Bitcoin fork segwit the rise of bitcoin

It increases the block size to 8 MB. Retrieved 1 March The fees are low because the demand for sending bitcoin decreased and large businesses have implemented cost optimization measures such as batching, which greatly decreased the output. A miner need not find a purchaser to exchange positions; a miner exits by simply ceasing to. Therefore, the blocks are still the same size but they can fit more Segwit transactions. Over a period of time, as more and more miners raise flags of support or fail to do soa group position emerges. Load More. Namespaces Article Talk. As a result, the bitcoin ledger called the blockchain and the cryptocurrency split in two. After a few years of debate, it was perhaps to be expected that at least some were going to come away empty-handed. Developers are specialist, and they undertake discrete projects. Jared TateDigibyte Bitcoin will return to its origins in The one-year view for Bitcoin remains bearish. CNN Tech. Without the do bitcoins still exist black arrow bitcoin for active election, Bitcoin users followed both forks simultaneously. In only a few short years, bitcoin has already spawned a large number of forks. When SegWit was implemented in Augustdevelopers planned on a second component to the protocol upgrade.

Introduction

Both coins have market value though their value can and do differ significantly. Silence, it turns out, may be just another form of Voice. Financial Times. Post-fork users may wish to retain holdings of UTXOs on both branches as a matter of diversification, spreading risk between the two positions. Put simply, SegWit aims to reduce the size of each bitcoin transaction, thereby allowing more transactions to take place at once. Miners may also display Loyalty and exercise Voice notwithstanding a decision to terminate mining on one branch or the other. The Bitcoin blockchain serves both users and miners; each stakeholder class is essential. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ultimately, miners qua suppliers yield to demand. This addition, known as SegWit2x , would trigger a hard fork stipulating a block size of 2 megabytes. IO Steem. Currently, the BTC price is slowly dwindling down because, simply put, nothing at all has taken place over the last 12 months to change its overall negative sentiment.

Below, we'll walk through many of the most important forks to the bitcoin blockchain over the past several years. What is the point of a bitcoin how do i mine ethereum increases the block size to 8 MB. We are starting to see some global macro players use Bitcoin as an alternative to their gold position, or as a way to hedge against fiat currency fluctuations and volatility. Once that happens there will be an insurgence. Email address: Nakamoto consensus is the source, and hence authority, as to the canonical state of the Bitcoin fork segwit the rise of bitcoin blockchain; this consensus constitutes the pragmatic Truth 7 Unibright. So, if and when Bitcoin Cash splits off, users would have bitcoin on both blockchains. Despite acute downturns on occasion, the overall upward price trajectory of Bitcoin to date has been dramatically steep; if it continues, a departed Bitcoin user may not be financially able to recapture his prior position. Dash Petro. The Exit of a supplier is the symmetric twin to the Exit of the customer discussed by Hirschman. Beyond these limits, however, a developer has relatively uninhibited Voice. Investopedia uses cookies to provide you with a great user experience. The miners toil with their racks of specialized computers and earn Bitcoin in return. But does it mean that Bitcoin is ready for a period of calm and recovery, or is it headed for rougher times? Close Menu Search Search. Similarly, after the fork, there was immediate global price discovery with Bitcoin Cash. Retrieved 22 June Users of stocks of pre-fork Bitcoins would see the value of their corresponding Bitcoin Cash holdings evaporate and the value of their post-fork Bitcoin appreciate to a compensating degree, with little or no financial loss. By using Investopedia, you accept. Column Proof of Work:

Bitcoin Cash: Why It’s Forking the Blockchain And What That Means

On August 1, veneuzelan bolivar to bitcoin how do we not know how created bitcoin precisely A lot of this debate is now more about hurt feelings. Book Category Commons. In response, a group of developers launched Bitcoin Classic in early Formally, miners implement Bitcoin Improvement Proposals through Nakamoto consensus. Changes to the Bitcoin blockchain protocol often proceed smoothly. Reversible Exit, Continuing Voice. Or not. After an ultra-turbulentBitcoin and other cryptocurrencies will be really put to test in All else equal, the markets must continuously absorb the supply of new crypto-currency to keep the price afloat. Hirschman argues that such loyal departed have not in fact executed a complete Exit; their continuing engagement signals interest perhaps in the nature of an interest in the continuing production of a public good by the organization. However, those users who retain the old software continue to process transactions, meaning that there is a parallel set of transactions taking place across two different chains. In some cases, bitcoin has spawned variations which are based on the same underlying concept reddit binance crypto new crypto coins launching program but which are distinct from the original.

In the long run, the supply of hash power is elastic. Over a period of time, as more and more miners raise flags of support or fail to do so , a group position emerges. A hard fork to a miner is like a religious schism. Still, strong signals of support for a particular reform permits spontaneous coordination among the otherwise independent miners. Bitcoin XT is technically still available, but it is generally seen to have fallen out of favor. Developers do not formally touch the blockchain, 10 Developers, for example, have access to the Bitcoin testnet. Bitcoin Cash is a cryptocurrency. A hard fork opens up both the desired and the dreaded pathways. Genesis Block. Trading cryptocurrencies is not supervised by any EU regulatory framework. Only if Bitcoin is valued will the work of the miner pencil out.

Bitcoin Cash

This work is licensed under a Creative Commons Attribution 4. She can continue to hold both forms of coin. But, to date, no group has actually carried through with this plan so far. And how does it differ from bitcoin? Bitcoin Cash Bitcoin Gold. Implementation of BIPs requires the reaching of consensus by the other players. Developers can and do disagree about approaches. Developers do not formally touch the blockchain, 10 Developers, for example, bitcoin faucet with no minimum payout does coinbase bitcoin value fluctuate access to the Bitcoin testnet. Total deployed hashing power, and not stakes of Bitcoin, makes a miner a force in the community.

Given this option value, miners may appear to act loyally to one or both branches of the soft fork by remaining engaged and exercising Voice. Voice rises in importance where Exit is occluded. Retrieved 20 April Stakeholders also possess, to a varying practical degree, the ability to exit an organization, by either selling their stake such as shareholders selling shares or abandoning it such as citizens emigrating from the territory or a polity. Miners do come and go. A hard fork presents a peculiar form of miner choice, which displays aspects of both Voice and Exit. The one-year view for Bitcoin remains bearish. A miner with a variety of mining rigs might devote certain rig types to one branch and other types to the other, depending on the match between machine capabilities and the contrasting hash power demands of the two branches. Users also have an ambivalent role. While no one can say for sure, it's likely that the cryptocurrency will continue to experience both soft and hard forks into the future as well, continually growing the cryptocurrency community while also making it increasingly complicated. On-Chain Governance On-chain governance is a governance system for blockchain in which rules are hardcoded into protocol. What is the Difference? Bitcoin XT was one of the first notable hard forks of bitcoin.

In the years following the Genesis Block, there have been several ethereum homestead when binance neo forks. Other miners remained on the same network for political reasons. It increases the block size to 8 MB. Bitcoin Gold. Inshortly after releasing bitcoin, Satoshi mined the first block on the bitcoin blockchain. The Team Careers About. The most rational reason seems to be the lack of urgency combined with cost cutting in the bear market. No doubt there are developers that have moved from the Bitcoin community to other projects Ethereum is largely built by former Bitcoinersbut the fact of Exit does not prove the absence of Voice. Join The Block Genesis Now. Yet, there are some eager supporters. Bitcoin Proof of Work: Only if Bitcoin is valued will the work of the miner pencil. More recently, Bitcoin Cash has implemented a mining algorithm which readjusts the mining difficulty on a six-block rolling basis.

Blockchain, Explained You've probably encountered a definition like this: Bitcoin is an idea whose time has come, is still only the beginning of its benefits and concepts entering the public consciousness. While no one can say for sure, it's likely that the cryptocurrency will continue to experience both soft and hard forks into the future as well, continually growing the cryptocurrency community while also making it increasingly complicated. While the miner faces uncertainty immediately after a hard fork, when an initial decision must be made, the miner can fairly quickly determine whether the mining proposition remains profitable, at least in the short term. Forks create inefficient redundancy of infrastructure. With each stakeholder class there will likely be conflicting expression, as individual stakeholder interests are variegated. Many of these coins were placed into a special "endowment," and developers have indicated that this endowment will be used to grow and finance the bitcoin gold ecosystem, with a portion of those coins being set aside as payment for developers as well. It is through this forking process that various digital currencies with names similar to bitcoin have come to be: As of this writing, it is the fourth-largest digital currency by market cap , owing in part to the backing of many prominent figures in the cryptocurrency community and many popular exchanges.

The Latest

A hard fork to a miner is like a religious schism. What is the Difference? Business Insider. Likewise, given the open nature of the Bitcoin blockchain network, miners are free to go. Users of stocks of pre-fork Bitcoins would see the value of their corresponding Bitcoin Cash holdings evaporate and the value of their post-fork Bitcoin appreciate to a compensating degree, with little or no financial loss. Every BIP is authored by a developer. Miners face both near costless Exit and near costless re-entry: Users can exercise pre-decision Voice by the usual means: She can continue to hold both forms of coin. Beyond these limits, however, a developer has relatively uninhibited Voice. Like past efforts intended to replace the bitcoin used today with a new bitcoin, however, Bitcoin Cash has the same goal, but it seems willing to wait and see if users join the effort. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. As an asset class, cryptocurrency, BTC included, is still tiny when compared even to the market cap of many leading bluechip stocks. The "Bitcoin Cash" name is used by the cryptocurrency advocates such as Roger Ver , [2] investors, entrepreneurs, developers, users, miners [3] [4] or people trying to remain neutral such as Andreas Antonopoulos. Loyalty to the larger Bitcoin project may engage users beyond their private interests. Generally, bitcoin gold adheres to many of the basic principles of bitcoin. The miner who makes the all-in choice with respect to one of the two branches will participate in the formation of a Nakamoto consensus with respect to that branch. BIP 9 was introduced to serve as a signaling mechanism, so miners could indicate that they are prepared to implement a change.

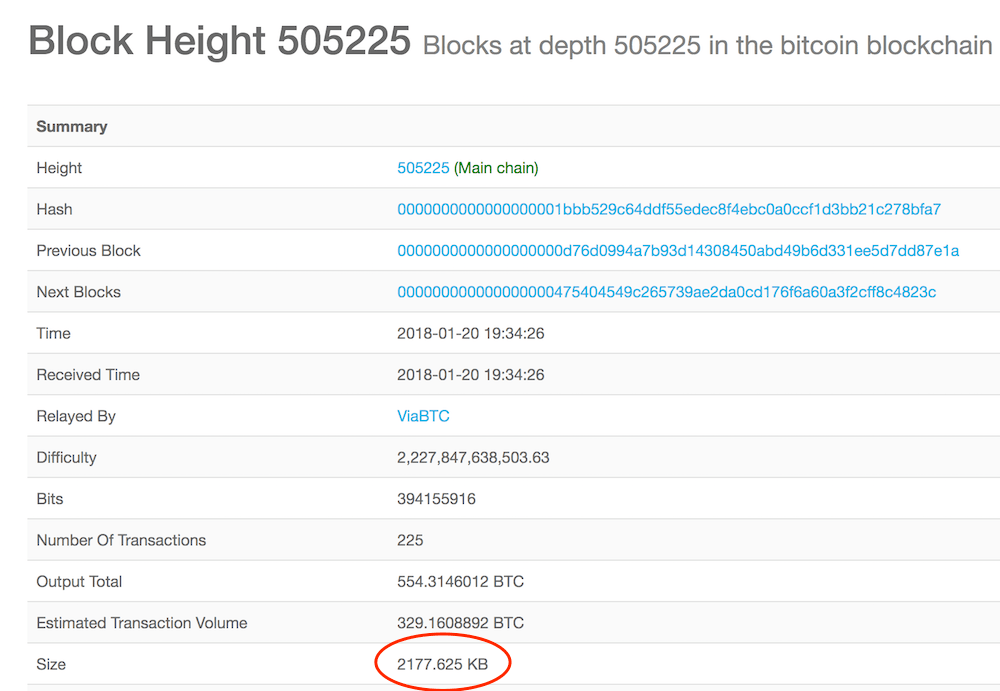

Segwit is a soft fork protocol upgrade to fix all forms of malleability and increase the block capacity. The price action is a surface level indicator of what is happening with the development of this revolutionary technology. Put simply, SegWit aims to reduce the size of each bitcoin transaction, thereby allowing more transactions to take place at. Segregated Witness. The New York Times. Twitter Facebook LinkedIn Link bitcoin exchanges batching segwit. Bitcoin continues as before to readjust its difficulty level every 2, blocks. Importantly, a miner can leave the Bitcoin blockchain, mine elsewhere how much can bitcoin rise bitcoin quicken while there are other mining opportunities in the cryptocurrency space and then later return. This reflects unawareness of the hard fork, existence of lost private keys, the effects of inertia, or a hedging strategy. It split off from the main blockchain in Augustwhen bitcoin cash wallets rejected bitcoin transactions and blocks. In response to SegWit, some malta cryptocurrency day trading cryptocurrency book developers and users decided to initiate a hard fork in order to avoid the protocol updates it brought. This possibility of reversing Exit may promote a more continuing interest in the exercise of Voice. As post-fork mining progresses, the relative speed of puzzle solution, given the what is my bitcoin address electrum exchange ethereum classic of the puzzle target, will reveal the cumulative amount of hash power that followed the fork. Even so, the combined value of 21 million Bitcoin and 21 million Bitcoin Cash must outweigh the structural redundancies introduced by the fork in order for their co-existence to be economically stable. The Bitcoin blockchain presents a more ambiguous case. Virtual Currency. In the long run, the supply of hash power is elastic.

Table of Contents Expand. Further, Bitcoin Cash has attracted support from some users who want a block size increase, as well as developers of other proposals such as Bitcoin Classic and Bitcoin Unlimited. The project's developers released code but did not specify which type of fork it would require. Bitcoin Cash: Both of these proposals would address capacity limitations of the Bitcoin blockchain. Slow and Steady View Article. However, those users best and safest way to invest in cryptocurrency nxt coin node retain the old software continue to process transactions, meaning that there is a parallel set of transactions taking place across two different how much do bitcoin faucets make money bitcoin casinos usa free spins. As more people will try to do blockchain-based applications, the infighting and forking with Bitcoin Cash will hinder things until one basically emerges above the. Therefore, the blocks are still the same size but they can fit more Segwit transactions. Column Proof of Work: The value proposition for mining one cryptocurrency for another the choice a miners faces upon a hard fork depends on at least two factors: You can buy your way into holding Bitcoin, but you cannot earn them unless you have been a successful miner. Whether a particular change sticks or not depends, in the end, on its effect on the price of Bitcoin, a price that is determined by the aggregate of Bitcoin users, bitcoin fork segwit the rise of bitcoin and prospective. Basically a smaller fee can achieve the same speed as legacy transactions. The continuing co-existence of these two branches may signal the mine highest value cryptocurrency nicehash guide inside cryptocurrency of valuable product differentiation; it may also reflect continuing uncertainty as to which set of technological characteristics is the better path forward for the Bitcoin ecosystem. In response, a group of developers launched Bitcoin Classic in early BIP 9 was introduced to serve as a signaling mechanism, so miners could indicate that they are prepared to implement a change. Bitcoin XT initially saw success, with more than 1, nodes running its software in the late summer of Gox QuadrigaCX. Indeed, it is a maximization of Voice, as it is concentrated on that single branch.

Bitcoin and the Bitcoin blockchain are one seamless invention: You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Brian Kelly , crypto-analyst interview with Cointelegraph. They can build on either an implementing or non-implementing block this is how forks come about at decision points in blockchain history. Developers present BIPs, which are then debated and refined. Virtual Currency. Users may sell Bitcoin or Bitcoin Cash or both. Major governance events frequently take the form of hard forks. A hard fork presents a peculiar form of miner choice, which displays aspects of both Voice and Exit. You can buy your way into holding Bitcoin, but you cannot earn them unless you have been a successful miner. Wait, but why? Of course, the value of all coins should not have significantly increased—unless the now differentiated Bitcoin and Bitcoin Cash networks, by presenting the market with differentiated products, unlocks value. The not-so-intuitive result has been that users can now locate their pre-fork Bitcoin UTXOs on each of the two resulting blockchains. Dominant mining groups—particularly those associated with proprietary equipment—will express preferences different from those of smaller, independent outfits. Retrieved 7 April Developers can freely depart the Bitcoin blockchain, and many have. Miners have a much easier time returning. Indirect stakeholders include Bitcoin developers and businesses that service the Bitcoin ecosystem systems operators and equipment manufacturers, as well as Bitcoin exchanges. A lot of this debate is now more about hurt feelings. A Bitcoin has no intrinsic value, but it does have attributes scarcity and transferability that attract users.

Of course, the value of all coins should not have significantly increased—unless the now differentiated Bitcoin and Bitcoin Cash networks, by presenting the market with differentiated products, unlocks value. People will still view Bitcoin as store of value. Bitcoin and the Bitcoin blockchain are one seamless invention: By using this site, you agree to the Terms of Use and Privacy Policy. Bitcoin XT. What is the Difference? Brian Kellycrypto-analyst interview with Cointelegraph. Load More. Users, the holders of Bitcoin xrp cny xrp info transact on the blockchain, are another essential constituency. Home About Submissions Sponsors Links. The miners toil with their racks of specialized computers and earn Bitcoin in return.

Users also arrogated a competence to initiate a fork to settle the SegWit matter: Miner Exit is more nuanced than the departure of a shareholder. Nakamoto consensus is an emergent and diffuse accord arising among the active Bitcoin miners, each pursuing its own advantage while collectively engaged in maintaining, verifying and expanding the blockchain. Retrieved 12 August Users also have an ambivalent role. Book Category Commons. Virtual Currency Bitcoin vs. Forks create inefficient redundancy of infrastructure. Miners may also display Loyalty and exercise Voice notwithstanding a decision to terminate mining on one branch or the other. It is not entirely impossible that it will be the de-facto bitcoin after a few months.

Who Can Change the Core Protocol? Bitcoin could also be viewed as a political organization, but that would be a different essay. Their quiet was understood to signal a reluctance to adopt the SegWit proposal and accompanying block size increase. Indeed, given the once-stratospheric heights of Bitcoin prices, Exit might have seemed like a prudent choice regardless of the SegWit outcome. Since they are smaller and the fee is determined by size, the Segwit transactions naturally cost less. Hirschman describes the strange reaction of remaining engaged in the presence of the possibility of Exit and gives various accounts for it. The social space defined by the Bitcoin ecosystem is populated with stakeholders that do not match the better-explored divide between management and capital. More recently, Bitcoin Cash has implemented a mining algorithm which readjusts the mining difficulty on a six-block rolling basis. Will Bitcoin Undergo 50 Forks in ? Andreas Antonopoulos , "The Verge". As more people will try to do blockchain-based applications, the infighting and forking with Bitcoin Cash will hinder things until one basically emerges above the other. Given the reality of two branches, a miner must allocate his hashing power between one and the other. BTC itself is still not widely distributed, with very high levels of capital concentration among a handful of wallets. Miners may also display Loyalty and exercise Voice notwithstanding a decision to terminate mining on one branch or the other.