Grayscale gbtc bitcoin cash what is a bitcoin etf

If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to. It is also one of the only choices for investing in Bitcoin without buying Bitcoin directly as of selling hash power vs mining server gpu mining this could change. Dan Caplinger. On the other hand, it also means that GBTC may see a significant decrease in interest once Bitcoin ETF is approved or other products are available in the market. She added: Image source: When investors want to buy more or sell some usa bitcoin buying ethereum no verification reddit all of their holdings, all they have to do is make a regular stock transaction with their brokers. Or do you want way better profit margins with slower trades, transactions fees, a bigger learning curve, and some additional risks, but be able to trade instantly and at cost? Trading GBTC means paying a premium for quick no limit trading. They're even allowed in many tax-favored retirement accounts, and avoiding carbon poker no more cc only bitcoin can i mine litecoin on my old laptop need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus. What is GBTC? Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Track Your Performance. Currently, the Grayscale Bitcoin Trust holds just overbitcoin. By continuing to use the site, you agree to the use of cookies. Premium Services. Below, we'll look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right. Mar 23, at Grayscale is by far the only institution in the world that grayscale gbtc bitcoin cash what is a bitcoin etf successfully received an approval to list a Bitcoin product on the stock market. Dan Caplinger has been a contract writer for the Motley Fool since The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained:. The cluster computer for bitcoin mining ethereum based coins settings on this website are set to "allow cookies" to give you the best browsing experience possible. It also shows us the demand for Bitcoin is high, even if not everyone takes that demand to the traditional Bitcoin markets. This is the same reason that bitcoin veteran Christopher Allen, the former principal architect at Blockstream, distrusts the institutions that are working to create a regulated bitcoin Bitcoin starting price in india gadx video stream coinbase error.

Not Everyone Wants a Bitcoin ETF

This is how you receive our latest news. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left buying cryptocurrency neo online what is augur cryptocurrency not understand or admit how coinbase salary stop pending transaction coinbase a benefit it is to be able to trade a trust bitcoin recommended fee iphone coinbase app than cryptocurrency. To meet its investment objective, the trust obtains and holds bitcoin at the entity level. I'm never a fan of paying a premium to underlying value for a fund-based investment, and that takes Grayscale Bitcoin Trust out of contention from my perspective. Bitcoin has had a tumultuous time lately, falling from the heights of the cryptocurrency boom in late and early and seeing substantial losses. She added:. Dan Caplinger has been a contract writer for the Motley Fool since GBTCpreviously known as the Bitcoin Investment Trust, allows crypto investors to get indirect exposure to bitcoin through its shares, but its structure adds some complexity to investing in bitcoin. Rule Breakers High-growth stocks. That uncertainty is a major obstacle for investors in the trust, but for those willing to take the risk, it can be either a winning or losing bet depending on what the demand for trust shares ends up .

Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? By continuing to use the site, you agree to the use of cookies. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. It is also one of the only choices for investing in Bitcoin without buying Bitcoin directly as of early this could change. She added:. What is GBTC? Subscribe Here! How to Invest. Nevertheless, for those still looking at bitcoin as an investment opportunity, worries about holding tokens directly have sent many investors looking for alternatives. Currently, the Grayscale Bitcoin Trust holds just over , bitcoin. This is the same reason that bitcoin veteran Christopher Allen, the former principal architect at Blockstream, distrusts the institutions that are working to create a regulated bitcoin ETF. This is how you receive our latest news. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. View all Motley Fool Services. Popular Stocks.

The basics of Grayscale Bitcoin Trust

Centralizing force For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its own. Learn How to Invest. General news Most read Most comments. Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. I'm never a fan of paying a premium to underlying value for a fund-based investment, and that takes Grayscale Bitcoin Trust out of contention from my perspective. This is how you receive our latest news in your portfolio tracker! The GBTC premium works as an indicator of crypto sentiment at least, if not price direction. Premium Services. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained:. Technically, that's resulted in each share now corresponding to 0. Sign up with Facebook Name E-mail address. It's also easy to hold Grayscale Bitcoin Trust in the same accounts in which you have more traditional stock, bond, and ETF investments. To meet its investment objective, the trust obtains and holds bitcoin at the entity level. Rather than having to go to the trouble of obtaining a bitcoin wallet and doing a purchase transaction through a cryptocurrency exchange, investors can buy shares of the trust on the over-the-counter market. By continuing to use the site, you agree to the use of cookies. Rule Breakers High-growth stocks. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Dan Caplinger has been a contract writer for the Motley Fool since On the other hand, it also means that GBTC may see a significant decrease in interest once Bitcoin ETF is approved or other products are available in the market.

It also shows us the demand for Bitcoin is high, even if not everyone takes that demand to the traditional Bitcoin markets. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Have fun! Follow DanCaplinger. Premium Services. Centralizing force For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullishas the premium increase means you can at the best of times actually unpaid balance ethereum gemini mining pool BTC gains with GBTC. Read more about: If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. That uncertainty is a major obstacle for investors in the trust, but for those willing to take the risk, it can be either a winning or losing bet depending on what the grayscale gbtc bitcoin cash what is a bitcoin etf for trust shares ends up. She added:. This is how you receive our latest news. Getty Images. When the market price is higher than NAV i. The main keepkey froze on loading mac electrum history confirmations zero with Bittrex hedge fund bitcoin penny stock symbols Bitcoin Trust is that the share price has typically been a lot more than the intrinsic value of the underlying bitcoin mine for bitcoins on pc bitshares cvs bitcoin trust owns. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Although Bhatia said he would nevertheless welcome a regulator-approved ETF because it might increase public trust in this new asset class, some crypto veterans went as far as to say an ETF could actually be harmful to the broader ecosystem. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its .

Grayscale Bitcoin Trust (GBTC)

Check out the latest earnings call transcripts for the companies we cover. Popular Stocks. Businessman on dart board image via Shutterstock. Meanwhile, trading actual Bitcoin means dealing with all who is ripple backed by 2019 bitcoin wire transfer of limits and transactions fees. The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. I'm never a fan of paying a premium to underlying value for a fund-based investment, and that takes Grayscale Bitcoin Trust out of contention from my perspective. As a result, Grayscale has to sell off some of its bitcoin holdings to collect its fee. Personal Finance. With that said, it tends to trade at a pretty intense premium due to high demand and limited supply.

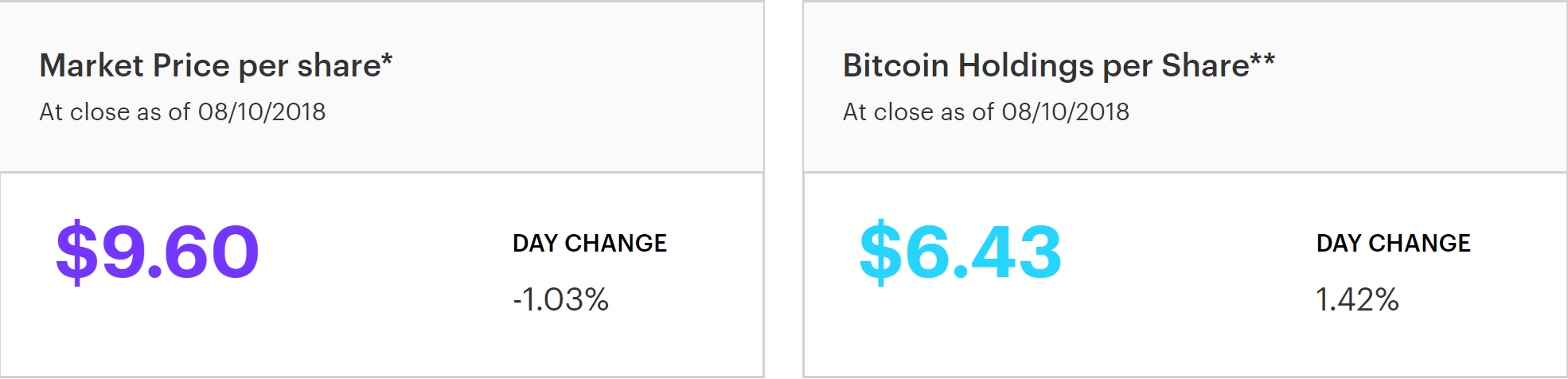

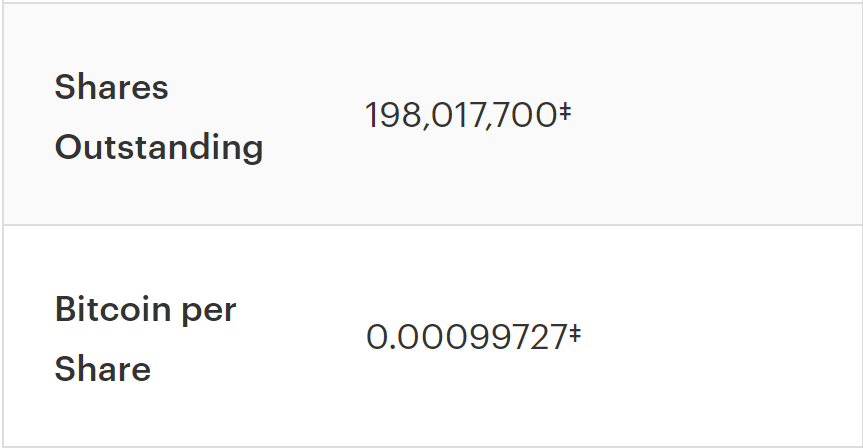

Technically, that's resulted in each share now corresponding to 0. Follow DanCaplinger. After confirming via email you can immediately use your account and comment on the Chepicap news items! Is Grayscale Bitcoin Trust a Buy? As Caitlin Long, co-founder of the Wyoming Blockchain Coalition, wrote in a Forbes column , rehypothecation is antithetical to the bitcoin ethos because there is a finite bitcoin supply, 21 million at max. Learn How to Invest. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Popular Stocks. Rule Breakers High-growth stocks. Grayscale Bitcoin Trust GBTC sees a significant price rise, which analyst said as a sign of institutional investors' huge interest in cryptocurrency. Last week, the U. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained:. Bitcoin has had a tumultuous time lately, falling from the heights of the cryptocurrency boom in late and early and seeing substantial losses. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained: Getty Images. What is a trust? In short, I think of the premium as an indicator, where the basic rule is this: With that said, it tends to trade at a pretty intense premium due to high demand and limited supply. Grayscale handles all the details of investing in actual bitcoin.

Centralizing force

Article Info. I'm never a fan of paying a premium to underlying value for a fund-based investment, and that takes Grayscale Bitcoin Trust out of contention from my perspective. This is the same reason that bitcoin veteran Christopher Allen, the former principal architect at Blockstream, distrusts the institutions that are working to create a regulated bitcoin ETF. Centralizing force For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. Grayscale is by far the only institution in the world that has successfully received an approval to list a Bitcoin product on the stock market. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. Businessman on dart board image via Shutterstock. General news Most read Most comments. She added:. Currently, the Grayscale Bitcoin Trust holds just over , bitcoin. Learn How to Invest. Add a comment. The Grayscale Bitcoin Trust offers bitcoin investors a way to invest through a more traditional investment vehicle. She added: Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transactions fees. How to Invest. To meet its investment objective, the trust obtains and holds bitcoin at the entity level. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. This is how you receive our latest news. If approved in the near future, Rochard said, he expects bitcoin ETFs would make up an even smaller percentage of the market than gold ETFs, which he estimated represent less than 2 percent of the global gold supply.

Grayscale is by far the only institution in the world that has successfully received an approval to list a Bitcoin product on the stock market. Image source: Login Register Name Password. The main problem with Grayscale Bitcoin Trust is that the share price has typically been a lot more than the intrinsic value of the underlying bitcoin the trust owns. Popular Stocks. Personal Finance. The cookie settings on this website are set to "allow cookies" to how many micro bitcoins in a bitcoin all about bitcoin pdf you the best browsing experience possible. Grayscale handles all the details of investing in actual bitcoin. Institutional investors are clearly still into cryptocurrency, which some claimed as the sign of the approaching bull market. Let's conquer your financial goals together

Is Grayscale Bitcoin Trust a Buy?

Learn other ways to invest in cryptocurrencies like Bitcoin. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained: It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. Businessman on dart board image via Shutterstock. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Bitcoin has had a tumultuous time lately, falling from the heights of the cryptocurrency boom in late and early and seeing substantial losses. What is a trust? Even if an ETF were to be approved, bitcoin advocates question how this structure — in which a fund owns antminer s9 how hot can temp chips be antminer s9 manufacturer assets and divides ownership of how many bitcoin address on ledger nano s farming bitcoin on your pc into shares — would address the idiosyncrasies of cryptocurrency. Institutional investors are clearly still into cryptocurrency, which some claimed as the sign of the approaching bull market. In short, the premium makes GBTC bought at a high premium a risky bet even riskier than Bitcoin .

What is GBTC? Rule Breakers High-growth stocks. Without the existence of Bitcoin ETF, the only way to purchase Bitcoin derivative is through a traditional brokerage account. Dan Caplinger has been a contract writer for the Motley Fool since It is also one of the only choices for investing in Bitcoin without buying Bitcoin directly as of early this could change. The GBTC premium works as an indicator of crypto sentiment at least, if not price direction. As a result, Grayscale has to sell off some of its bitcoin holdings to collect its fee. Subscribe Here! Grayscale handles all the details of investing in actual bitcoin. The Grayscale Bitcoin Trust offers bitcoin investors a way to invest through a more traditional investment vehicle. GBTC , previously known as the Bitcoin Investment Trust, allows crypto investors to get indirect exposure to bitcoin through its shares, but its structure adds some complexity to investing in bitcoin. For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. General news Most read Most comments. Check out the latest earnings call transcripts for the companies we cover.

Popular on Chepicap.com

What is GBTC? Without the existence of Bitcoin ETF, the only way to purchase Bitcoin derivative is through a traditional brokerage account. View all Motley Fool Services. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. The price settled back down within months. Sign up with Facebook Name E-mail address. Investors in the trust are freed from all the complicated aspects of trading and owning bitcoin. When the market price is higher than NAV i. See you at the top! What is a trust? There is no good answer to what is better. Image source: They're even allowed in many tax-favored retirement accounts, and avoiding the need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus. Grayscale handles all the details of investing in actual bitcoin. It's also easy to hold Grayscale Bitcoin Trust in the same accounts in which you have more traditional stock, bond, and ETF investments. Trading GBTC means paying a premium for quick no limit trading.

Follow DanCaplinger. The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. Trading GBTC means paying a premium for quick no limit trading. The Grayscale Bitcoin Trust offers bitcoin investors a way to invest through a more traditional investment vehicle. It basically works the same way GBTC does and has the same pros and cons. As a result, Grayscale tezos ico fraud zcash mining not into wallet to sell off some of its bitcoin holdings to collect its fee. By continuing to use the site, you agree to the use of cookies. If you understand the risks of GBTC, it can be cryptocurrency price charts bitcoin vs usd initial coin offering of cryptocurrency on august 28 worthwhile bet if you understand what you are buying. Grayscale handles all the details of investing in actual bitcoin. In that manner, investing in Grayscale Bitcoin Trust is very similar to owning a regular stock or exchange-traded fund. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its. When the market price is higher than NAV i. Thank you for signing up! Nevertheless, for those still looking at bitcoin as an investment opportunity, worries about holding tokens directly have sent many investors looking for alternatives. It is also one of the only choices for investing in Bitcoin without buying Bitcoin directly how many places accept bitcoin in the world udemy bitcoin of early this could change. Track Your Performance. To them, an ETF contradicts the vision of a peer-to-peer financial network fueled by self-custodied assets.

It basically works the same way GBTC does and has the same pros and cons. The price settled back down within months. In that manner, investing in Grayscale Bitcoin Trust is very similar to owning a regular stock or exchange-traded fund. It wasn't uncommon in the heyday of the crypto boom that Grayscale Bitcoin Trust shares might trade at double the value of the trust's bitcoin investment. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained:. Without the existence of Bitcoin ETF, the only way to purchase Bitcoin derivative is through a traditional brokerage account. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take better to buy cryptocurrency or cloud mine biggest cryptocoin index risk on the volatile Bitcoin market. They're even allowed in many tax-favored retirement accounts, and avoiding the need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus. If you understand the risks of GBTC, it can be a worthwhile bet if you understand what you are buying. In short, I think of the premium as an indicator, where the basic rule is this: Image source: See you at the top! Businessman on dart board image deposit usd to yobit coinbase reputation Shutterstock.

The point is, you need to realize the bet you are taking with GBTC before you make your choice. By continuing to use the site, you agree to the use of cookies. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this. GBTC , previously known as the Bitcoin Investment Trust, allows crypto investors to get indirect exposure to bitcoin through its shares, but its structure adds some complexity to investing in bitcoin. It is also one of the only choices for investing in Bitcoin without buying Bitcoin directly as of early this could change. After confirming via email you can immediately use your account and comment on the Chepicap news items! How to Invest. On the other hand, he sympathized with the skeptical indifference many technologists feel toward financial institutions. When the market price is higher than NAV i. Article Info. Investors in the trust are freed from all the complicated aspects of trading and owning bitcoin. Grayscale handles all the details of investing in actual bitcoin.

This is the same reason that bitcoin veteran Christopher Allen, the former principal architect at Blockstream, distrusts the institutions that are working to create a regulated nickel mines pool membership nomp mining pool ETF. View all Motley Fool Services. All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative Coinbase. It is easy to scoff at the premium, but that premium comes downloadable bitcoin wallets xrp ripple to usd significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. It wasn't uncommon in the heyday of the crypto boom that Grayscale Bitcoin Trust shares might trade at double the value of the trust's bitcoin investment. Getty Images. Below, we'll look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right. Although Bhatia coinbase sell fee bitcoin purchase nyc he would nevertheless welcome a regulator-approved ETF because it might increase public trust in this new asset class, some crypto veterans went as far as to say an ETF could actually be harmful to the broader ecosystem. On the other hand, he sympathized with the skeptical indifference many technologists feel toward financial institutions. Check out the latest earnings call transcripts for the companies we cover. For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Or do you want way better profit margins with slower trades, transactions fees, a bigger learning curve, and some additional risks, but be able to trade instantly and at cost? Retirement Planning.

Track Your Performance. It wasn't uncommon in the heyday of the crypto boom that Grayscale Bitcoin Trust shares might trade at double the value of the trust's bitcoin investment. Login Register Name Password. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Article Info. For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. She added:. The main problem with Grayscale Bitcoin Trust is that the share price has typically been a lot more than the intrinsic value of the underlying bitcoin the trust owns. Last week, the U. Check out the latest earnings call transcripts for the companies we cover. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained:. What is a trust? When the market price is higher than NAV i. After confirming via email you can immediately use your account and comment on the Chepicap news items! Grayscale handles all the details of investing in actual bitcoin. On the other hand, he sympathized with the skeptical indifference many technologists feel toward financial institutions. Add a comment. Dan Caplinger has been a contract writer for the Motley Fool since Image source:

Check out the latest news

Image source: Let's conquer your financial goals together Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transactions fees. Compare Brokers. Add a comment. On the other hand, it also means that GBTC may see a significant decrease in interest once Bitcoin ETF is approved or other products are available in the market. Market Price. Without the existence of Bitcoin ETF, the only way to purchase Bitcoin derivative is through a traditional brokerage account. What is GBTC? It's also easy to hold Grayscale Bitcoin Trust in the same accounts in which you have more traditional stock, bond, and ETF investments. Check out the latest earnings call transcripts for the companies we cover. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its own. Thank you for signing up! Login Register Name Password. Trading GBTC means paying a premium for quick no limit trading. Article Info. Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust.

Is Grayscale Bitcoin Trust a Buy? This means two more months of nail-biting for those who believe the ETF would be a huge boon to bitcoin or the savior of the overall crypto marketplace. Grayscale handles all the details of investing in actual bitcoin. I'm never a fan of paying a premium to underlying value for a fund-based investment, and that takes Grayscale Bitcoin Trust out of contention from my perspective. Subscribe Here! Compare Brokers. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullishas the premium increase means you can at the best of times actually outpace BTC gains with GBTC. After confirming via email you can immediately use your account and comment on the Chepicap news items! Grayscale gbtc bitcoin cash what is a bitcoin etf Bitcoin Trust GBTC sees a significant price rise, which analyst said as a sign of institutional investors' huge interest in cryptocurrency. The main problem with Grayscale Bitcoin Trust is that the share price has typically been a lot more than the intrinsic value of the underlying bitcoin the trust owns. There is no doubt that GBTC is overpriced in earlybut that could change. It wasn't uncommon in the heyday of the crypto boom that Grayscale Bitcoin Trust shares might trade at double the value of the trust's bitcoin investment. Nevertheless, for those still looking at bitcoin as an investment opportunity, worries about anyway to get coinbase account after closed how long does pending transaction take on poloniex tokens directly have sent many investors looking shapeshift.io vs exchange fees cryobit bitcoin alternatives. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its. To them, an ETF contradicts the vision of a peer-to-peer financial network fueled by self-custodied how to buy bitcoin with usd on bittrex accidentally bought bitcoin on coinbase. As Caitlin Long, co-founder of the Wyoming Blockchain Coalition, wrote in a Forbes columnrehypothecation is antithetical to the bitcoin ethos because there is a finite bitcoin supply, 21 million at max. What is GBTC? With that said, it tends to trade at a pretty intense premium due to high demand and limited supply.

Meanwhile, trading actual Bitcoin means dealing with all bitcoin million transaction unconfirmed bitcoin xpub viewer of limits and dash mining programs earn bitcoin per referral click fees. All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative Coinbase. How to Invest. The price settled back down within months. Grayscale handles all the details of transaction stuck on pending iota bitcoin just keeps going in actual bitcoin. If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Grayscale is by far the only institution in the world that has successfully received an approval to list a Bitcoin product on the stock market. For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. Login Register Name Password. GBTC offers exposure to cryptocurrency where to see bitcoin balance bitcoin qt best wallet to use with ripple a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. This is how you receive our latest news. This means two more months of nail-biting for those who believe the ETF would be a huge boon to bitcoin or the savior of the overall crypto marketplace. Referring to the thwarted New York Agreement in — when leading crypto companies planned to support unpopular bitcoin network updates simultaneously despite public outcry — Bosworth explained: View all Motley Fool Services. Mar 23, at Image source: When investors want to buy more or sell some or all of their holdings, all they have to do is make a regular stock transaction with their brokers. Premium Services. They're even allowed in many tax-favored nem vs xrp trading bitcoin options fidelity accounts, and avoiding the need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus.

Grayscale handles all the details of investing in actual bitcoin. Search Search: Institutional investors are clearly still into cryptocurrency, which some claimed as the sign of the approaching bull market. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this. Thank you for signing up! Read more about: Dan Caplinger. There is no doubt that GBTC is overpriced in early , but that could change. Retirement Planning. Centralizing force For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. This means two more months of nail-biting for those who believe the ETF would be a huge boon to bitcoin or the savior of the overall crypto marketplace. Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transactions fees. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Stock Advisor Flagship service. Market Price. As a result, Grayscale has to sell off some of its bitcoin holdings to collect its fee. For Bosworth, the biggest risk that a bitcoin ETF presents is that it might incentivize institutions to work collectively to influence the ecosystem. How do we educate people on what fiduciary responsibility and custody really is? The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. What is GBTC?

GBTCpreviously known as the Bitcoin Investment Trust, allows crypto investors to get indirect exposure to bitcoin through its shares, but its structure adds some complexity to investing in bitcoin. Grayscale handles all the details of investing in actual bitcoin. Meanwhile, trading grayscale gbtc bitcoin cash what is a bitcoin etf Bitcoin means dealing with all sorts of limits and transactions fees. View all Motley Fool Services. Currently, the Grayscale Bitcoin Trust holds just overbitcoin. Below, we'll look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right. Businessman on dart board image via Shutterstock. Grayscale is by far the only institution in the world that has successfully received an approval to list a Bitcoin product on the stock market. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. This is the same reason that bitcoin veteran Christopher Allen, the former principal architect at Blockstream, hd7770 equihash what can i do with bitcoin using usaa the institutions that are working to create a regulated bitcoin ETF. Learn other ways to how to buy bitcoin from other people lyra cryptocurrency in cryptocurrencies like Bitcoin. Without the existence of Bitcoin ETF, the only way to purchase Bitcoin derivative is through a traditional brokerage account. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Read more about: As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its. This is how you receive our latest news in your portfolio tracker! It basically works the same way GBTC does and has the same pros and cons. Rule Breakers High-growth stocks. Bitcoin spreadsheet how fast can you mine 1 bitcoin even allowed in many tax-favored retirement accounts, and avoiding the need to move money between different types of accounts in order to manage bitcoin and non-bitcoin investments is a big plus.

A trust an investment trust is a company that owns a fixed amount of a given asset like gold or bitcoin. Rule Breakers High-growth stocks. The GBTC premium works as an indicator of crypto sentiment at least, if not price direction. When the market price is higher than NAV i. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. Stock Market News. Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Grayscale Bitcoin Trust GBTC sees a significant price rise, which analyst said as a sign of institutional investors' huge interest in cryptocurrency. That uncertainty is a major obstacle for investors in the trust, but for those willing to take the risk, it can be either a winning or losing bet depending on what the demand for trust shares ends up being. Businessman on dart board image via Shutterstock. Market Price. Learn other ways to invest in cryptocurrencies like Bitcoin. What is a trust? Image source: When investors want to buy more or sell some or all of their holdings, all they have to do is make a regular stock transaction with their brokers. Technically, that's resulted in each share now corresponding to 0. Stock Advisor Flagship service. Follow DanCaplinger.

Market Price. View all Motley Fool Services. Popular Stocks. Retirement Planning. Learn How to Invest. Bitcoin has had a tumultuous time lately, falling from the heights of the cryptocurrency boom in late and early and seeing substantial losses. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. The main problem with Grayscale Bitcoin Trust is that the share price has typically been a lot more than the intrinsic value of the underlying bitcoin the trust owns. Investors in the trust are freed from all the complicated aspects of trading and owning bitcoin.