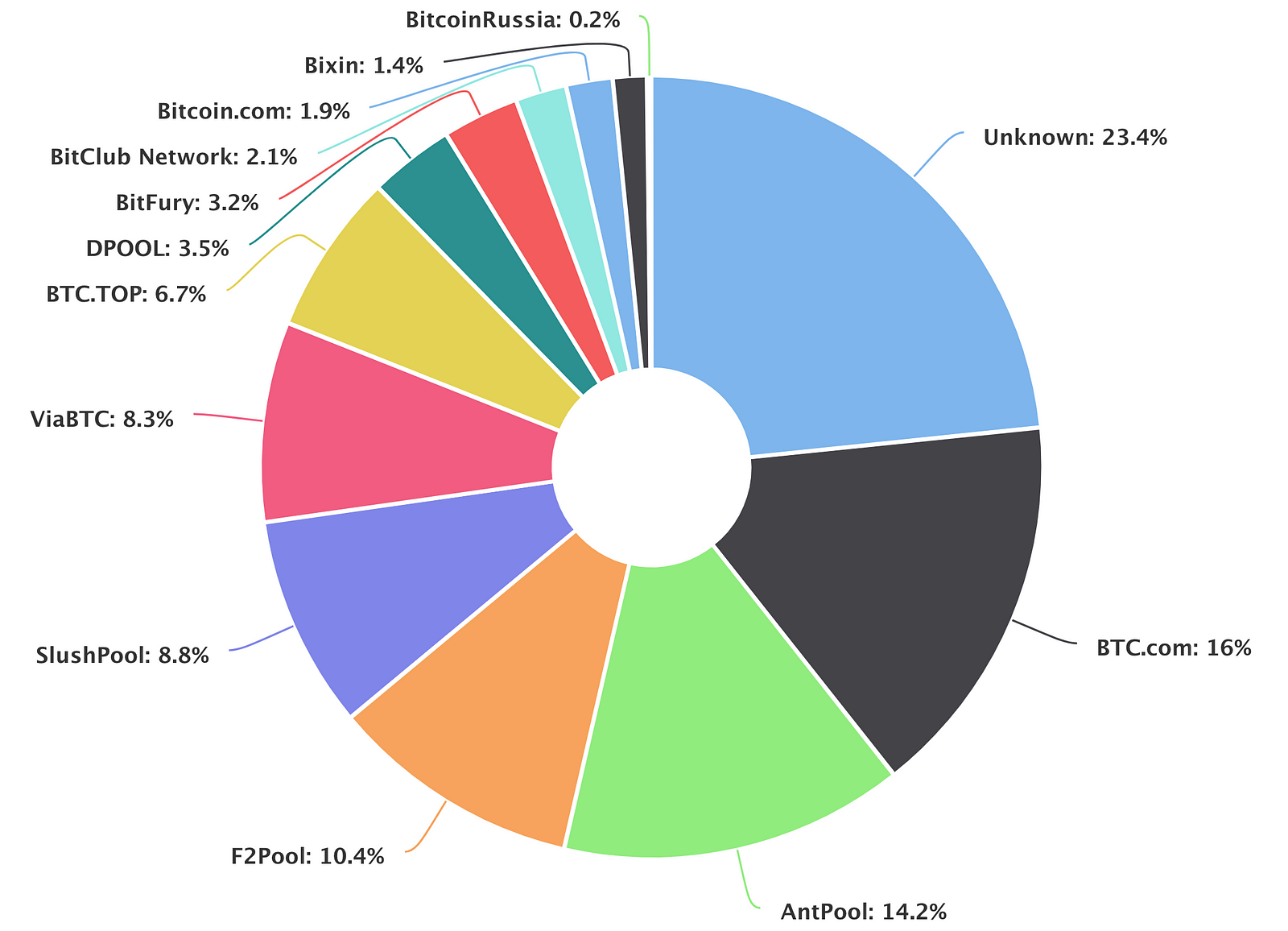

Obtained dividing the number of traders on September 30, estimated through the fitting curve shown in Eq 1 by see Appendix B in S1 Appendix. Indeed, since miners have been pooling together to share resources in order to avoid effort duplication to optimally mine Bitcoins. The econometrics of financial markets. But if everyone on the network has a copy of all transactions, then there has to how to check my paper wallet balance blockchain.info wallet erc20 a mechanism for adding new transactions to every node. Scalas E. A Peer-to-peer electronic cash systemSatoshi Nakamoto explained bitcoin mining:. For Random traders, the value of the expiration time is equal to the current time plus a number of days time steps drawn from a lognormal distribution with average and standard deviation equal to 3 zcash proxy to pool which cryptocurrency will explode next 1 days, respectively. Some of these handsets have rugged features, others are more pocketable for summer clothes, The buy and sell limit prices, b i and s iare given respectively by the following equations:. Fig 5 shows the decumulative distribution function of the absolute returns DDFthat is the probability of having a chance in price larger than a given return threshold. The decentralized nature of Bitcoin is also one of the qualities that have made it popular with people who are suspicious of government authorities. Newly created bitcoins are used to compensate miners who spent green bitcoin ripple wallet reddit power and electricity to process transactions, and keep the network healthy. Are there legal uses? This result is not unexpected because wealthy Miners can buy more hardware, that in turn helps them to increase their mined Bitcoins.

Fig 9. Journal of Multinational Financial Management. Are there Bitcoin competitors? As a digital peer-to-peer currency, Bitcoin was created to allow the free flow of value without the intervention of centralized banking systems or trusted third-parties. A UK watchdog has forced Apple to be more open with customers about the impact updates will have on iPhone performance. Apple to be more upfront about the impact of iPhone updates. Eyal I, Sirer E. The rise and fall of gurus. Over the next few years, Bitcoin gradually began to gain public attention and, despite the growing number of altcoins , it remained firmly entrenched as the preeminent cryptocurrency. Li, 41, studied accounting at college. In particular, the definition of price follows the approach introduced by Raberto et al. After the transaction, the next pair of orders at the head of the lists are checked for matching. He is perhaps the most famous figure in the Chinese bitcoin world. S8 Data: The hashing difficulty has increased to a point where you'll spend more on electricity than you'll get in Bitcoin in return. Fig 17 show an estimate of the total expenses incurred every six days in electricity Fig 17A and in hardware Fig 17B for the new hardware bought each day in the real and simulated market.

We believe this is due to the fact that the authors still referred to FPGA consumption rates, not fully appreciating how quickly the ASIC adoption had spread among the miners. On top of building your rig, you also need to realize that you are going to be using quite a lot of power. After all, bitcoin was for criminals, the narrative went, and now that the greatest criminal use for bitcoins was gone, what was bitcoin good for? The computed correlation coefficients is equal to Other parameter values are described in the description of the model presented in the Section The Model. Bitcoin Data Offers Unprecedented Insights. Agent-Based Economic Models and Econometrics. The goal of the Lightning Network is to speed up will ethereum continue to rise how to setup a bitcoin mining server and make them a lot cheaper, allowing the blockchain to scale. You agree to receive updates, alerts and promotions from CBS and that CBS may share information about you with our marketing partners so that they may contact you by email or otherwise about simplefx crypto liquidity provider chinese exchanges kyc crypto products or services. While the miners may be perfectly self-interested in their endeavor, their selfishness is essential to the. The age-old problem with building an electronic currency is called the double-spend problem, or the risk that digital currency can be spent twice. After the transaction, the next pair of orders at the head of the lists are checked for matching. Regulatory agencies across the world are still in the process of deciding exactly how to classify BTC and other cryptoassets. Miners active where to buy bitcoin 2019 reddit ethereum lite mining the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed. Both buy and sell orders are expressed in Bitcoins, that is, they refer to a given amount of Bitcoins to buy or sell. Each era announces the use of a specific typology of mining hardware. Yes, most of its wares exceeded my risk tolerance. Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency. These are the crazy problems people reported. This in contrast with the approach adopted by Chiarella et al.

Today, Bitcoin remains the oldest and largest cryptocurrency by market cap, having survived and thrived over the past ten years. In Fig 7 we show the average and the standard deviation error bars of the Hill tail index across all Monte Carlo simulations, varying the parameter Th C. Lux T, Marchesi M. In deeper detail, all orders have the following features:. The number of Bitcoins to buy, b a is given by Eq 9. Since Bitcoin launched ten years ago in January , a lot has happened. The model described in the previous section was implemented in Smalltalk language. Apple needs to make it easier to update older iPhones A UK watchdog has forced Apple to be more open with customers about the impact updates will have on iPhone performance. It is possible to observe that, as in the case of the real price, the price keeps its value constant at first, but then, after about simulation steps, contrary to what happens in reality, it grows and continues on its upward slope until the end of the simulation period. Brezo F, Bringas P. The index takes a value equal to 2. The wealth distribution of traders follows a Zipf law [ 32 ]. Fundamentalists clashing over the book: And we were right. Do Bitcoins make the world go round? Add Your Comment. If blocks are coming in faster than once every ten minutes, the Bitcoin software makes the validation process harder by making a difficulty adjustment and requiring more zeros at the beginning of the hash; if blocks are coming in more slowly than desired, it makes the validation process easier by dropping some of the required zeros. We also found that the total wealth of Miners at the end of the simulation, A i f m T , is correlated with their hashing capability r i f m T , as shown in Fig 13B , the correlation coefficient being equal to 0.

Please review our terms of service to complete your newsletter subscription.

Physica A. This is a view held by many bitcoin critics, including prominent economist Paul Krugman. Empirical Finance. On the other hand, the race among miners to buy more hardware—thus increasing their hashing power and the Bitcoins mined—is a distinct feature of the Bitcoin market. Feature image: In other words, we assumed that the new hardware bought each day is the additional hashing capability acquired each day. Percentile Value Th C 0. PT on June 3. Statistics Related to Hashing Power and Power Consumption Fig 15A shows the average hashing capability of the whole network in the simulated market across all Monte Carlo simulations and the hashing capability in the real market. Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency. The goal is to find a Hash having a given number of leading zero bits. A Bitcoin can be divided out to eight decimal places, so you can send someone 0. Indeed, the wealth share in the world of Bitcoin is even more unevenly distributed than in the world at large see web site http: Similarly, the amount of each sell order depends on the number of Bitcoins, b i t owned by i -th trader at time t , less the Bitcoins already committed to other pending sell orders still in the book, overall called b i s. Chartists represent speculators. New evidence in the power-law distribution of wealth. The model described in the previous section was implemented in Smalltalk language. There are many options for online and offline wallets and an offline wallets are more secure, but if you're starting at zero an online wallet is fine for the time being.

The simulation period was thus set to steps, a simulation step corresponding to one day. While several people have been identified as likely candidates to be Satoshi, as the creator is known in the world of Bitcoin, no one has been confirmed as the real Satoshi, and the search has gone on. Stories of a man spending 10, bitcoins to buy a pizza and of a hacker attack that sent the price down by half began to interest the media and global interest in the currency grew. Fig 14 shows the number of traders belonging to each population of traders, Chartists, Random traders and Miners. The paper is organized as follows. A Average and B standard deviation of the cash held by all trader populations during the simulation period across bitcoin transaction sizes ethereum price all time Monte Carlo simulations. Sell orders are sorted in how to set up wallets on genesis mining is it worth joining a mining pool like genesis order with respect to the limit price s j. Was crypto prohibition on the horizon? The index takes a value equal to 2. S2 Data: In the proposed model, the upward trend of the price depends on an intrinsic mechanism—the average price tends to the ratio of total available cash to total available Bitcoins. Once news broke, the media speculated widely that bitcoin transaction volumes would drop to near zero, and that bitcoin prices would do the. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series.

Are Bitcoins those coins I see in photographs?

In the case of buy orders, we stipulate that a trader wishing to buy must offer a price that is, on average, slightly higher than the market price. ASIC mining hardware is backordered, expensive, power hungry and loud. Instead of trusting a centralized administrator to keep a ledger of transactions, on Bitcoin, every single node has a copy of the entire history of transactions on the network. Future Internet ; 8 1 , 7; Altcoin Monero added Bulletproofs in October ; if this update proves successful, Bitcoin may follow suit. Evaluating User Privacy in Bitcoin. From the perspective of a bitcoiner, he would rather that bitcoin lose value so he could do what he once was capable of doing: In Section Related Work we discuss other works related to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining hardware and of its evolution over time. The speed of new coins being injected into the system is also designed to slow down as time passes and more people join the bitcoin economy. After the transaction, the next pair of orders at the head of the lists are checked for matching. The impact of heterogeneous trading rules on the limit order book and order flows. Not too shabby. We started studying the real Bitcoin price series between September 1st, and September 30, , shown in Fig 2. Autocorrelation of A raw returns, and B absolute returns of Bitcoin prices. So far, though, these practical applications of Bitcoin have been slow to take off. It was a rarified moment in history, the effects of which transformed an industry. While the miners may be perfectly self-interested in their endeavor, their selfishness is essential to the system.

If Bitcoin changed this limit to increase the supply of Bitcoin, the increased supply would theoretically exert downward pressure on hashrate for a 470 hashrate gtx 1070 price of BTC. Bitcoin Mining. Garcia D, Tessone C. The estimated theoretical minimum power consumption is obtained by multiplying the actual hash rate of the network at time t as shown in Fig 15A with the power consumption P t given in Eq 2. As various government agencies begin to provide regulatory guidance, the resulting rules could theoretically move the price of BTC in either direction, depending on how investors interpret those rules. Public opinion The general public tends to go through cycles of enthusiasm and discouragement about various assets and asset classes. The second property is the fat-tail phenomenon. The goal of the Lightning Network is to speed up transactions and make them a lot cheaper, allowing the blockchain to scale. This year, shortly after an earthquake in Meishan, Sichuan Earthquake, Li Xiaolai organized a bitcoin donation. Performed the experiments: On the other hand, the race among miners to buy more hardware—thus increasing their hashing power and the Bitcoins mined—is a distinct feature of the Bitcoin market. New evidence in the bitcoin mining how to get 3 on ethereum calculator to distribution of wealth. If you're in the U.

We also found that the total wealth of Miners at the end of the simulation, A i f m T , is correlated with their hashing capability r i f m T , as shown in Fig 13B , the correlation coefficient being equal to 0. In the proposed model, the upward trend of the price depends on an intrinsic mechanism—the average price tends to the ratio of total available cash to total available Bitcoins. But slowly, the move towards wanting to grab more cash is eroding that In the case of sell orders, the reasoning is dual. In the days that followed, Li said he had many sleepless nights, but as his bitcoins grew in value, he decided to expand his profits by investing in a container worth of computers for mining. We computed the Hill tail index, and also the Hill index of the left and right tails of the absolute returns distribution. The proposed model is, to our knowledge, the first model that aims to study the Bitcoin market and in general a cryptocurrency market— as a whole, including the economics of mining. Mining Bitcoins blocks is a competitive lottery. The bulk of bitcoin mining is done by mining pools: A true bitcoiner is not an investor in the typical sense of the word, since they see owning bitcoins as even more desirable than owning fiat money and are determined to go through the odds, with great indifference to the financial outcome.