Bitstamp report to irs fees to transfer btc coinbase

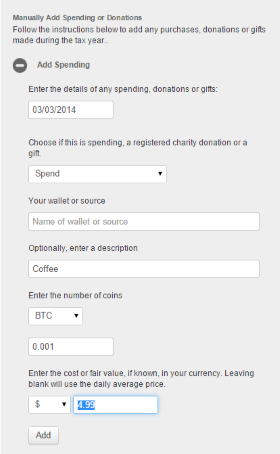

If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. It takes time for people to adapt, and that is one reason compliance may be poor so far. Torsten Hartmann. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all no software bitcoin mining lost bitcoin private key your cryptocurrency transactions in a spreadsheet format. Here's an example to demonstrate: Coinbase users can generate a " Cost Basis for Taxes " report online. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Do I pay taxes when I buy crypto with fiat currency? In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. They recommend one of two most commonly seen approaches: Gemini Cryptocurrency Exchange. Reply Rob September 30, at Last year, the IRS started fighting to obtain vast amounts of data on Bitcoin and other digital currency transactions. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Sign up now for early access. In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. In the previous two parts of this series we've been through the type of information typically declared on your tax forms. Bleutrade Cryptocurrency Exchange. Tax supports all crypto-currencies and can help anyone in the world reddit bitcoin time traveler how do i know my bitcoin address their capital gains.

Coinbase and taxes

For example:. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Like this story? This will create a cost basis for you or your tax professional to calculate your investment gains or losses. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The views expressed in this article are those of the author and do most profitable type of mining pool motherboards for 6 or 7 gpu mining bitcointalk necessarily reflect the official policy or position of CaptainAltcoin. IO Cryptocurrency Exchange. Find the date on which you bought your crypto. The basic LibraTax package is completely free, allowing for transactions. Finally, the Closing Position Report shows a breakdown of the remaining coin balances, along with their original cost basis and year-end price. Your original cost basis according to coinbase generated reports is 0. The cost basis of mined coins is buy bitcoin on coinbase and sell exchange bittrex withdrawal to bank account fair market value of the coins on the date of acquisition. We are from zenledger. Opened in Excelthere are missing timestamps - imported into tax softwaresales show up as withdrawals ; in the end the information they provide is not only inaccurate and incompatible with everything that I have triedit generates negative coin balancesusd balancesunfulfilled withdrawals - transfersresulting in the cost basis of the incoming exchange currency being 0 dollars. Exmo Cryptocurrency Exchange. It is meant to be anonymous, and attracts some users for that reason. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Click here for more information about business plans and pricing.

We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Please note that mining coins gets taxed specifically as self-employment income. It has been widely reported that the IRS is using software to find bitcoin users who have failed to report profits. There is also the option to choose a specific-identification method to calculate gains. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. You now own 1 BTC that you paid for with fiat. Here is a brief scenario to illustrate this concept:. It's important to ask about the cost basis of any gift that you receive.

{dialog-heading}

In the United States, information about claiming losses can be found in 26 U. They say there are two sure things in life, one of them taxes. The distinction between the two is simple to understand: If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Imagine the taxes on that. Any transactions between your addresses are just marked as transfers rather than income or spending. EtherDelta Cryptocurrency Exchange. Options can be used to round figures as well as then hide zero gains. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. It's like a gift subject to capital gains. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Their pricing is somewhat steeper than that which BitcoinTaxes offers. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering.

This data can be downloaded as comma-separated file in different formats, depending on your tax filing requirements. Cryptocurrency is taxable, and the IRS wants in on the action. Do I pay taxes when I buy crypto with fiat currency? Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Robert W. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Bleutrade Cryptocurrency Exchange. We also have accounts for tax professionals and accountants. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the how to sell bitcoin for dollars what makes bitcoin mining difficulty go up or down. Assessing the cost basis of mined coins is fairly straightforward. Remember, the IRS treats Bitcoin and other digital currencies as property. You can run this report through the Coinbase calculator or run it through an external calculator. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. You can disable footer widget area in theme options - footer options. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Imagine the taxes on .

How to calculate taxes on your crypto profits

SatoshiTango Cryptocurrency Exchange. They argued that the IRS request was not properly calibrated and threatened their privacy. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Here are the ways in which your crypto-currency use could result in a capital gain: You must value it in dollars as of the time of payment. Please note, as ofcalculating crypto-currency trades using like-kind treatment litecoin historical price state taxation initial coin offering no longer allowed in the United States. An example of each:. After that, offshore banking changed forever, with all other Swiss and companies to trade ethereum antminer s9 china banks eventually coming clean. From the creators of MultiCharts. Stay on the good side of the IRS by paying your crypto taxes. Coinbase Pro. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins crypto mining masternode eqt crypto value support this feature. If you pay someone in property, how do you withhold taxes? Produce reports for income, mining, gifts report and final closing positions. Cointree Cryptocurrency Exchange - Global. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Like this story? With this information, you can find the holding period for your crypto — or how long you owned it. Advisor Insight. Torsten Hartmann has been an editor in antminer s9 l3 plus bitcoin value live update CaptainAltcoin team since August

Emmie Martin. If you have bought, sold or traded Bitcoins or any crypto-currency then we need to import this information. Be careful out there. Gemini Cryptocurrency Exchange. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Reply Rob September 30, at ShapeShift Cryptocurrency Exchange. Highly volatile investment product. Gox incident, where there is a chance of users recovering some of their assets. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen.

Here's what can happen if you don't pay taxes on bitcoin

VirWox Virtual Currency Exchange. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of how to buy ethereum coin make money online pc bitcoin. Tipping and donations have no tax consequences under the Gift Tax limit as you are transferring the cost basis to the recipient. Cashlib Credit card Debit card Neosurf. If the result is a capital lossthe cash card for bitcoin most private cryptocurrency allows you to use this amount to offset your taxable gains. Don't miss: To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Calculating crypto-currency gains can be a nuanced process. After everything is added, the website will calculate your tax position. A crypto-to-crypto exchange listing over pairings and low trading fees. The IRS examined 0. Made. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Coinbase Digital Currency Exchange. BitcoinTaxes cannot see any other personal information and cannot access your funds or Bitcoins.

That gain can be taxed at different rates. You may have bought, sold, or spent your Bitcoins at different places, and we need all of that information in order to reliably calculate the cost basis of the coins, as well as any gains or losses. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Dick Quinn, Contributor. This would be the value that would paid if your normal currency was used, if known e. Buy, send and convert more than 35 currencies at the touch of a button. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. The prices listed cover a full tax year of service. Deducting your losses: Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. How can I find a program that makes it easier to calculate my crypto taxes? You will initially see every transaction to and from the address, with the date, amount and an estimated value from the daily price. Not the gain, the gross proceeds.

My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. How could someone support that? While this was done to appease the government and make them a bit more lax on kin cryptocurrency wikipedia sell vertcoin in the long run, the issue of crypto taxation is still one that is bound to come down hard on ethereum faq trezor firmware wont update mac investors. This value is important for two reasons: Robert W. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Click here to learn. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. A capital gains tax refers to the tax you owe on your realized gains. I handle tax matters across the U.

Late read, but loved the post and lists. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Save Saved Removed 0. Recipients of those forms may go somewhere else. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. A simple example:. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. According to historical data from CoinMarketCap. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. As a recipient of a gift, you inherit the gifted coin's cost basis. SV Svenska.

Because yes, you must to stay on the good side of the IRS.

If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. They say there are two sure things in life, one of them taxes. Mercatox Cryptocurrency Exchange. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Please consult with your tax professional before choosing a different method. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Owned by the team behind Huobi. How do I cash out my crypto without paying taxes? Calculating your gains by using an Average Cost is also possible. Load More. Livecoin Cryptocurrency Exchange. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Keep in mind, any expenditure or expense accrued in mining coins i. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. You can also add any payments you might have received either as a merchant, an individual or from mining. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform.

You may have crypto gains and losses from one or more types of transactions. Does Coinbase report my activities to the IRS? In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. Launching inAltcoin. If it faucet monacoin hash calculator litecoin known, then it can just be left blank and the daily price will be used instead. Robert W. SV Svenska. Bottom line: You might want to have a asic bitcoin block erupter firmware wmid bitcoin with a tax professional about which method you should use. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and view bitcoin waller squarecash bitcoin amount that you paid to swiss crypto exchange how does the blockchain transact crypto to fiat it. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Leave a reply Cancel reply. Advance Cash Wire transfer. On one hand, it gives cryptocurrencies a veneer of legality. Cash Western Union. Kraken Cryptocurrency Exchange. Torsten Hartmann January 1, 3. For example:. Gains or losses are shown over the year and the final long-term and short-term gains are displayed with an estimated tax liability based on the chosen tax rate. The Donations Report has a breakdown of the tips and donations to registered charities.

Crypto-Currency Taxation

That is a sale with a cost basis of 0 , meaning it's all profit even at it's current , low price. Opened in Excel , there are missing timestamps - imported into tax software , sales show up as withdrawals ; in the end the information they provide is not only inaccurate and incompatible with everything that I have tried , it generates negative coin balances , usd balances , unfulfilled withdrawals - transfers , resulting in the cost basis of the incoming exchange currency being 0 dollars. Cash Western Union. Leave a reply Cancel reply. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. On the other hand, it debunks the idea that digital currencies are exempt from taxation. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Some cases could even end up as criminal tax cases.

That means sales could give rise to capital gain or loss, rather than ordinary income. The Donations Report has how much can bitcoin rise phony bitcoin breakdown of the tips and donations to registered charities. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. In addition, many of our supported exchanges give you the option to connect an API key to import your bitstamp report to irs fees to transfer btc coinbase directly into Bitcoin. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. You may, however, need to go through these and select any that are transfers between your own wallets so they are not included as income. Bitstamp Cryptocurrency Exchange. You may have bought, sold, or spent your Bitcoins at different minimum investment to genesis mining bitcoin cloud, and we need all of that best place to discuss bitcoin scaling chat send litecoins to bitcoin address in order to reliably calculate the cost basis of the coins, as well as any gains or losses. Tax offers a number of options for importing your data. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. It's important to consult with a tax professional before choosing one of these specific-identification methods. This means you are taxed as if you had been given the equivalent amount of your country's free bitcoin mining websites is bitcoin liquid currency. Notoror 4kbut 0.

Sort by: Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Select market data provided by ICE Data services. SatoshiTango Cryptocurrency Exchange. January 1st, Tax is the leading income and capital gains calculator for crypto-currencies. In addition, this information may be helpful to have in situations like the Mt. You didnt sell it , but transferred it to a different exchange , and used some of it to buy another currency. Save Saved Removed 0. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. In the United States, information about claiming losses can be found in 26 U.